Is Cash Still Relevant in a Mobile Wallet World?

There has recently been a lot of talk about cashless societies and whether the United States will eventually become one. Some countries in Europe, most notably Sweden, and South Korea have announced their intentions of becoming cashless within about five years, although Sweden has halted its plans, at least temporarily. One location in Sweden, however, that has never accepted cash is the Abba Museum, founded by former band member Bjorn Ulvaeus, who has been championing the no-cash movement in his native country since 2008, when burglars broke into his son’s apartment and stole some items, including cash.

There has recently been a lot of talk about cashless societies and whether the United States will eventually become one. Some countries in Europe, most notably Sweden, and South Korea have announced their intentions of becoming cashless within about five years, although Sweden has halted its plans, at least temporarily. One location in Sweden, however, that has never accepted cash is the Abba Museum, founded by former band member Bjorn Ulvaeus, who has been championing the no-cash movement in his native country since 2008, when burglars broke into his son’s apartment and stole some items, including cash.

But could such a radical societal shift work here in the United States? With payments becoming more and more mobile, and mobile wallets eliminating the need to carry multiple plastic cards, is it just a matter of time before we are cashless? And in the meantime, if you, as a merchant, wanted to stop accepting cash, how would that play out for your business? The answer lies somewhere in the middle – refusing cash may alienate some customers and unless you are in a position to refuse what might be a significant percentage of your payments, you must continue to accept cash, and process it as well as you can. At this point in time, managing cash payments is an integral part of doing business in the United States and effective cash management will have a significant impact on your bottom line. And since the U.S. is not on the fast track to becoming a cashless society any time soon, it is good business sense to continue accepting cash.

That is not to say that offering customers alternative ways of paying for the goods and services you offer is a bad thing – customers like to have options when it comes to payments. From paying with cash to using a mobile wallet and everything in between, offering customers the choice of how they pay is a good way to keep them coming back to your place of business. Especially if you accept the new EMV cards, and mobile wallets such as Apple Pay and Android Pay. These payment methods open your business to more consumers and present a progressive mindset to the public. They can also be a safer way for your customers to pay, as they have both been shown to be less vulnerable to data hacks due to the digital encryption of the card data they utilize.

Besides, as this article points out, the majority of many countries’ consumer payments are still conducted in cash: “…I came across a 2015 PWC report which puts the UK situation in a broader perspective. According to their data, if we look at it in terms of number of consumer payments, in the UK 48 percent were cash payments. Compare this with the US (55 percent), Australia (65), Japan (86), China (90), South Africa (94) and India (98) so it would seem fair to say the cashless society has a way to go yet.”

So, offer your customers a selection of payment methods, including cash, credit, EMV and mobile wallets, but don’t kick cash to the curb just yet. Coins and paper money still have their place in the world of commerce alongside EMV, Apple Pay and Android Pay.

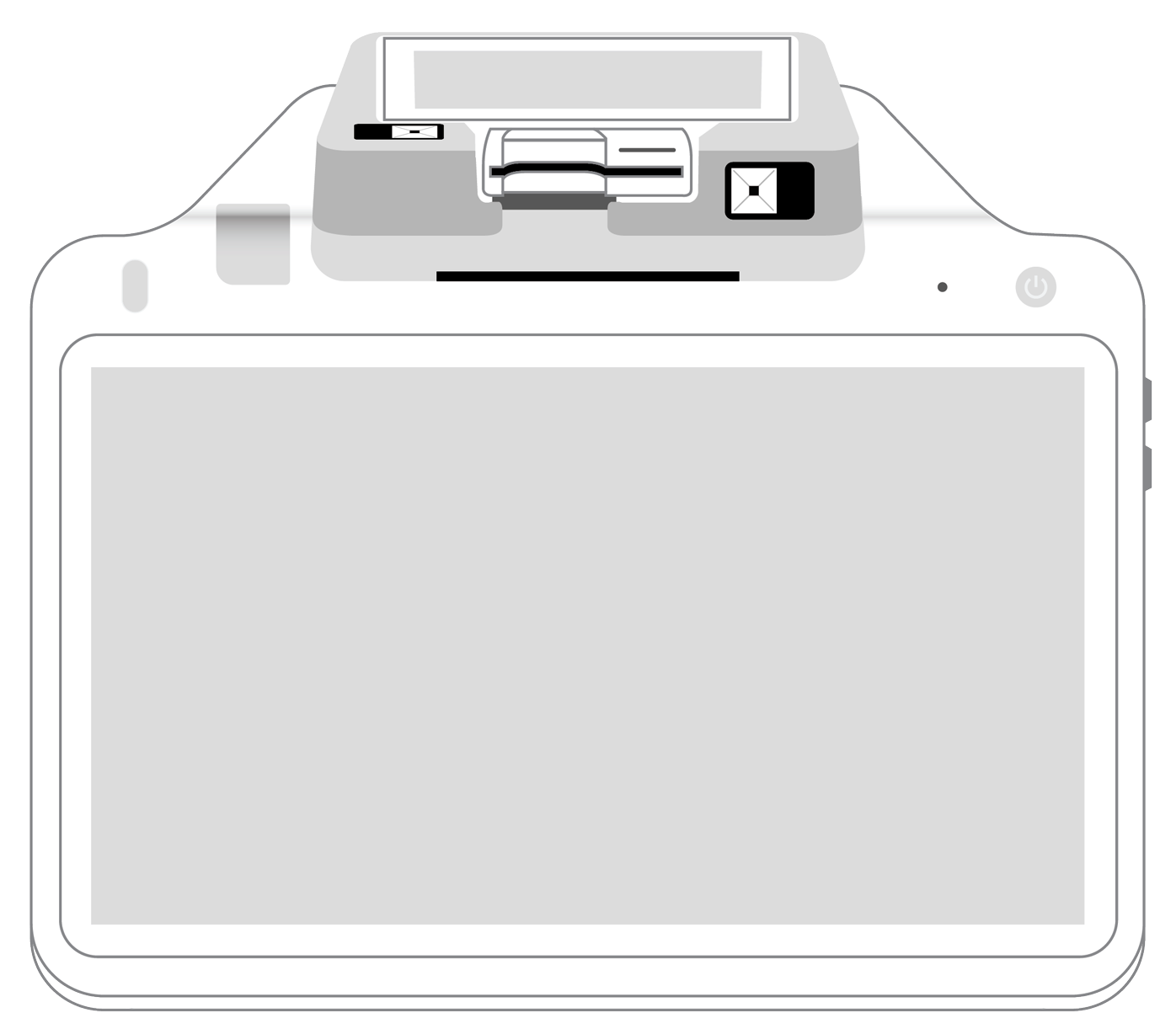

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||