Start Planning For The New Year Now

Budgeting is a necessary evil for any small business owner – it needs to be done so that you don’t overextend yourself and put your business at risk. PayAnywhere has put together a few things for you to keep in mind as you map out your budget for the upcoming year.

Budgeting is a necessary evil for any small business owner – it needs to be done so that you don’t overextend yourself and put your business at risk. PayAnywhere has put together a few things for you to keep in mind as you map out your budget for the upcoming year.

First, let’s take a look at why budgeting is so important. First, it gives you a path for your spending. If you get too far off the path, you can start to outspend your earnings, which will increase your debt and, if not reined in, could mean the closure of your business.

Second, budgeting can help you figure out if you have enough money coming in to upgrade your equipment. If you need to get a new meat slicer, you can review your budgets and see if you’ll have a surplus at the end of the year. If the projections check out, you can buy your new piece of equipment with confidence.

The experts at 1800accountant.biz say there are five must-haves in any small business budget. They are:

- Infrastructure. No matter if you have a home-based business or a storefront in a posh part of town, all small businesses have infrastructure costs that need to be included in any budget. Be sure to explore how you could get a tax deduction for your infrastructure costs.

- Supplies. We’re talking more than pens and pencils here. We’re talking about equipment like computers and other materials (including those pens and pencils) you need to get the job done. When buying these business necessities, it’s hard to resist the latest and greatest of what’s out there, but last year’s model might be just as effective, and more friendly on the bank account than the new models. Shop around for the best deals possible, that way your overhead is lower than the competition and you can pass that savings onto your customers.

- Marketing. How are you going to make any money if no one knows about your business? This is where the saying “you have to spend money to make money” comes in. From traditional print ads to pay per click (PPC) advertising, you have to find the right place to put your ad dollars. Do small test runs of different types of advertising and shift your focus to what’s working.

- Payroll. Even the smallest of businesses, like those who employee one (the owner), must factor in a payroll. If you’re a one-person operation, you need to be paid for your time and effort. If you’re a larger business, you need to take the time to find the most cost-effective insurance and decide what other benefits you’re going to offer your employees.

- Revenues. Budgets aren’t always about money going out. Budgets also need to account for the money you’re expecting to earn in a set period of time. You need to know this so you can cover operating expenses and not fall too far into the red, if at all.

Related Reading

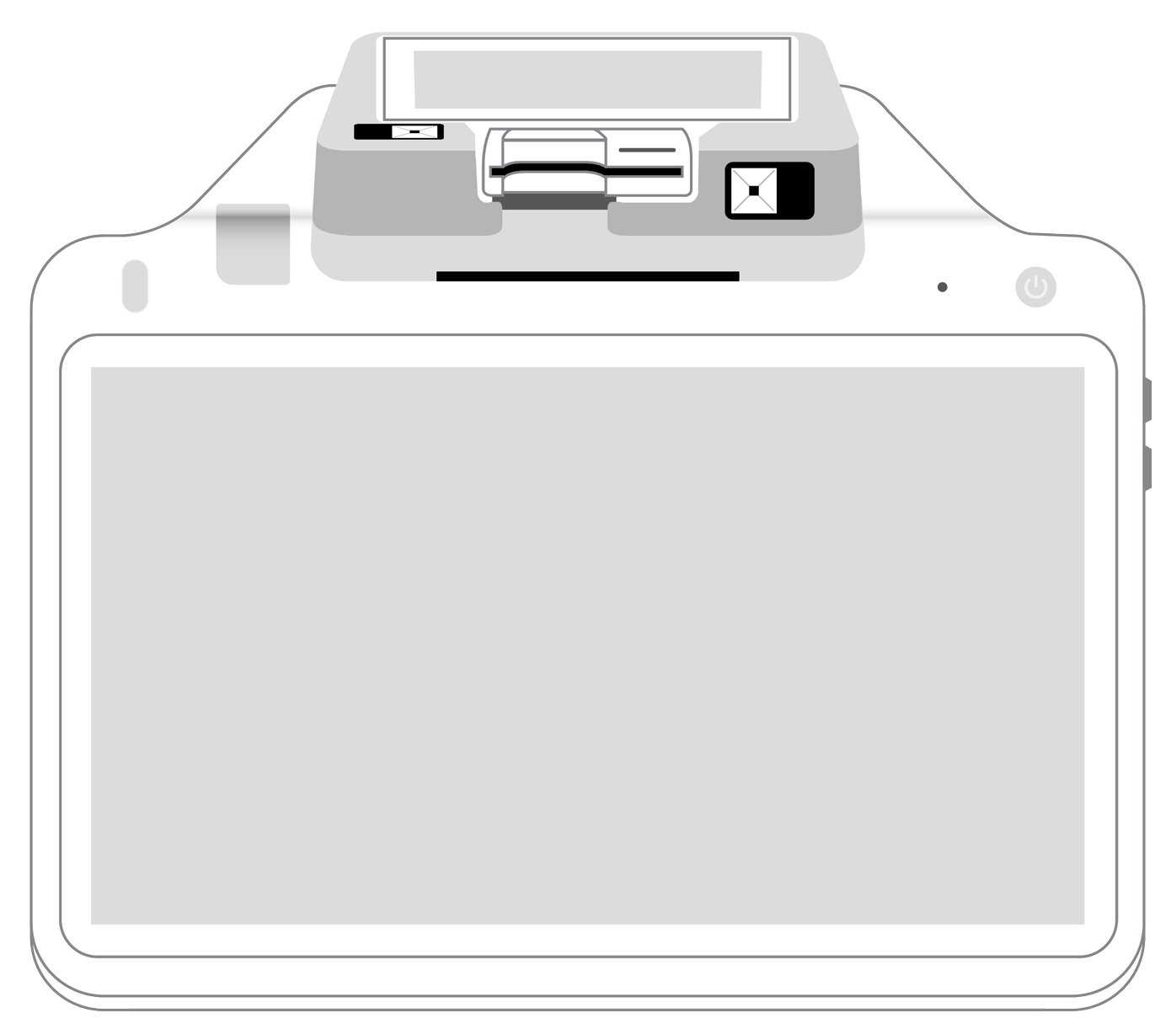

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||