Will your Business be Ready for the Shift to EMV-Chip Cards?

It has been years in the making, but every business that processes credit card transactions on October 1, 2015 and after will be responsible for paying for fraud that is handled at a business’s point of sale — unless they have made the transition to EMV-chip credit card terminals and mobile readers.

It has been years in the making, but every business that processes credit card transactions on October 1, 2015 and after will be responsible for paying for fraud that is handled at a business’s point of sale — unless they have made the transition to EMV-chip credit card terminals and mobile readers.

Will your business be ready?

We at PayAnywhere want to give you a few tips on how you can limit your liability. We’ll explain what the advantages are of doing each and every transaction via an EMV-equipped terminal unit (Contact your Sales Agent to inquire about the availability of a PayAnywhere unit that is EMV-ready, if you don’t already have one).

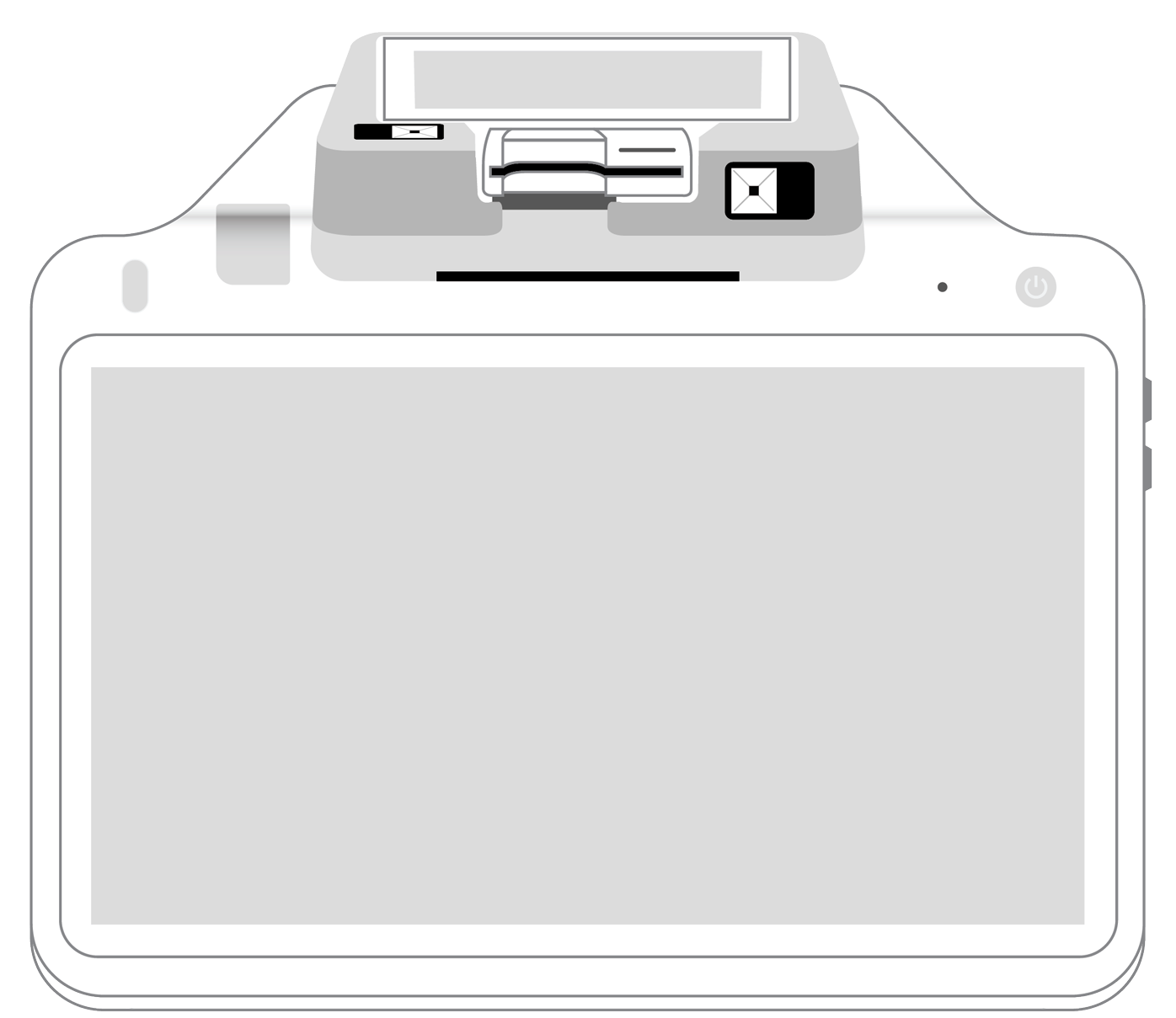

Swipe. Dip. Both. For the foreseeable future, EMV-chip cards will also have the standard magnetic stripe on the back for those merchants who haven’t completed the EMV transition yet. But, if the machine is EMV-ready and the customer swipes their card like they have for years, the machine will request that the customer “dip” their card. “Dipping” is the process of inserting an EMV card into the EMV slot and allowing the microprocessor chip to connect with the terminal to complete the transaction.

Give it time. Unlike the standard swipe, the EMV process of dipping the card takes a few seconds. These extra few moments are needed to allow the chip to communicate with the terminal so it can make sure the terminal is legitimate, and the terminal can do the same for the card. Interrupting this communication by taking the card out will cause the transaction to be declined. Customers will have to either sign or enter a PIN number for each purchase made with an EMV card. The card issuer determines which method that needs to be used.

The time is now. If you haven’t already, you need to get an EMV-ready terminal as soon as you can, or as close to Oct. 1 as possible so you can limit your liability. Liability shifts to the party in the transaction that is least EMV-compliant and they will have to cover the costs when a fraudulent card is used at the point of sale. This EMV-readiness will extend to ATMs and fuel pumps at gas stations in 2017.

The main purpose for the switch. The reason for the transition to EMV-chips is to decrease the use of fraudulent cards by making them more difficult to counterfeit. EMV-chip cards create a new code for each transaction, making it nearly impossible to create a counterfeit card. The magnetic-stripe cards store unchanged data in that magnetic stripe on the back of the card, opening them to fraudulent purchases in the form of a fake card, because the cardholder’s personal data could be compromised in a swiped transaction.

Change is coming, no matter how much a store owner has procrastinated — so protect yourself by being EMV-ready as soon as you can.

Contact PayAnywhere at 877-387-5640 if you have any questions about being EMV-ready.

More from News

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||