Five mobile payment trends that are here to stay.

Technology and changing social and work priorities have led to a marked evolution in the ways people shop. When the coronavirus pandemic hit in 2020, these trends accelerated exponentially. As a result, consumers and merchants alike are continuing to embrace several of the emerging mobile payment trends that show no signs of disappearing anytime soon.

Mobile wallets.

Now that the majority of shoppers never leave home without their cellphones, the dawn of digital payments powered by mobile wallets has officially arrived. Buyers simply preload their digital payment information into their smartphones’ built-in apps and then use them to pay for products or services. The technology is supported by PCI-compliant encryption and tokenization that keep the transaction secure, and the shopper’s identity is authenticated using biometrics. The process could not be any faster, easier, or safer.

Contactless payments.

The coronavirus brought home the fact that germs and viruses can be transmitted by touching contaminated surfaces. Touchless payments use near-field communication (NFC) technology embedded in a merchant’s card reader to communicate with a phone or other device placed in close proximity to it. Sensitive payment information can then be passed securely back and forth without any physical contact needing to occur.

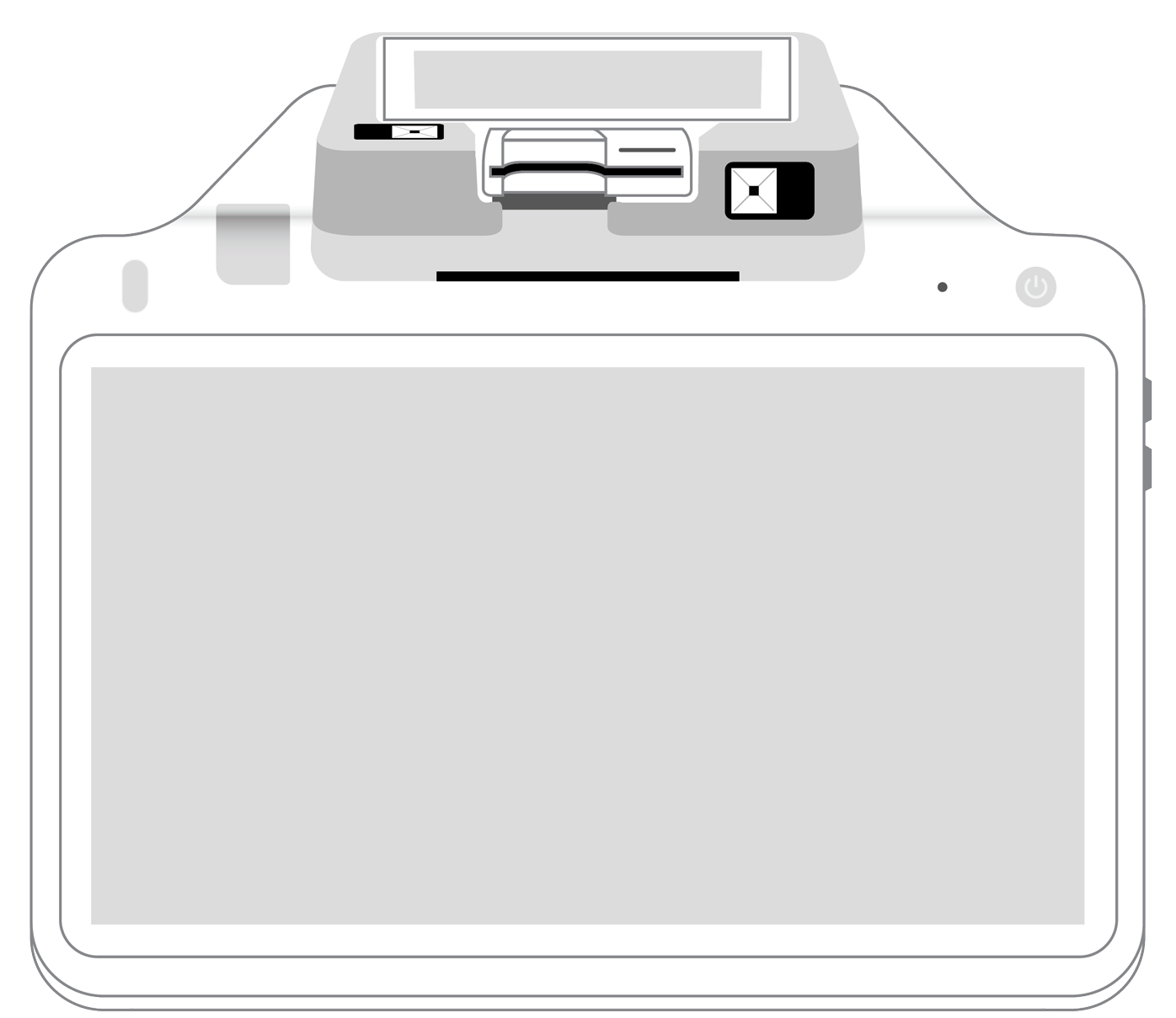

Mobile point of sale (mPOS) technology.

Mobile credit card processing has also freed merchants from the confines of wires and stationary terminals. Thanks to today’s wireless solutions, you and your associates can now conduct payment transactions from anywhere: on the sales floor, across town, or at a trade show in another country. Best of all, you won’t have to sacrifice security to do it.

Social media marketing and tools.

The omnipresence of the mobile phone has also facilitated greater adoption of social media. People of all ages are now making videos, reading reviews, and taking the recommendations of influencers on sites such as Instagram, TikTok, Facebook, YouTube, and many more. As a merchant, you can jump-start your marketing, engage with current and future customers, and build brand recognition by making yourself known on social media and updating your posts regularly.

Flexible payment options.

Buying goods and services can still happen at a cash register. However, the reality is: Other choices have become increasingly popular. Businesses are now becoming multichannel, allowing purchases to happen via online invoices and even over the phone.

Furthermore, retailers are giving buyers flexibility when it comes to the nature of their payments. One of the most popular models involves encouraging customers to sign up for recurring or subscription transactions. The arrangement is made in advance and involves scheduling regular withdrawals from the shopper’s bank account. With a Recurring Billing Program in place, neither merchant nor customer has to worry about late or incorrect payments, and both cash flow and product delivery become more predictable and reliable.

At some point, COVID-19 will be fully in our rearview mirror. However, it is sure to leave behind many lasting effects, including permanent changes in how customers expect to shop and pay for products. If you have not incorporated these solutions into your operations, now might be the ideal time to evolve with the changing times to meet new customer demands.

More from Business tips

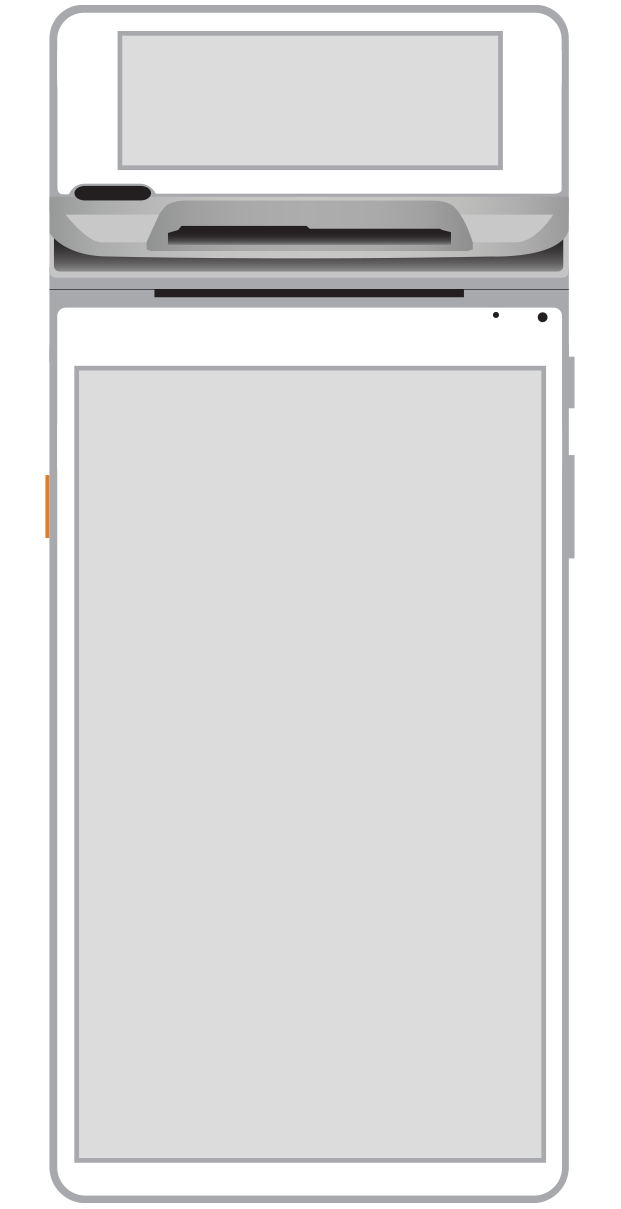

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||