How to decide the payment terms for your small business.

When your business income relies on invoices being paid on time, striking the balance between customer convenience and consistent cash flow can be a challenge. Here are a few questions to ask when establishing payment terms.

Which terms are best?

The one thing you want to avoid at all costs when setting terms is giving yourself too short a period between the time payments come in and when you have to pay your suppliers. This could put you at risk for overdrawing your bank account. It also causes all kinds of unnecessary stress if one or more of your customers is late making good on an invoice.

Depending on your cash flow needs, you could:

- Offer net terms, in which customers have a certain number of days to pay from the time the invoice is issued.

- Ask that a percentage be paid upfront with the rest collected when a job is completed.

- Offer installment payment options.

- Request immediate payment upon receipt of goods or services.

Should you offer discounts?

Giving customers a small discount for paying early (such as 2% or 5%) can get money into your business bank account sooner. Be careful about how much you slash your prices, though. Too big of a markdown can cut into profits and set customers up to expect lower fees for all your work.

What’s the best way to handle late payments?

While avoiding late payments altogether would be ideal, it’s pretty much impossible in real-world situations. Customers have busy lives and lots of other expenses. Sometimes, they’ll forget/fail to pay you on time. Try these simple ways of jogging their memories:

- Use invoicing software with automated due date reminders.

- Set up recurring invoices for weekly or monthly services.

- Offer an automatic payment option.

You may also choose to charge late fees, but it’s important to be willing to work with customers in the event that unforeseen circumstances affect their ability to pay.

What payment types should you accept?

Credit cards are probably the most convenient way for customers to pay. You can accept credit card payments on the spot with a mobile card reader or virtual terminal. You can also send invoices online for customers to pay at their convenience. Older customers may still prefer cash or checks, so consider taking these forms of payment if your target audience consists mostly of baby boomers.

When should you define payment terms?

You should always discuss terms with customers prior to delivering goods or services. Lay those terms out clearly in contracts, including upfront payments and late fees. Go over contracts with customers to make sure they understand the terms they’re agreeing to.

Be clear about payment terms and diligent in following up on outstanding invoices keeps customers happy and your budget balanced. Pay attention to your books to determine if the established terms are appropriate for your industry and business structure. Then, make any necessary adjustments to future contracts to maintain positive cash flow.

More from Business tips

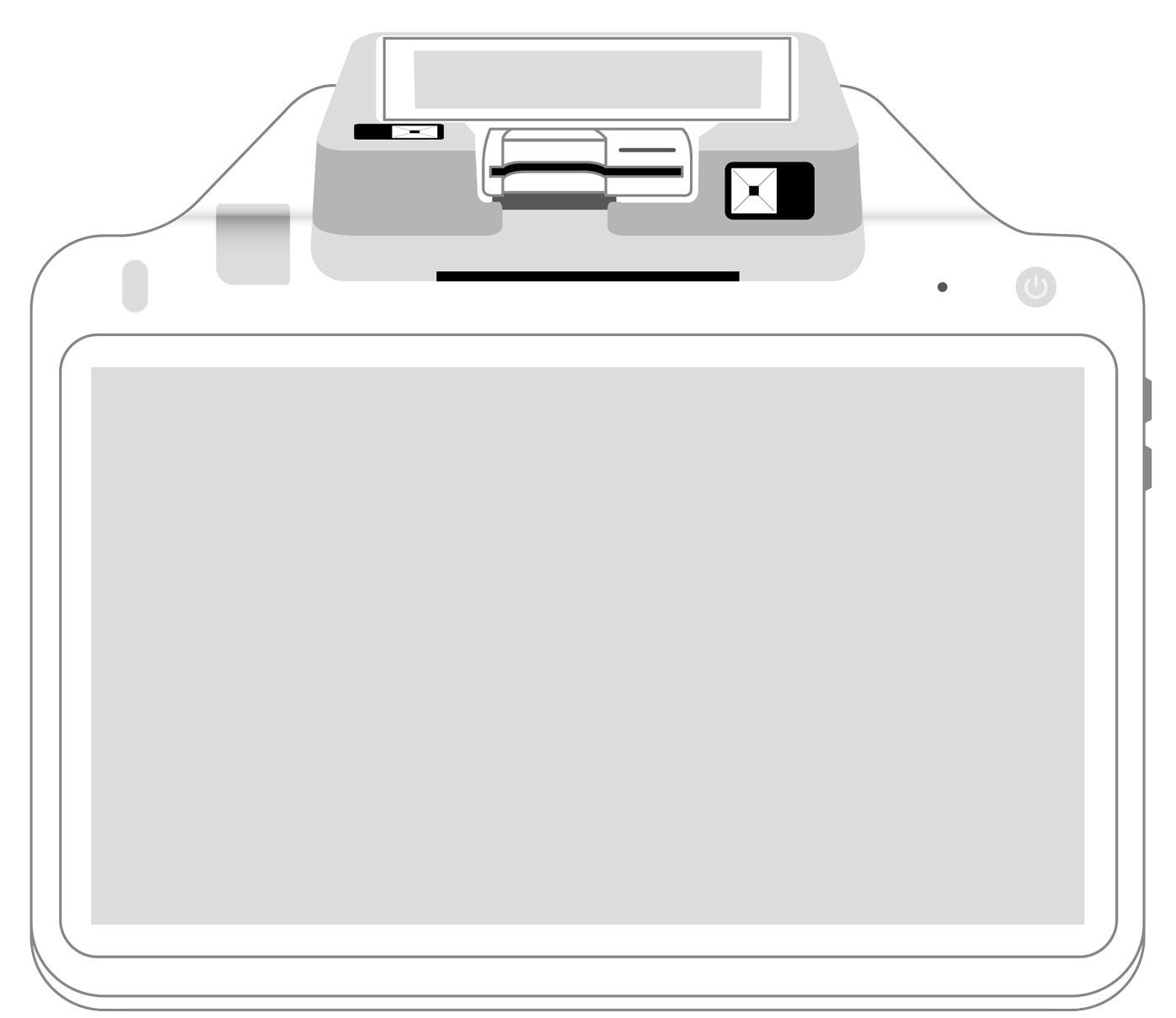

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||