What You Really Need To Know About Mobile Payment Security

Concerns have been raised in various quarters about the security features of mobile payment systems. While such concerns were valid in the late nineties, the technology for mobile POS has grown by leaps and bounds in recent years. As the sun shines over 2013, merchants can rest assured that the safest way for accepting payments in today's market is through wireless, digital handheld devices like smartphones and tablets.

Electronic Signature Verification

One of the primary recent advances in the payment industry is the development of electronic signature technology. Contracts and receipts can now be signed on an iPad or Android from virtually any business or residential setting Ð which does beg the question as to whether this would enable ID theft.

Fortunately, the risk of forgery has been greatly reduced with the recently-developed technologies for cross-referencing. With most of today's services, signatures are verified against universal databases of pre-existing signatures - which ultimately verifies whether or not a document has been signed by a legitimate party. Such services are sent through SSL and backed with 128-bit encryption for utmost user safety.

Receipt Authentication

Another way for mobile merchants to prevent fraud is through the digital verification of e-receipts. With the ability to track and visually compare original database receipts with returned copies, merchants have the upper hand when it comes to chargebacks and warranty fraud stemming from doctored receipts.

Content Protection

Unlike registers, safes and wallets, mobile payment systems cannot be accessed by thieves. For anyone who accepts payments in remote locations with a handheld reader, the security of monies is of primary importance. Until recently, outbound merchants and service people often accepted only cash or checks, which could easily be lost, stolen or damaged on site or in transit. Mobile payment systems solve this problem by keeping all monies paperless and protected under digital, password-protected lock and key.

In the event of a smartphone theft, owners can track their stolen devices via third-party software programs. For added assurance of content safety, third-party apps can also be used to wipe all data from a stolen mobile device.

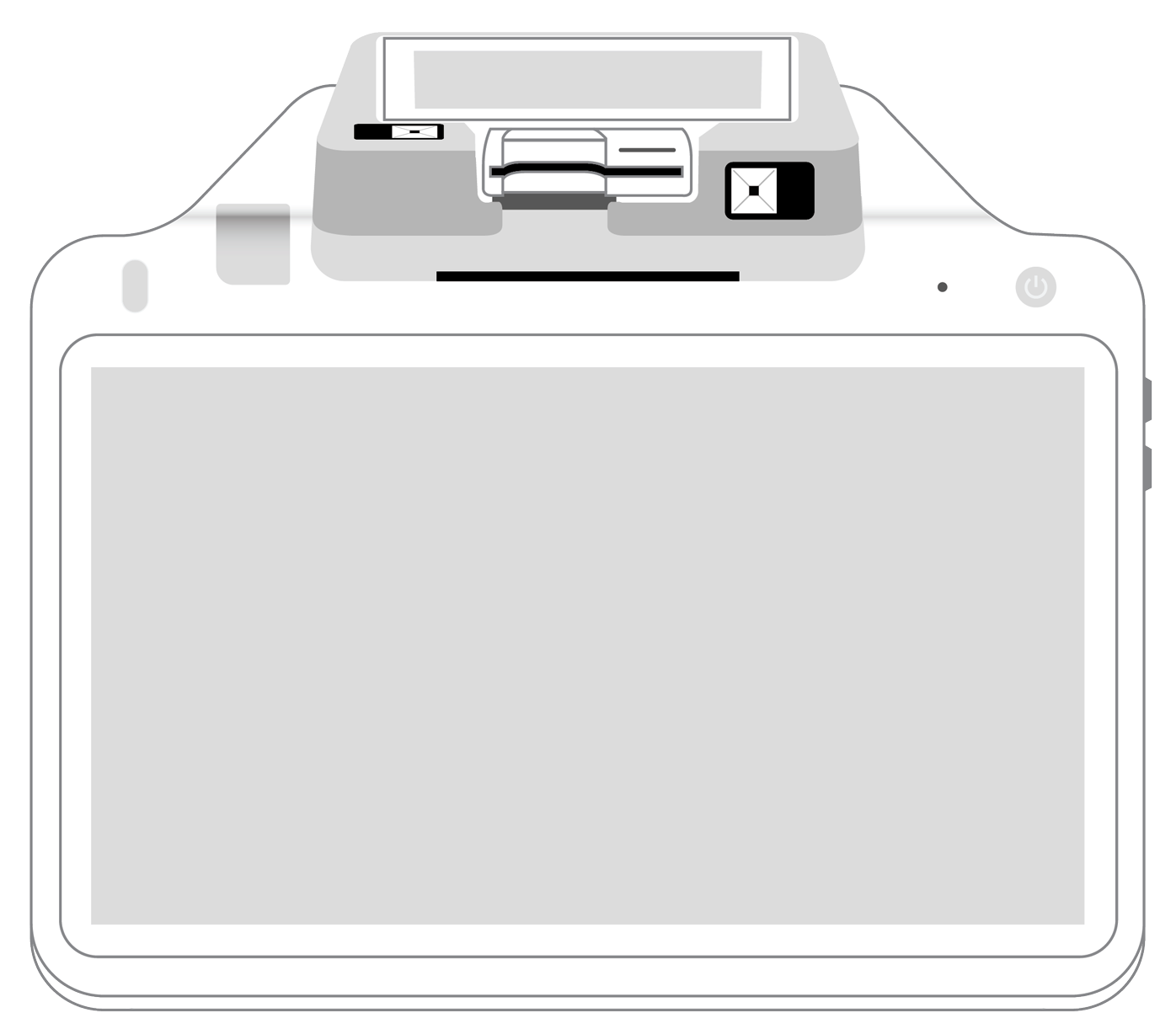

When it comes to accepting payments from any setting, the best mobile unit is the PayAnywhere iPads, iPhones, Androids, and BlackBerry, the lightweight reader is available free-of-charge to all qualifying merchants. As a PCI compliant and encrypted reader, PayAnywhere is the best device on the market for accepting credit card payments on Visa, MasterCard, Discover or American Express Ð from any indoor or outdoor location with an Internet connection.

More from News

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||