Need a new POS system? Choose the best with these handy tips.

Are you looking for better POS software for your small business? You need a system designed to simplify common processes and make transactions a breeze for you and your customers. The best solutions incorporate these 10 important features for optimal performance:

User-friendly setup and operation.

The whole point of upgrading your POS system is to streamline the way you do business. Unfortunately, some POS platforms are more complicated than they need to be, which leads to frustration for both business owners and customers.

A good POS platform is easy to set up with your business information and will seamlessly link with the other software programs you rely on. It shouldn’t take ages to train employees to use all the features. Finally, it of course needs to be easy for customers to interact with, especially if you offer options like self-service check-in or kiosk ordering.

Robust payment options.

According to a 2017 survey by TSYS, a payment processing company, 77 percent of consumers prefer to pay with either a credit card or debit card instead of cash. In other words, your customers probably want to pay with plastic, so your POS system needs to accept the major card brands if you want to draw more people and increase sales.

The use of mobile wallets is also on the rise. In fact, acceptance of this quick payment method is expected to grow from 29 percent to 62 percent over the course of 2019, suggesting it’s a smart idea to implement support for it now to get the jump on your competitors.

Adding credit cards and mobile wallets to the payment types you accept not only attracts more customers, it also allows you to process transactions more quickly than when you’re limited to checks and cash. It’s a winning combination for growth in a society where consumers are becoming more tech-savvy by the minute.

Relevant integrations.

Many POS platforms are evolving into robust solutions for much more than just payment processing. Today’s best systems either offer features for a variety of back-office business needs or integrate with common software options you’re already using. These should include:

- Employee time tracking and scheduling to simplify payroll and shift management.

- Inventory tracking with low stock alerts to keep popular items from running out.

- Integration with your accounting software for better budgeting and easier tax preparation.

- CRM platforms to track customer behaviors and improve your marketing efforts and enhance your customer service.

- Ecommerce solutions to link online and offline sales data.

- Delivery management and tracking and more.

The more you can do or link to with your POS, the better. Integrations break down barriers between processes and eliminate the silos typically responsible for limiting business growth. When you can access all the key details about your sales, customers, and team members from one omnichannel payments platform, you no longer have to waste time jumping between applications to get things done.

Industry-specific options.

Whereas a cash register can do only one thing, a robust POS solution has the ability to adapt to a wide range of uses. This flexibility is the beauty of modern POS systems and can even be expanded upon through the use of integrations.

For example, inventory tracking and management are vital if you run a retail store or restaurant. Knowing how much stock you have on hand and when to order more ensures you never run out of customer favorites and prevents lost sales. Restaurants benefit even more from inventory features designed to track individual ingredients used in dishes and drinks.

If your business deals primarily in a service industry, you need a POS with scheduling options, including online booking to allow customers to choose the most convenient appointment times. Mobile and kiosk check-in features expedite service and move clients through faster.

Maximum mobility.

Mobile features untether you and your customers from static terminals, which can be a lifesaver during busy seasons. You may think of a mobile POS as a tool for offsite sales, but it’s also ideal for line-busting — checking out customers while there in line or elsewhere in your store. When employees are equipped with mobile devices, they can help customers find exactly what they’re looking for and make sales on the spot instead of wasting precious minutes wandering around the store in search of an open terminal. As a result, customers have better experiences and your sales numbers grow.

Restaurants get unique benefits from mobile POS options, which allow customers to pay at the table instead of handing cards to servers and waiting for the bill to be processed. It’s a much faster approach and customers enjoy greater peace of mind because their cards never leave their sight. Faster payments translate to higher table turnover rates, allowing you to decrease wait times at peak hours and serve more customers throughout the day.

Online and offline use.

Whether you already have an established ecommerce branch for your business or you’re just getting started with building your web presence, your POS solution needs to properly support online sales. Trying to use two different platforms makes it nearly impossible to consolidate customer data and provide a unified shopping experience. Your online data will forever be separate from in-store purchase information, which can cause confusion regarding purchase histories and reduce the efficacy of your marketing campaigns.

Service businesses run the additional risks of double-booking time slots or overbooking staff members. It’s great to have an online booking calendar, but if the information doesn’t show up on your in-store POS system, you have no way of knowing how many appointment times are open or if your most popular employees are available when customers want them.

Customer service and loyalty.

Unity between all touchpoints creates complete customer histories you can use to create customized marketing campaigns and loyalty programs. Recent statistics show just how much customers love personalized deals:

- 91 percent are more likely to choose brands whose offers are relevant.

- 72 percent will only pay attention if marketing is customized.

- 71 percent find impersonal shopping experiences frustrating.

- 36 percent want brands to offer more personalization.

Customer data from your POS system provides the foundation for the custom offers your devoted shoppers want, including recommendations, product-specific discounts, and special rewards.

Detailed analytics and reporting.

Knowing more about your customers isn’t the only way a POS system can improve business management. You also get a comprehensive view of sales, inventory, and advertising campaigns. By tracking the popularity of products and services, you can adjust your marketing to play up the benefits of slow movers or choose to discontinue items entirely.

Employee details like sales performance, attendance, and total working hours provide insights to improve how you handle scheduling and training. You can more easily pair staff members with corresponding skill sets together on shifts to provide better customer service or make sure your best salespeople are on the clock during periods of high-volume shopping.

Service and support.

By now, it should be clear your POS is the heart of your business both at your physical location and online. If something goes wrong and you don’t have consistent access to support, you run the risk of losing a significant number of sales and missing out on collecting critical customer data. You need to know the platform will get up and running again quickly in the event of an outage or error.

Look for 24/7 support teams staffed by knowledgeable people who can help with troubleshooting whenever you have a problem. Make sure support is included in the price of the POS so that you don’t get a nasty shock the first time the system goes down and you wind up with a bill for the assistance you receive. It’s even better if the vendor provides support during the setup process to ensure all aspects of the system are fully operational and your integrations work as they should.

Platform pricing vs. business budget.

The size of your business and how much you have available to spend on a POS system may limit the available features, but this doesn’t mean you’re stuck with a bare-bones option. There are plenty of POS solutions you can implement for free or at a very low cost. The biggest expenses to watch out for include:

- Hardware.

- Monthly use fees.

- Transaction fees

Free systems charge only per transaction, which is often a percentage of each sale plus a small fixed amount. Comparing these fees is crucial, especially if the majority of your customers make small purchases or you sell a lot of low-ticket items. Look for lower fees to ensure you don’t lose big chunks of each sale to charges. Some POS providers may include additional fees for integrations or advanced tech support.

You also need to consider how much hardware you need at the start. Are you replacing or upgrading to multiple terminals as your business expands, or just setting up a single terminal at the front counter in a small shop? Do you need additional devices for employees? Does ecommerce enter the picture? Each of these considerations will impact the price of implementation and operation.

Use these criteria to narrow down the options regarding POS software for your small business. Evaluate available systems in light of current and future needs and be sure to take advantage of demos or free trials to get a feel for how platforms work in practice. Choose a solution with a combination of features and pricing to support business processes and growth.

More from Business tips

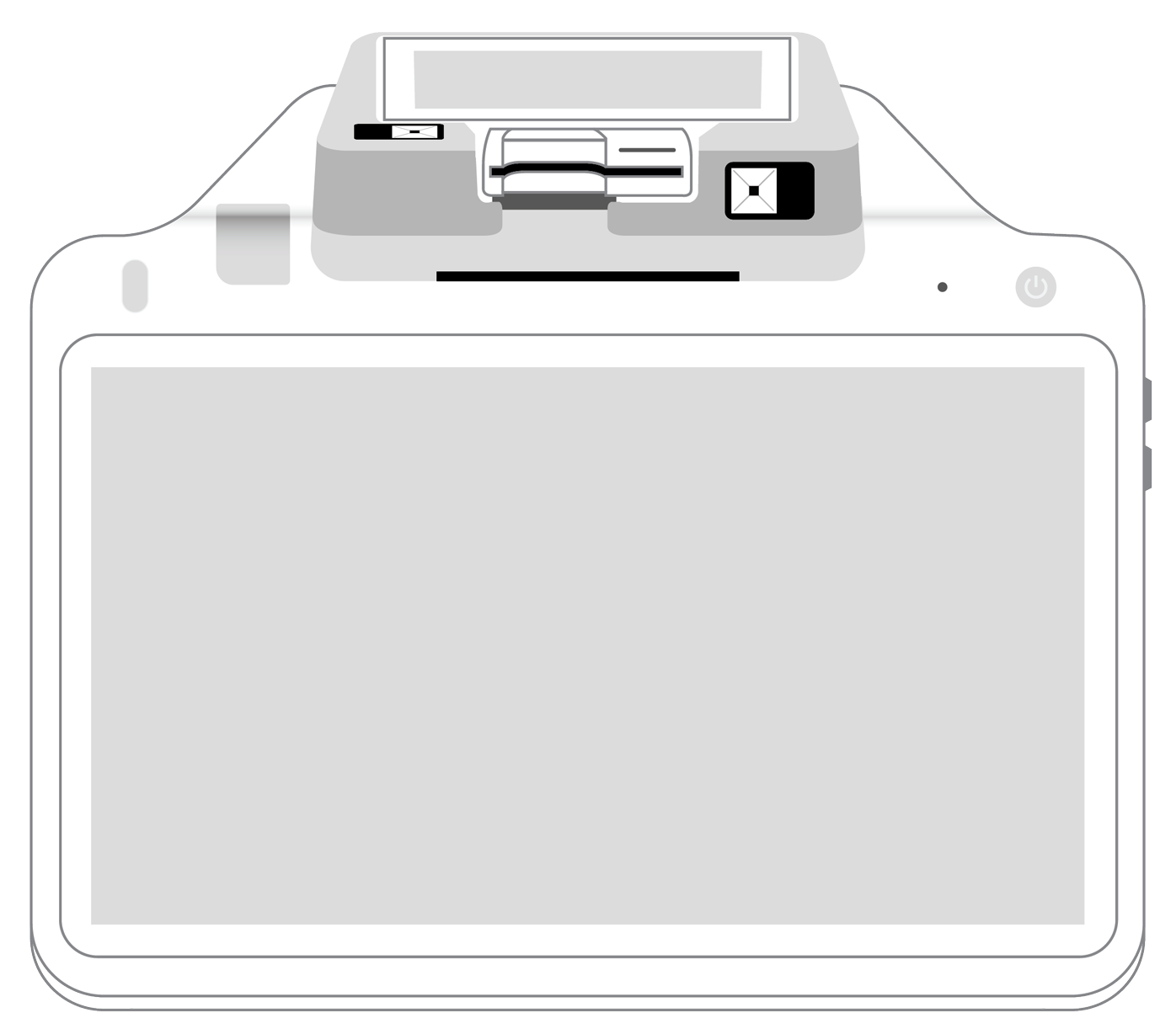

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||