Need to improve small business cash flow in 2019? Try mobile payments!

A study conducted by U.S. Bank shows cash flow issues account for 82% of small business failures. According to JPMorgan Chase, most small to medium enterprises (SMEs) only have enough cash flow for 27 days, which has likely contributed to the 40% increase in the use of SME business financing.

Can simply adding a mobile payment option for your customers prevent your business from experiencing similar problems with cash flow? The answer is yes. By accepting mobile payments, you’ll:

Profit from a growing trend.

More customers are using mobile payments in brick-and-mortar stores than ever before. In fact, mobile purchases are expected to increase to $500 billion by 2020, up from just $75 billion in 2016. Cashless purchases among Americans stand at 29% and only 18% of consumers still use cash for everything they buy. The shift has prompted the release of branded mobile payment options by major brands like Walmart, Target, and Starbucks.

Increase transaction speed.

It only takes a split second for a customer to pay using a mobile device, which drastically cuts down on time spent on each transaction. This can reduce line sizes without the need to recruit more employees to run registers. It also makes the checkout experience more pleasant during busy periods. You’re able to process more sales each day and customers will remember and appreciate the fast service they receive at your store.

Get money in your account sooner.

Service businesses suffer when invoices go unpaid, but mobile payments can be processed instantly on the spot. Whether you make payment in full or ask for a percentage of the total upfront, the money goes right into your business bank account with no delays and you no longer have to deal with the frustration of bounced checks.

Take advantage of more sales options.

Going mobile untethers you and your employees from your physical location and opens up more opportunities to make sales. In addition to trade shows and festivals, you’re free to participate in local events and pop-up shopping experiences, both of which attract potential customers with whom you wouldn’t normally interact. Branded marketing events are also fantastic ways to increase sales; eighty-five percent of customers going to such events are more likely to make purchases afterward.

Create a seamless customer experience.

Mobility is just as important in your physical store as it is offsite. With mobile point-of-sale (POS) devices in hand, your employees can assist customers in finding desired items and use past purchasing information to make relevant product suggestions. If your POS solution integrates with inventory, it only takes a moment to look up whether a product is in stock and find its location in the store. Customers enjoy such personalized service and every mobile purchase contributes more data you can capture to make their future shopping experiences even more seamless and rewarding.

It isn’t hard to add a mobile payments option to your current POS system or upgrade to a better solution with an integrated mobile option. You should see the investment start to pay off almost immediately as transactions become smoother, sales increase, and cash-flow gaps disappear.

More from Business tips

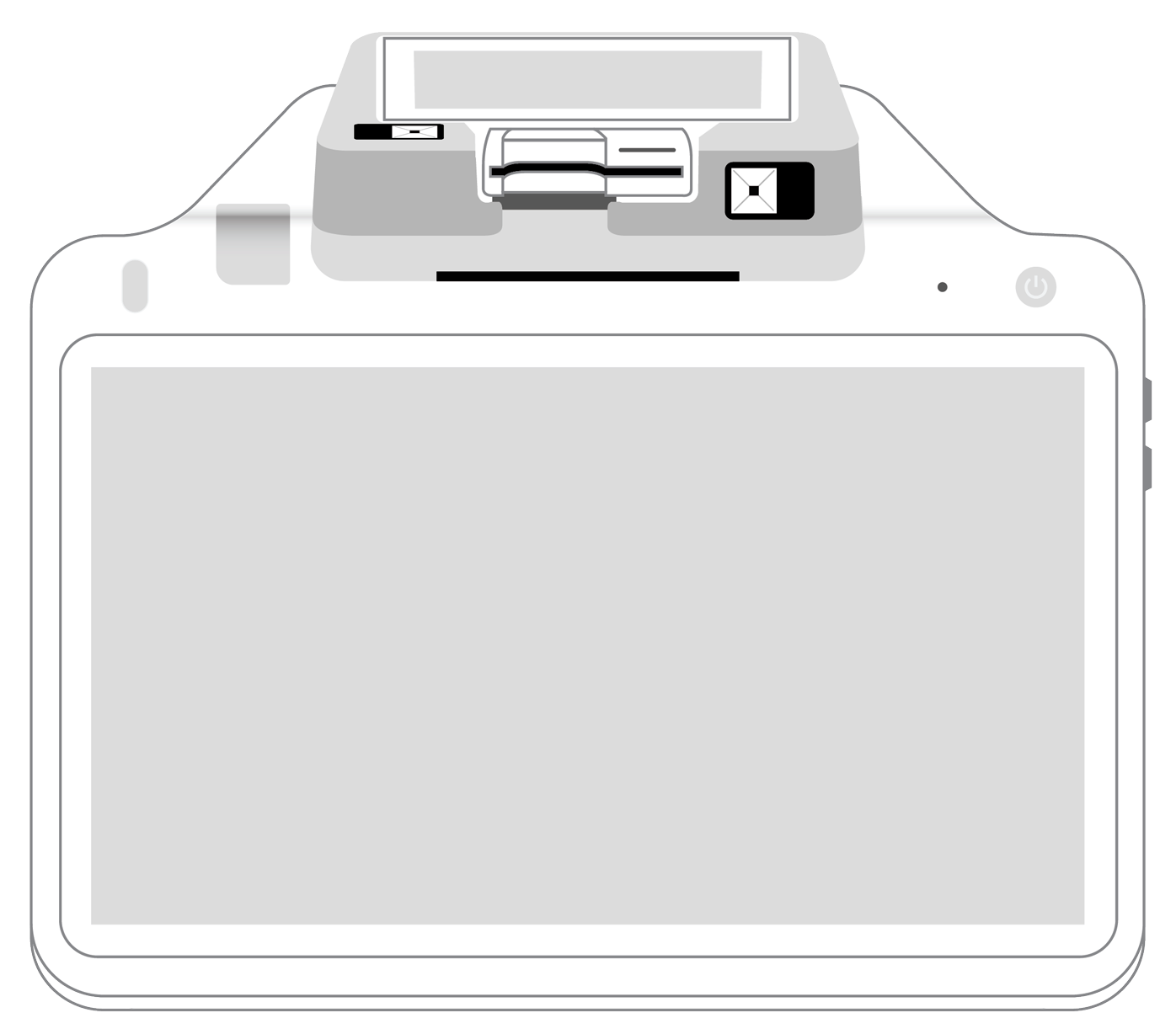

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||