Retail point of sale trends for 2021 and beyond.

You are likely well aware that a point of sale (POS) system can do much more than simply allow you to accept payments. Even before the COVID-19 epidemic came into full and frightening fruition, merchants were harnessing their checkout hardware and software for numerous tasks, including customer relations, inventory management, report generation, and sales forecasting. As we begin to come out the other side of the pandemic, you’d do well to track how retail payment processing is expected to evolve over the next few years.

1. A continued increased emphasis on mobile payments.

If the coronavirus brought any point home, it was that it is in every merchant’s interests to offer flexibility in how, where, and when consumers pay for goods and services. After all, retailers who were already equipped with a dedicated mobile app or, at the very least, hardware and software that allowed for contactless in-person and/or ecommerce transactions, found themselves far better situated in the evolving payments landscape than their less tech-savvy competitors.

With every passing year, more consumers are carrying smartphones with them and more importantly, using these ubiquitous devices whenever possible. That includes paying for public transportation, banking, browsing the internet, and purchasing products and services.

The driving force behind this increasing popularity is found in the digital wallets that come pre-loaded in today’s mobile phones. Consumers need only enter their payment information, which is encrypted and stored for later use. At the time of purchase, a successful transaction can then be completed in mere seconds with optimal security and convenience.

If you have not already upgraded your POS system to accept contactless near-field communication (NFC) payments, you may be missing out on a significant number of potential customers. Since this trend shows no signs of subsiding, why not upgrade as soon as possible to meet this increasingly common customer demand?

2. Enhancing the customer experience in other ways.

Modern POS solutions come jam-packed with other capabilities destined to make shoppers feel as if they are the center of your attention and priorities.

• Efficient, secure checkout. When consumers recognize that you’ve taken pains to make their payment experience as safe and frictionless as possible, they’ll see you as a trusted merchant.

• Multiple payment options. The POS systems of the future will continue to provide more ways for customers to make purchases. For now, these include cash, credit and debit cards, and even EBT.

• Inventory management. With a POS that keeps track of what is in stock, what isn’t selling, and what needs to be reordered, your customers can have the items they want in a timely fashion. When you reorder only what people are actually buying, you free up more funds for other priorities.

3. Increased adoption of cloud-based POS solutions.

Keeping digital information in the cloud instead of inside your legacy POS is a trend that will continue to grow in popularity. Many businesses are making the switch to these cloud-based solutions for the following reasons.

• They are intuitive to set up and easy to use. Updates are installed remotely as needed via a single payments app.

• They offer maximum ease of use. Most cloud-based systems integrate seamlessly with other software or systems that you are already employing.

• They provide greater flexibility. You can fit a cloud-based solution into even the tightest of budgets by installing it in stages. Pay for only what you need, gradually incorporating the entire package over time.

4. Faster payment processing.

Whether you operate in the Retail or Hospitality industry, your customers share one desire: They want their payments to be fast, frictionless, and secure. Today’s POS systems take this priority into account by making it increasingly easier for buyers to use their phones, tablets, and smartwatches to safely pay and be on their way. As a result, businesses are seeing several benefits.

• The ability to process transactions using tap-and-go contactless technology.

• Easy integration with your business’s mobile app, allowing payments to be made from anywhere.

• Virtual terminal access so that you can take card-not-present orders over the phone.

5. An omnichannel sales approach.

In today’s payments climate, you want to take advantage of all possible sales venues. To that end, most physical stores also have an online component that allows for internet browsing and purchasing.

Your POS system should help you to take this multi-channel approach to the next level. That means understanding that today’s customers often go on a complex buying journey. For instance, they might see one of your products on Instagram, search for your site on Google, and ultimately come to your physical store to make the actual purchase.

Another option is the buy-online-pickup-in-store (BOPIS) arrangement that became so popular during the pandemic. This click-and-collect scheme provides your customers with maximum flexibility and convenience. It is also made exponentially easier thanks to today’s POS systems. The POS solutions of the future will likely allow buyers to initiate a purchase via one channel and complete it through another.

6. Enhanced payment flexibility.

In addition to allowing you to accept both cash and credit cards, your modern-day POS system should also be capable of accepting the following.

• BOPIS payments.

• Installment payments. Particularly helpful for those without traditional credit, this method allows customers to pay for their bigger-ticket items over time.

• Stored payments. Your POS system can safely store customers’ payment information, allowing for a faster and more seamless repeat buying experience.

• Bill splitting. Especially useful for restaurants, this enables customers to easily divide their bill at the checkout counter.

The more diverse and flexible the payment options you offer, the more likely you are to attract and retain customers.

Upgrading your retail payment processing is one of the best ways to take your business to the next level. Today’s purchasers want flexibility, security, and convenience. Luckily, contemporary POS systems are uniquely tailored to provide you and your buyers with maximum efficiency, safety, and functionality. All of which serve to enhance the purchasing and customer experience.

More from Business tips

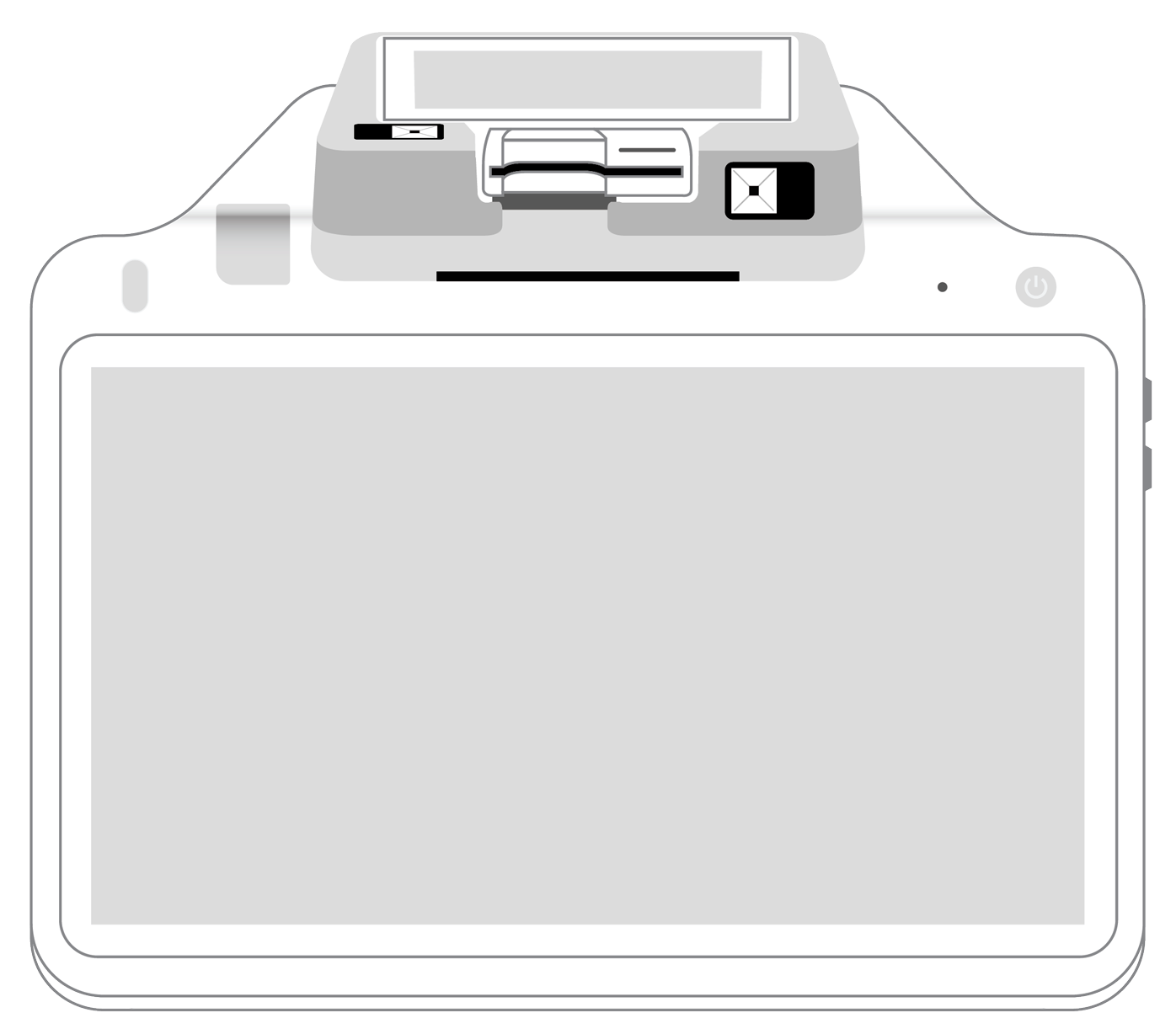

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||