Six signs it's time to upgrade to a smart terminal.

Back in the day, your parents may have run your refrigerator, washer, and dryer into the ground before they shelled out the money to replace them. Now that you’re all grown up and are running a business, you might be tempted to use the same philosophy when it comes to upgrading your credit card equipment. As it turns out, you shouldn’t wait until your payments hardware fails before you upgrade to a more advanced smart terminal. Here are some of the most compelling reasons to make the change now.

Your current terminal is too slow.

Do your customers’ eyes start to glaze over as they wait for their transactions to process? Today’s equipment is lightning-fast, without sacrificing security. That leads to shorter waits and fewer frustrated customers at the checkout line, which is good news for everyone, including your employees.

Your terminal doesn’t accept certain types of credit cards.

If your present payment device is overly picky about what types of plastic it will allow you to accept, you’re in danger of losing customers. Today’s consumers want maximum flexibility in the ways they pay. An advanced smart terminal will accept all types of major credit, debit, and even EBT cards without any fuss at all.

You cannot accept contactless payments.

One unquestioned result of the pandemic is that it increased the popularity of all things touchless, including the ability for shoppers to make payments without coming into physical contact with your POS equipment. To that end, your payment device should be outfitted with the near-field communication (NFC) technology that makes secure, efficient payments like Apple Pay and Samsung Pay possible.

You experience frequent card reading problems.

An occasional glitch is one thing. However, if your readers frequently fail to register the information on your customers’ cards, you could be in trouble. Entering information manually paves the way for data input errors, overcharging, increased processing fees, and even costly and reputation-damaging data breaches.

Your terminal is not EMV-compliant.

Back in 2015, the card industry rolled out new security standards designed to replace less secure magnetic stripe technology with chips that are embedded within customers’ credit and debit cards. If you’re still using a clunky credit card terminal that can only read these old-school magnetic stripes, you need to upgrade your equipment today. Otherwise, you could be held financially liable in the event of a data breach.

Your terminal is wired.

Using a credit card terminal that requires an ethernet connection, literally ties your business down. Contrarily, today’s wireless terminals give you the freedom to accept payments from anywhere, including on your own sales floor, across town at a fair or farmers market, or in another city altogether.

Today’s smart credit card terminals offer maximum ease of use, affordability, and flexibility. Not to mention, seamless integration with your existing software and business systems. Why hold on to outdated and oversized readers that might be causing you to lose valuable customers? Upgrade to a smart terminal or POS system today. It will likely be one of the best decisions you’ll ever make for your business.

More from Business tips

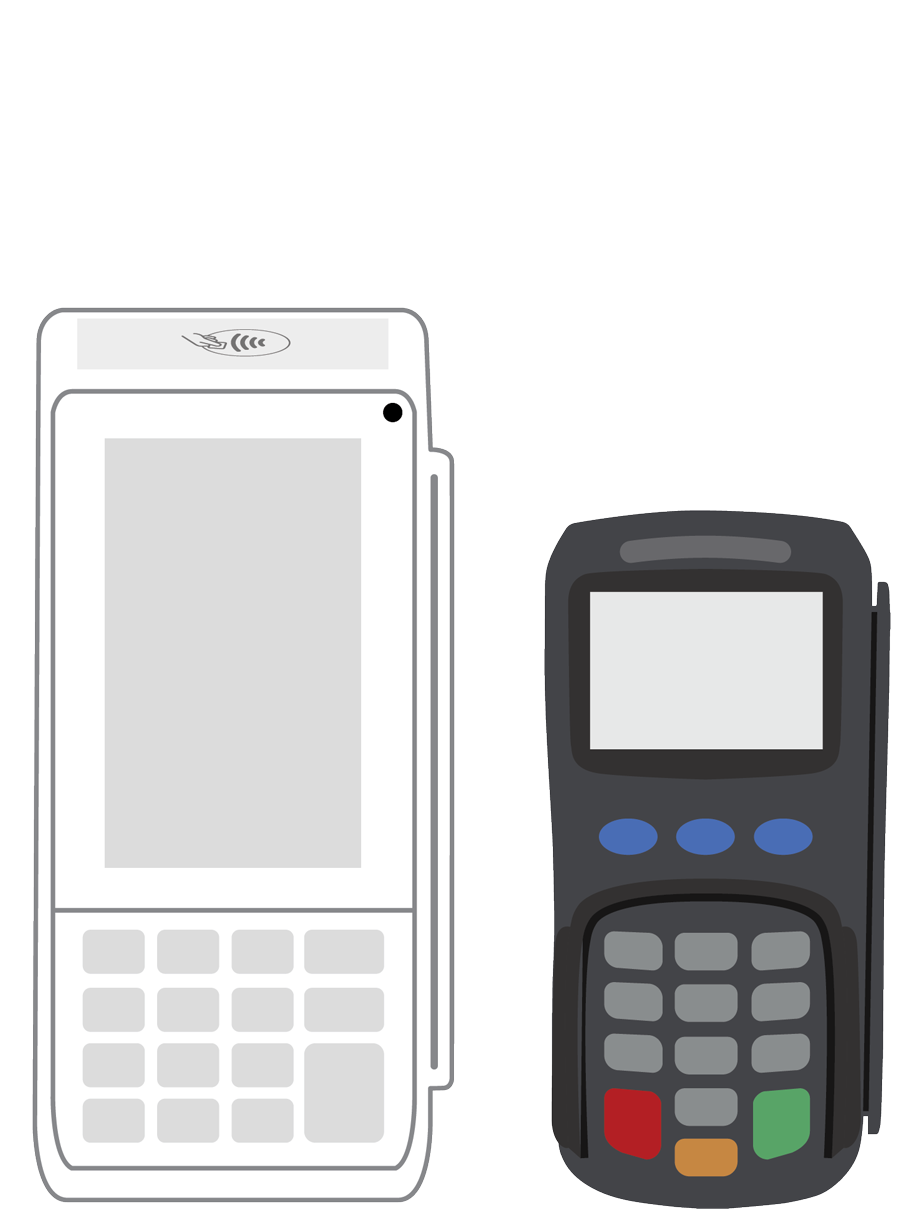

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||