Small Businesses Positive About 2014 Holiday Sales

National Funding, a private lender of small business loans, recently found that more than 25% of small business owners expect better holiday season sales this year, compated to 2013. In the survey, 88% of small business owners said they have a neutral to positive outlook on the holiday season this year. This is a result of the increase in consumer confidence and the improvement in the economy, according to National Funding.

National Funding, a private lender of small business loans, recently found that more than 25% of small business owners expect better holiday season sales this year, compated to 2013. In the survey, 88% of small business owners said they have a neutral to positive outlook on the holiday season this year. This is a result of the increase in consumer confidence and the improvement in the economy, according to National Funding.

National Funding CEO David Gilbert said the holiday season is a busy time for alternative lenders because small businesses tend to have seasonal needs. The increase in customer demand often requires financing during the last quarter of the year, he said. It is expected that the 28 million small businesses in the U.S. will see revenue of over $985 billion by the end of 2014 - thanks to strong holiday sales.

Among small business owners, 4.3% reported that they expect to borrow money during the holiday season and 37% of them did not think banks would grant their loans.

“The truth is that 4.3% is probably under-reported because the majority of loans that arise during the holiday season are last minute," Gilbert said. "Whether or not a small business believes they will need to borrow money, owners should always be planning ahead and anticipate the need for financing. These days, they have more alternative lending options."

He added that, in most cases, small to medium size businesses do not have a need for long term financing during the holidays. Alternative lending options better suit their needs as they offer faster turnarounds and greater flexibility, according to Gilbert.

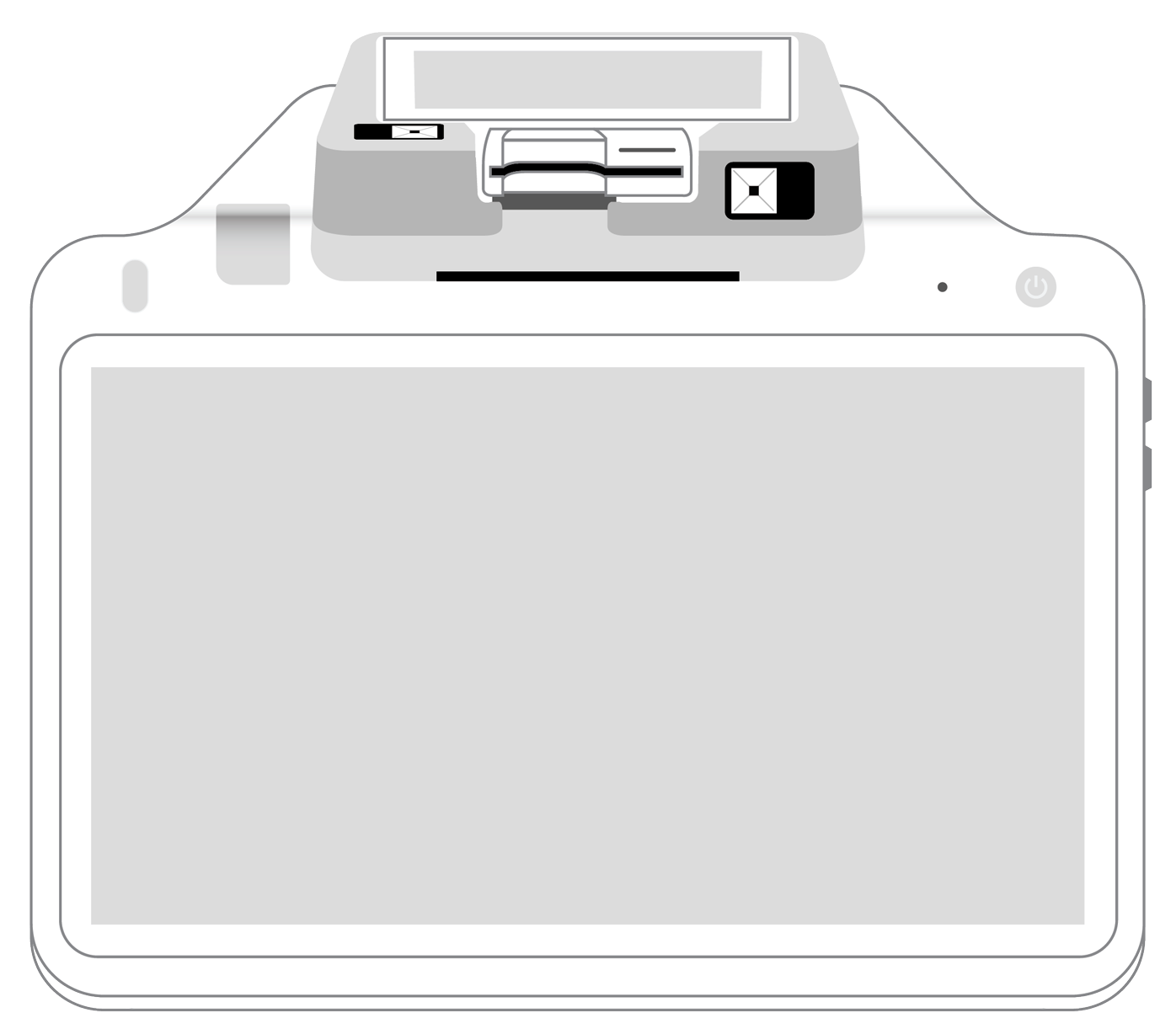

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||