Prepare Your Business for Mobile Payments

Mobile payments are here, and the options for consumers are growing. Several major companies now offer mobile payment platforms, including Apple, Google, Facebook and PayPal. While the majority of mobile payment activity takes place online, more and more people are taking advantage of in-person mobile payments at stores across the U.S.

Mobile payments are here, and the options for consumers are growing. Several major companies now offer mobile payment platforms, including Apple, Google, Facebook and PayPal. While the majority of mobile payment activity takes place online, more and more people are taking advantage of in-person mobile payments at stores across the U.S.

According to MasterCard, all types of mobile payments are projected to expand four-fold by 2019, exceeding $1 trillion in payments made through tablets and mobile phones. In-person mobile payments are expected to increase 12-fold by 2019 to $104 billion.

The benefits of mobile payments include:

- The ability to reduce cost by lowering fraud loss and/or processing fees for businesses.

- The ability to increase store traffic and profits by moving people through checkout lines more efficiently.

- The ability to track the actions and purchases of your customers, allowing you to target your marketing efforts and make the most of your marketing budget.

- The ability to attract customers during off hours with special offers and coupons.

So why should you prepare your business for mobile payments? That’s easy. Mobile payments are quickly becoming the new reality, and to stay competitive with big box stores and other small businesses – you’ll want to offer your customers as many payment options as you can in order to make their shopping experience an quick and easy one.

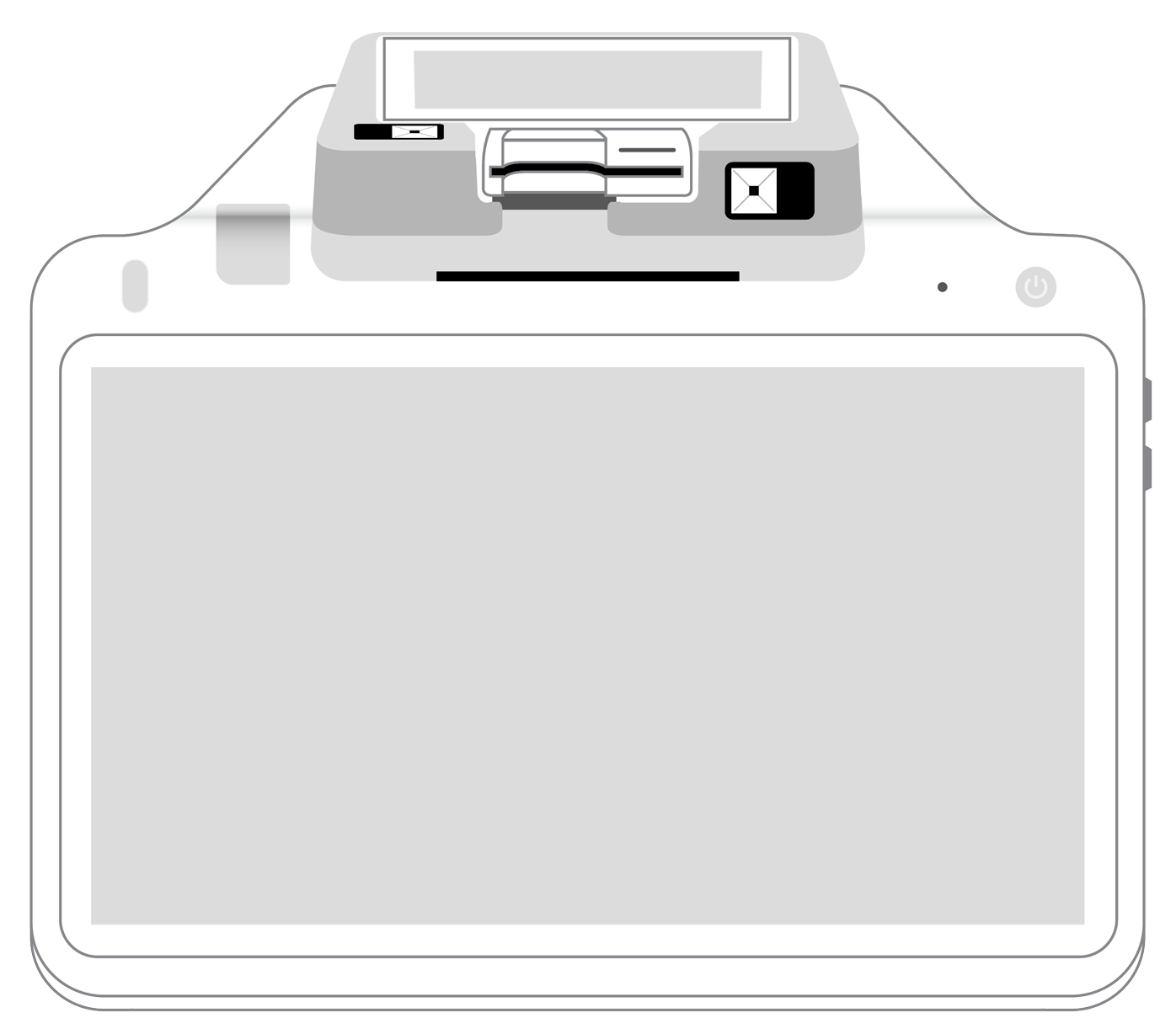

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||