Business tips

How to use your current customer sales data to drive future sales

Ryan Gibbons

You have already equipped your business with a smart terminal a...

Send one time or recurring invoices.

Add and designate employees to accept payments and help manage your business.

Accept online and phone orders right in your web browser.

Get real-time insights into your sales data.

Be in control of your deposits.

Accept contactless payments with only an iPhone and the Payanywhere app.

Easily sell, track, and restock your product catalog.

Monitor customers, generate reports and get paid with our merchant portal.

For a business of any size, the importance of sterling customer service cannot be overstat...

You have already equipped your business with a smart terminal a...

You launched your lawn care business because you loved the idea of being your own boss and working outdoors.

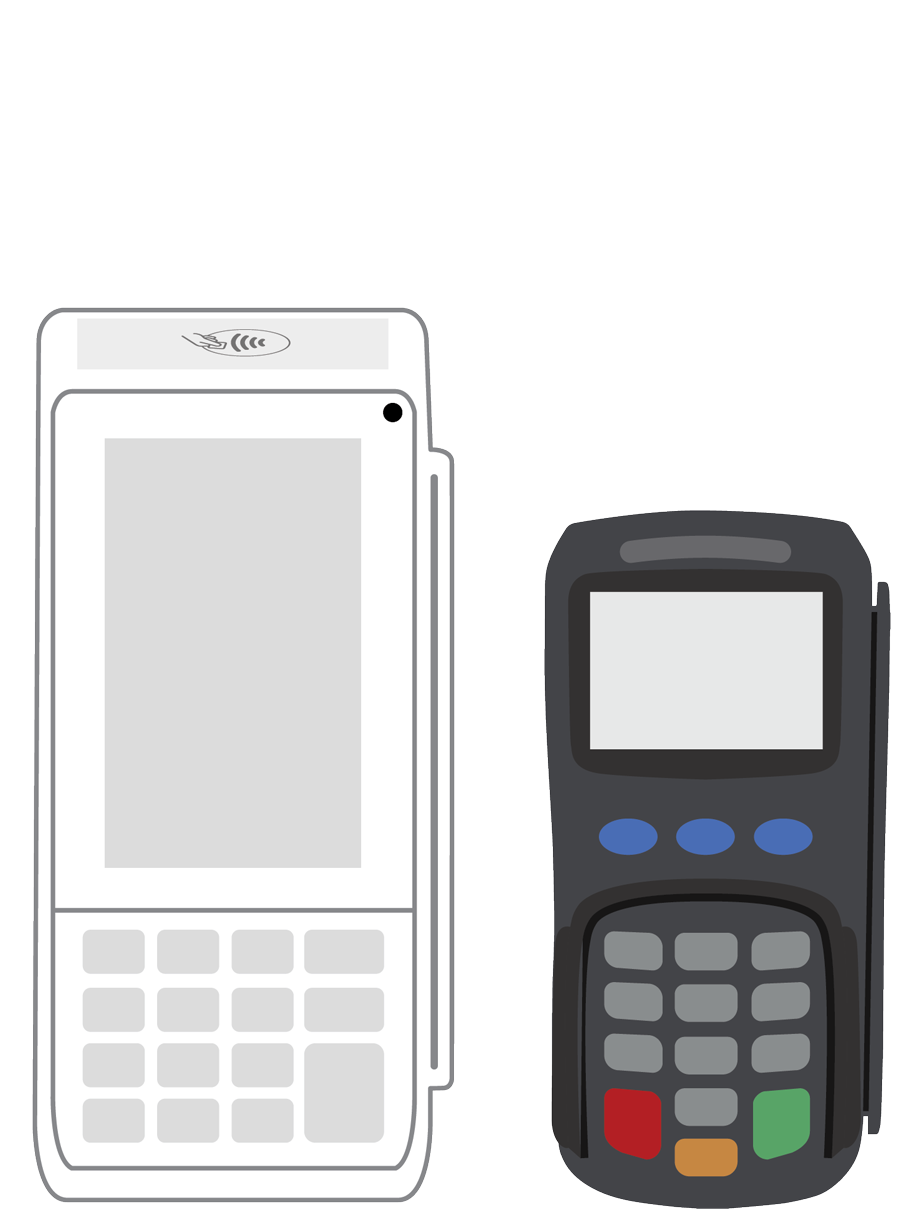

Point of sale systems and credit card terminals offer two popular ways for retailers of all sizes to complete customer purchases.

Today’s point of sale systems are designed to optimize the buying and payment experience for everyone involved.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||