Statistics on American consumer credit card usage that you need to know

Today’s point of sale systems are designed to optimize the buying and payment experience for everyone involved.

On the merchant side, these solutions pave the way for streamlined behind-the-scenes activities such as optimized inventory and employee management, customer relationships, reports, bookkeeping, and integrations with third-party software.

For customers, the buying journey is made faster, more secure and readily retrievable from anywhere. The following statistics underscore buyers’ ongoing reliance on credit cards as well as their underlying spending behaviors.

How often do Americans use credit cards?

Each day, U.S. consumers swipe, dip, or tap their credit cards more than 150.15 million times. Considering that the population of the country in 2024 was 342 million, a percentage of whom were children, this statistic illuminates just how prevalent and popular paying with plastic has become.

Their credit card use is rising across the board. Already, 40% consumers use credit cards to pay for in-store purchases. Online buyers are not far behind, with 30% of customers checking out using this method.

To drill down further into these numbers, it is also important to understand that plastic is quickly gaining prominence.

Nearly one-third of consumers now report that credit cards are their main way to pay. In a similar vein, a small but significant 4% of customers state a preference for using virtual credit cards above all other payment methods.

These include digital options like PayPal as well as Apple Pay and Google Pay.

How much do Americans spend using credit cards?

In years past, customers were slow to adopt credit cards. This was primarily because they were reluctant to trust this relatively new form of payment.

However, the mood has swiftly changed to the extent that the average credit card purchase today is $90.89. Back in 2022, statistics indicated that people spent a whopping $13.6 billion every day using plastic.

In a single month, the average American consumer uses their cards to pay for $1,506 worth of goods and services.

Millennials, also known as Generation Y, are the cohort commonly thought to have been born between 1981 through 1996. Thanks to their long familiarity with and trust in technology and their access to financial resources, they are even bigger credit card spenders.

Their average monthly credit card bills amount to $2,410. Given these skyrocketing spending figures, it is no wonder that the collective U.S. credit card balance surpassed $1 trillion in 2023.

How many Americans use credit cards?

Although there was a time when having a credit card was optional, this is no longer proving to be the case for most adult Americans.

After all, it is virtually impossible to make big-ticket purchases or obtain a loan or mortgage without a reasonably good credit score. And the only way to obtain a score is to apply for and use a credit card.

Therefore, it is no surprise to learn that in 2022, more than eight out of 10 Americans had at least one credit card. In fact, the average U.S. adult today has four.

Perhaps counterintuitively, older consumers seem to be accumulating a greater quantity of cards, with Baby Boomers having an average of 4.61 cards and Gen X with 4.23. By contrast, younger Gen Z Americans come in at a more modest 1.91.

This translates into a whopping 441 million open credit cards in this country as of the third quarter of 2022.

Credit cards provide a host of advantages to consumers. They are convenient, safe, and easy to use. They allow people to spend more money than they actually have on hand.

What’s more, purchases are backed by the financial institutions that sponsor the cards. It is no wonder that paying with plastic continues to be the number one payment method in 2022 and beyond.

How much do Americans owe on credit cards?

Along with their security and ease of use comes one of the biggest downsides of credit cards. The average American owes $6,365 in credit card debt. With the average interest rate coming in at a punishing 22%, this can quickly become a heavy financial burden for many.

Unfortunately, the trend is only expanding. In 2023 alone, credit card debt increased by $45 billion, with Alaska, Maryland, and New Jersey residents being in the most debt.

Only 35% of cardholders pay off their entire balance each month.

Clearly, American buyers have overcome their initial reluctance to embrace the credit card.

Today, they are using plastic to pay for everything from the most minor convenience store purchases to charging big-ticket items such as furniture and automobiles. Regardless of the industry in which you operate or the size and scope of your business, you cannot afford to be shut out from the lucrative profits that taking credit cards will bring.

That’s why you need to contact Payanywhere about incorporating an all-in-one point of sale solution into your business.

Payanywhere is a widely respected merchant services provider trusted by enterprises of all types and sizes across the country.

Our goal is to provide your customers with a seamless payment experience while giving you everything you need to optimize the running of your operations. When you speak with our friendly and knowledgeable representatives, you will learn about all the ways we work to revolutionize your store’s payment security, speed and versatility.

We know that when your customers receive a top-shelf shopping and payments experience, they are likely to make repeat purchases and refer their friends and family to your shop. When business is booming, everyone wins.

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.

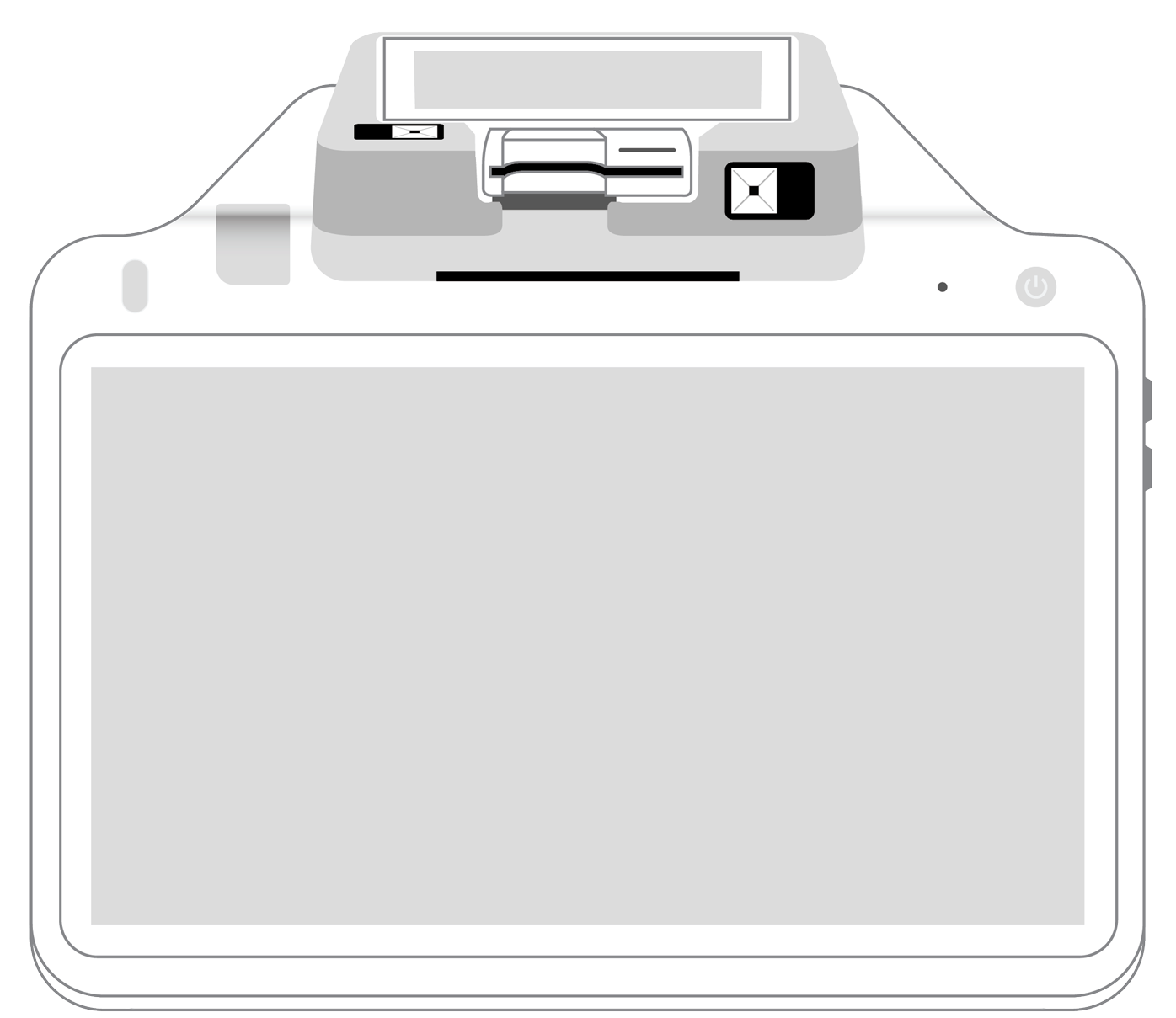

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||