Payment technology for professional services businesses.

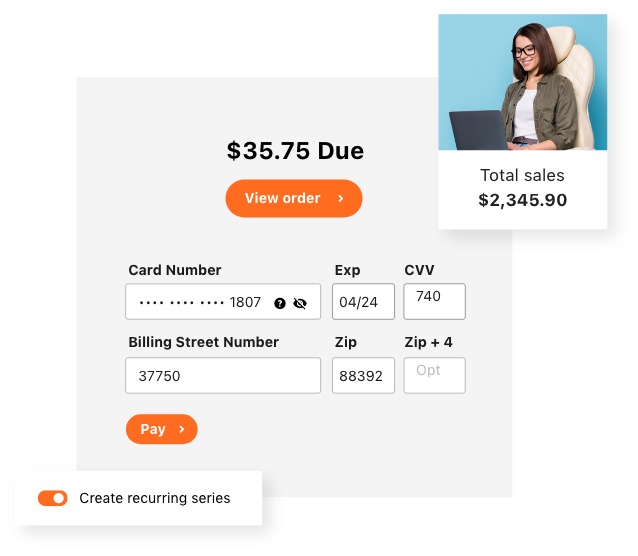

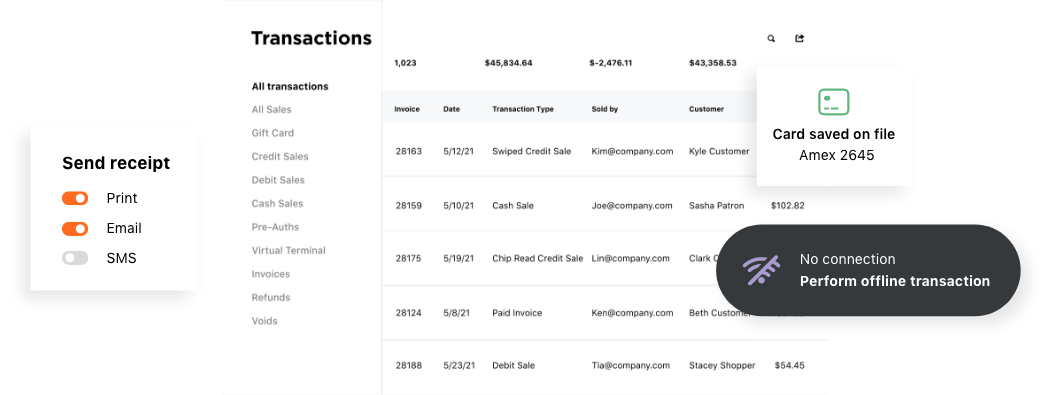

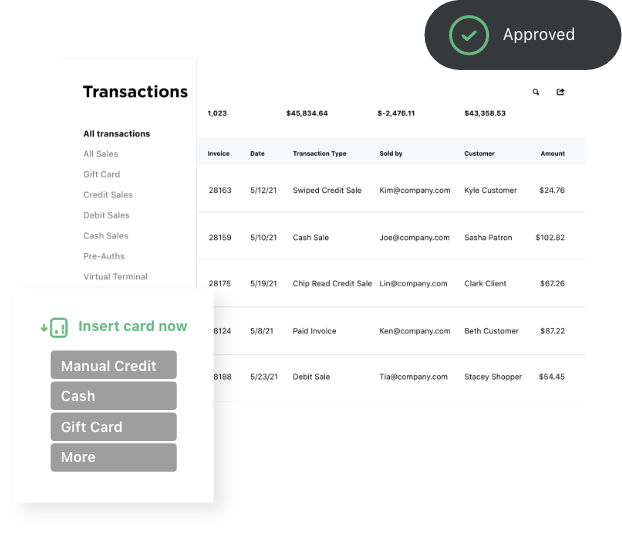

At Payanywhere, we are committed to simplifying credit card processing for professional service businesses, including those in the legal industry, marketing firms, accountants, and their clients. Whether it’s in-person payments, or those made online through a secure virtual terminal, we’ll help you offer payment processing services that are as professional as you are are.