Payanywhere tips

How Contactless Payments Can Speed Up Your Holiday Checkout Lines

Jereme Sanborn

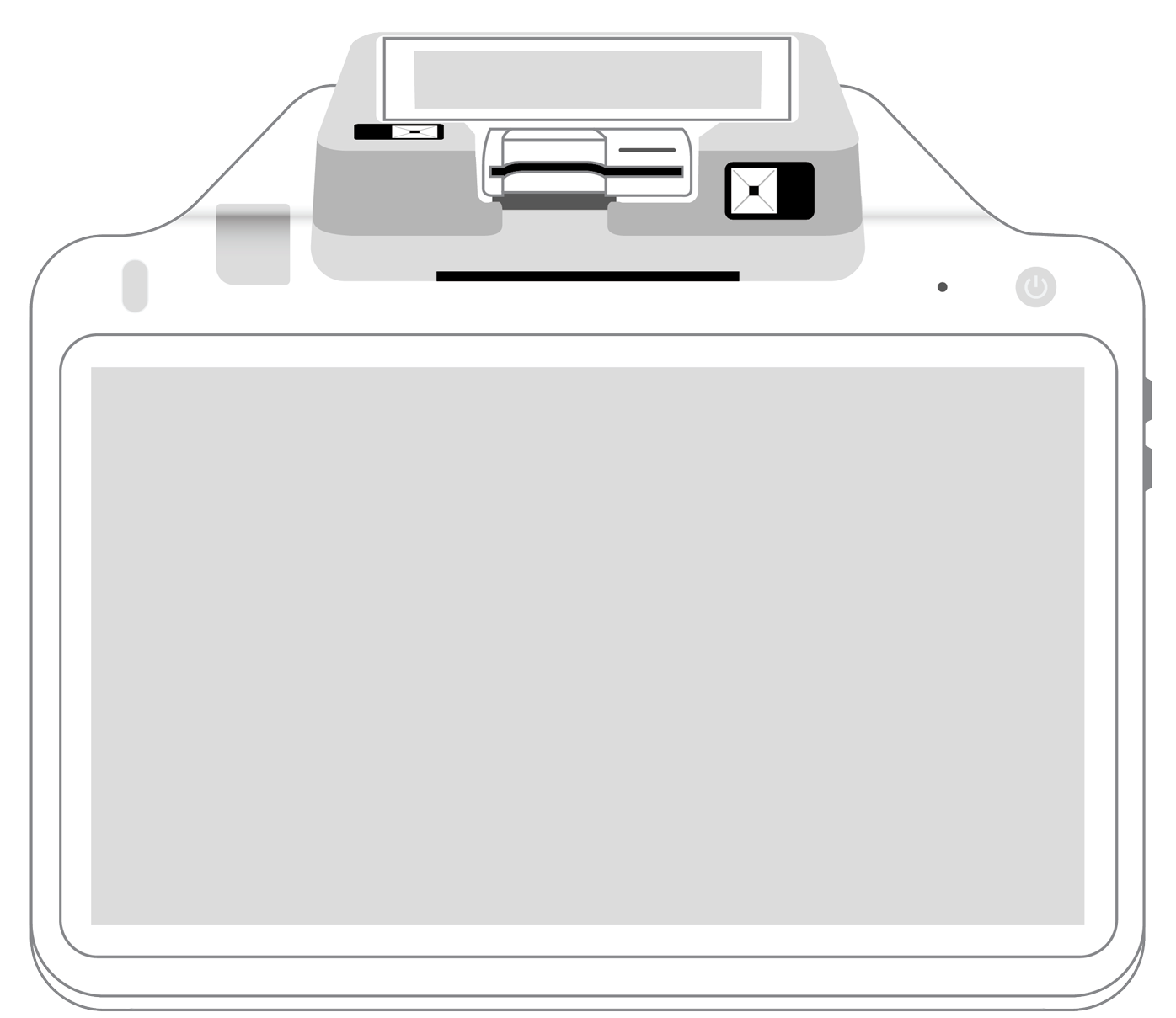

During the holidays, every second at the register counts. Long lines can frustrate customers and discourage purchases, while a fast, secure checkou...