Why Credit Card Processing Rates Are Different for Different Types of Cards or Transactions

Your credit card processor and merchant account provider are in the business of supporting your transactions at the lowest possible risk level. This helps to explain why you see such stark differences in the credit card processing rates you are charged. Yes, you may not be able to change this reality. However, understanding the reasons behind the disparities can help you make better business decisions.

Understanding processing fees

Processing fees contain three main components.

Interchange fees

Set by the card networks, interchange fees are non-negotiable. They compensate the lender for the risk they incur in extending credit, managing accounts, and funding rewards programs.

Assessment fees

Assessment fees are charged by the credit card networks. You are paying for the ability to use their infrastructure and services, such as authorization and settlement.

Payment processing fees

Payment processing fees are charged by your payment services provider. They include per-transaction, monthly, equipment, and gateway fees. These are by far the most negotiable.

Factors influencing credit card processing rates

Several factors affect variations in what you will pay, particularly when it comes to interchange fees. You may notice that fees rise when people use certain cards.

For instance, the fees attached to debit cards are typically lower because funds are immediately withdrawn, posing lower risk. By contrast, credit cards are paid over time, leaving a lengthier time frame in which problems can arise.

Premium cards that furnish rewards such as travel points, cash, or airline miles can also generate higher merchant transaction fees. This is because the issuing bank needs to recoup some or all of the cost of these benefits. Business and corporate cards are also larger merchant fee generators, due to their perceived higher transaction values.

Fees can also vary according to the transaction method. When you accept in-person payments, the customer processes their physical card through your terminal or POS device. In this case, fraud risks are lower because you can authenticate the customer’s identity. This is not true of card-not-present online, phone, or mail order transactions.

Additionally, some industries that pose a greater risk of fraud or chargebacks or have larger transaction values must pay higher fees. Examples include adult entertainment, travel, and health supplements companies.

Lowering transaction fees

As stated above, interchange fees are non-negotiable and should be considered a cost of doing business. However, you do have some leeway when it comes to markup charges. If you have a long history of low chargebacks and actively use anti-fraud and security tools, your online payment processing provider may take notice. This could lead to reduced fees, or fewer obligations in your agreement.

Credit card processing rates are a fact of life. Now that you know more about how they work and why they vary, you may be able to have better control over the ones that you actually can negotiate.

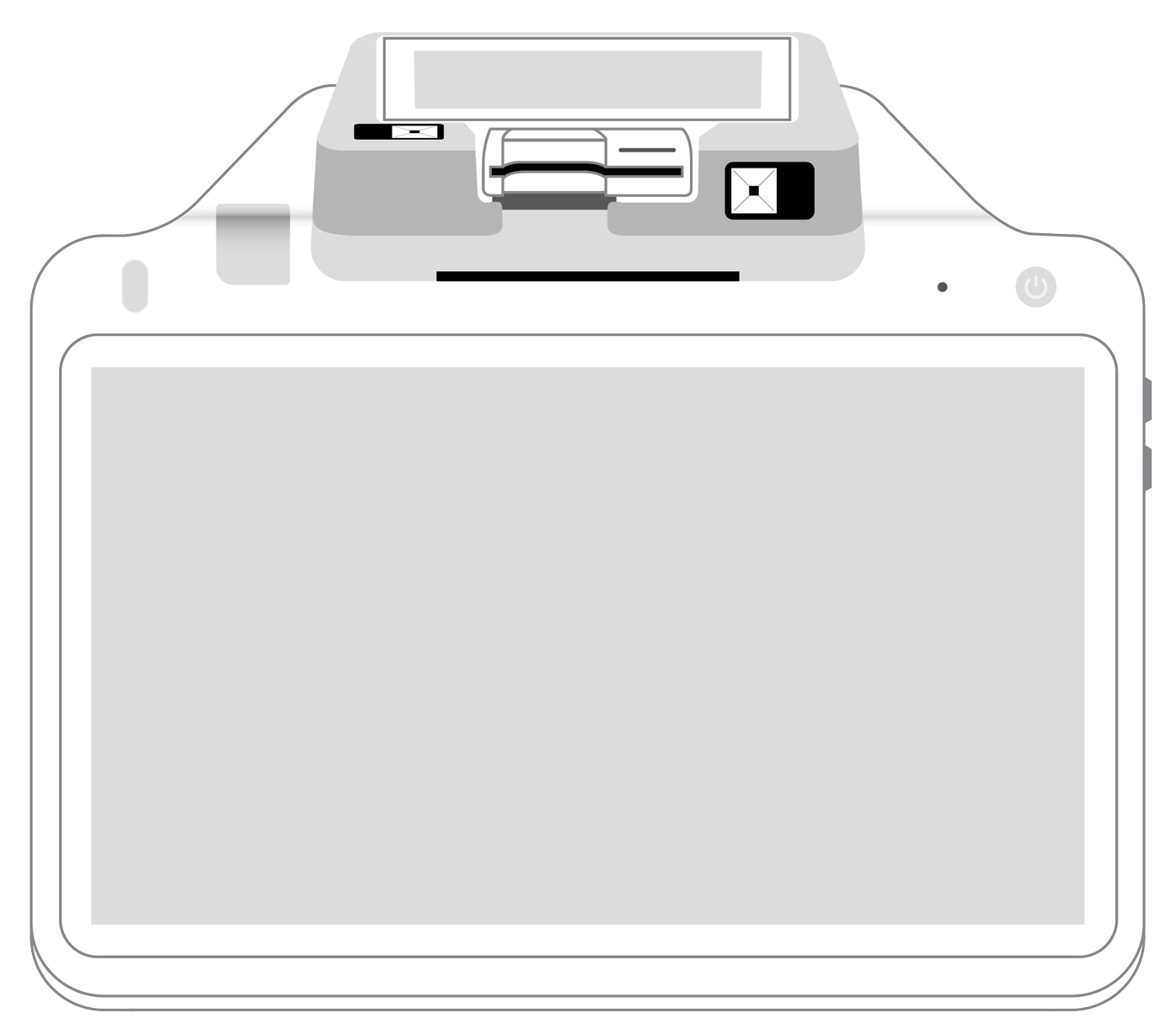

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||