How Accepting Contactless Payment Can Impact Shopping Habits and Your Bottom Line

The subtle sound of a tap confirming a transaction has become one of the most common sounds in modern commerce. What began as a convenience has rapidly evolved into a consumer expectation.

For businesses, adopting contactless payment methods is no longer just a technological upgrade. It's a strategic move that fundamentally alters customer shopping habits and directly impacts the financial health of your business.

Frictionless transactions, freer spending

The benefits to your bottom line are tangible and multifaceted. The most immediate advantage is increased speed and efficiency. A contactless transaction takes mere seconds, significantly faster than chip-and-PIN or cash transactions.

Consider a busy cafe during the morning rush. Shaving just 10-15 seconds off each order might not sound like much, but over dozens of customers, this time saving translates into serving several more people during your peak hour.

This increase in customer throughput directly translates to higher revenue. Faster lines also mean a better customer experience, reducing the chance of potential buyers walking away due to long waits.

Furthermore, contactless payments offer enhanced security. Utilizing tokenization and EMV chip technology, these transactions are far more secure than traditional magnetic stripe swipes. This reduces the risk of fraudulent chargebacks, saving your business time and money while protecting your customers' data.

Offering Tap to Pay on iPhone helps to position your company highly in comparison to peers who have not yet begun to provide this option.

Consequently, buyers may spend more money in your store and return more frequently once they know how simple and streamlined you have made their payment experience.

A non-negotiable upgrade

In today's competitive market, meeting customer expectations is paramount. Consumer spending habits indicate touchless payments are here to stay.

Consumers, particularly younger demographics, now view contactless payment as a standard feature, not a perk. A business that fails to offer this option can be perceived as outdated, potentially driving tech-savvy customers to competitors.

Accepting contactless payments is an investment in the customer experience and your operational efficiency. It fosters loyalty by providing the speed and security customers demand, encourages higher spending by making purchasing effortless, and streamlines your operations to maximize sales.

Now that you have learned how incorporating them into your operations can enhance your company and heighten your clients’ buying experience, isn’t it time to take your business to the next level?

Contact your payment services provider today to get started.

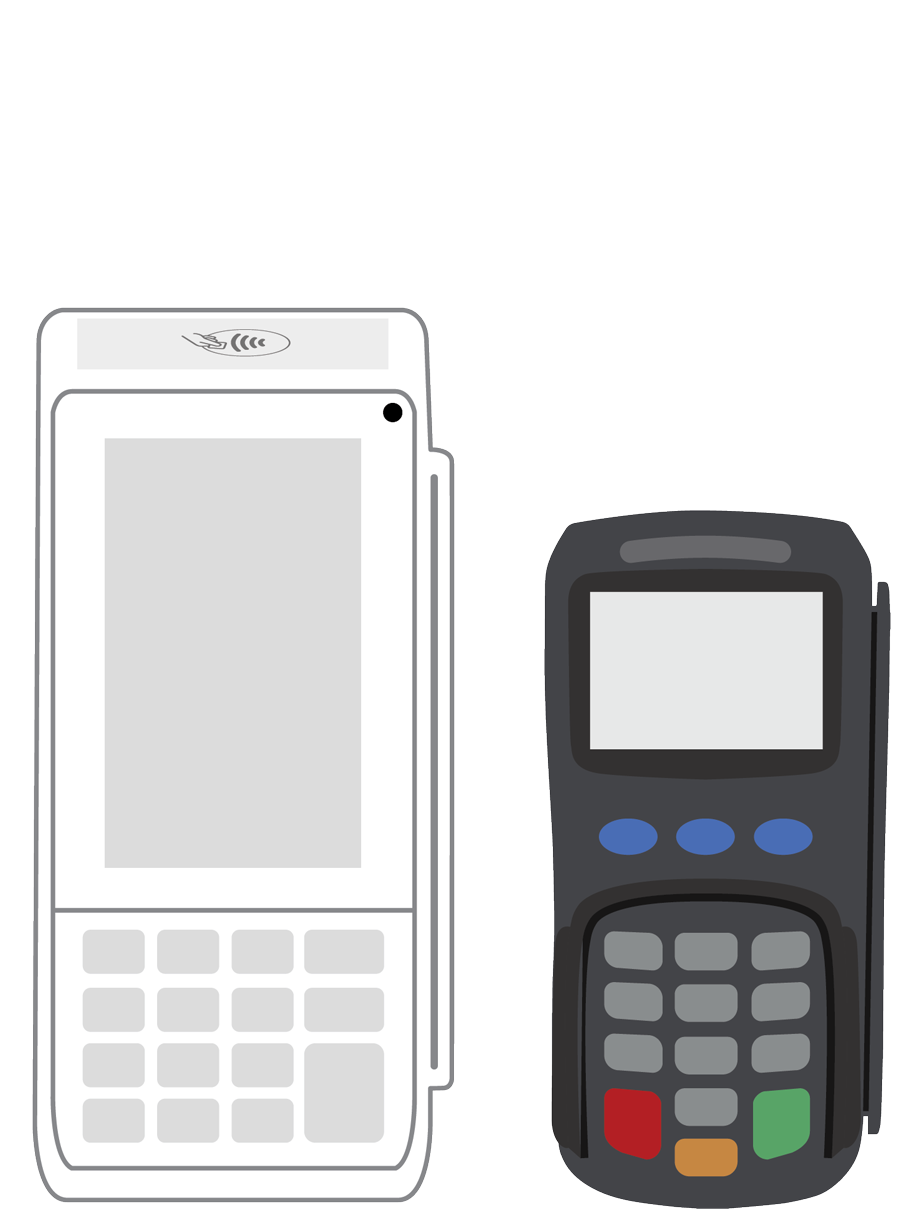

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||