Are Contactless Payments Safe?

Are you thinking about offering your customers contactless payments, but first need to know whether it’s safe? This guide is for you.

While initial business planning often centers on sales and revenue, selecting a payment processing solution is a critical decision that impacts conversions, security, and customer satisfaction.

As contactless payments become a standard expectation for consumers, it is imperative for business owners to evaluate their suitability and security protocols.

Yes, contactless payments are exceptionally safe

Yes, contactless payments made with both physical cards and mobile wallets are considered one of the most secure payment methods available today.

They are significantly more secure than older methods like magnetic stripe swiping and even offer security advantages over traditional chip and PIN transactions.

This high level of safety is not accidental; it is built upon multiple, modern layers of security technology working in tandem to protect every transaction.

Contactless security and safety features

The security of contactless payments is not based on a single feature but on a combination of sophisticated technologies that protect your data at every step.solution.

Tokenization: Your real card number is never shared

The most critical security feature of contactless payments is tokenization. When you tap your card or phone to pay, the system does not transmit your actual 16-digit card number to the merchant.

Instead, it creates a unique, one-time-use code, or "token," that represents your card for that specific transaction. Even if a hacker were to intercept this data, it would be a useless string of characters that could not be used for future fraudulent purchases, leaving your real card information secure.

Encryption: data is scrambled and unreadable

In addition to tokenization, all transaction data is encrypted as it travels the short distance from your card or phone to the payment terminal.

This process scrambles the information, including the token, into an unreadable format. This ensures that even if the data were somehow intercepted during that brief transmission, it would be completely unintelligible and worthless to criminals.

NFC technology: the power of proximity

The technology that enables contactless payments, Near Field Communication (NFC), is itself a powerful security feature.

NFC technology is designed to work only within a very short range, typically one to two inches.

This physical limitation is a built-in defense against remote digital theft, as a criminal would need to be unrealistically close to your card or device at the exact moment of a transaction to even attempt to intercept the signal.

Dynamic cryptograms: unique codes for every purchase

Each contactless transaction generates a new, unique security code known as a dynamic cryptogram. This code is valid for only that single purchase and cannot be reused.

This feature makes it impossible for criminals to copy transaction details to create a counterfeit card or perform a fraudulent transaction at a later time, adding a crucial layer of protection against replication fraud.

Common myths about contactless fraud

Despite the robust security features, misinformation can cause consumers to question the safety of contactless payments. Here, we address the most common myths and explain the reality behind the technology.

Myth: "electronic pickpocketing" or skimming in a crowd

It’s a natural concern: what happens if someone gets their reader next to my card?

In reality, the idea of a criminal walking through a crowd and stealing your card information remotely is practically impossible.

A fraudster would need to position a specialized, bulky card reader within one to two inches of your specific card, completely undetected, at the exact right angle.

Even in this highly unlikely scenario, the layered security of tokenization and dynamic cryptograms means they would only capture an encrypted, useless one-time code, not your actual card details, name, or PIN.

Myth: accidental or double payments

It is not possible to be accidentally charged by walking past a reader or to be charged twice for a single purchase.

Payment terminals are designed to initiate and process only one transaction at a time and require a deliberate action - placing your card or device directly over the reader to begin the payment process.

Once a transaction is complete, the terminal immediately deactivates until it is reset by the merchant for the next purchase, preventing any possibility of a single tap resulting in multiple charges.

Myth: easy fraudulent use if I lose my card

While losing a card is always a concern, contactless technology includes safeguards to limit potential damage.

Most financial institutions implement a transaction limit for individual tap-to-pay purchases (often around $100), after which a PIN is required, preventing a thief from making large fraudulent purchases.

Furthermore, the instant notifications and easy access provided by mobile banking apps allow you to immediately freeze or cancel a lost card, rendering it useless to anyone who finds it.

Why you can trust contactless payments

Ultimately, you can trust contactless payments because their security is not based on a single point of defense, but on multiple, robust layers working in unison.

The core security pillars of tokenization, encryption, the physical proximity required by NFC technology, and the use of unique dynamic codes for every purchase create a formidable barrier against fraud.

Each layer is designed to protect your financial data, ensuring that even in the unlikely event one was compromised, the others would prevent any actual loss.

The greatest risk associated with contactless payments is not a failure of the technology itself, but rather the physical loss or theft of a card, a risk that exists for all payment methods.

Advanced technology provides the foundation for the security of contactless payments. This is combined with user-controlled features like biometric security on mobile wallets and instant transaction alerts.

Together, these elements make contactless payments a highly secure, trustworthy, and convenient way to handle everyday transactions.

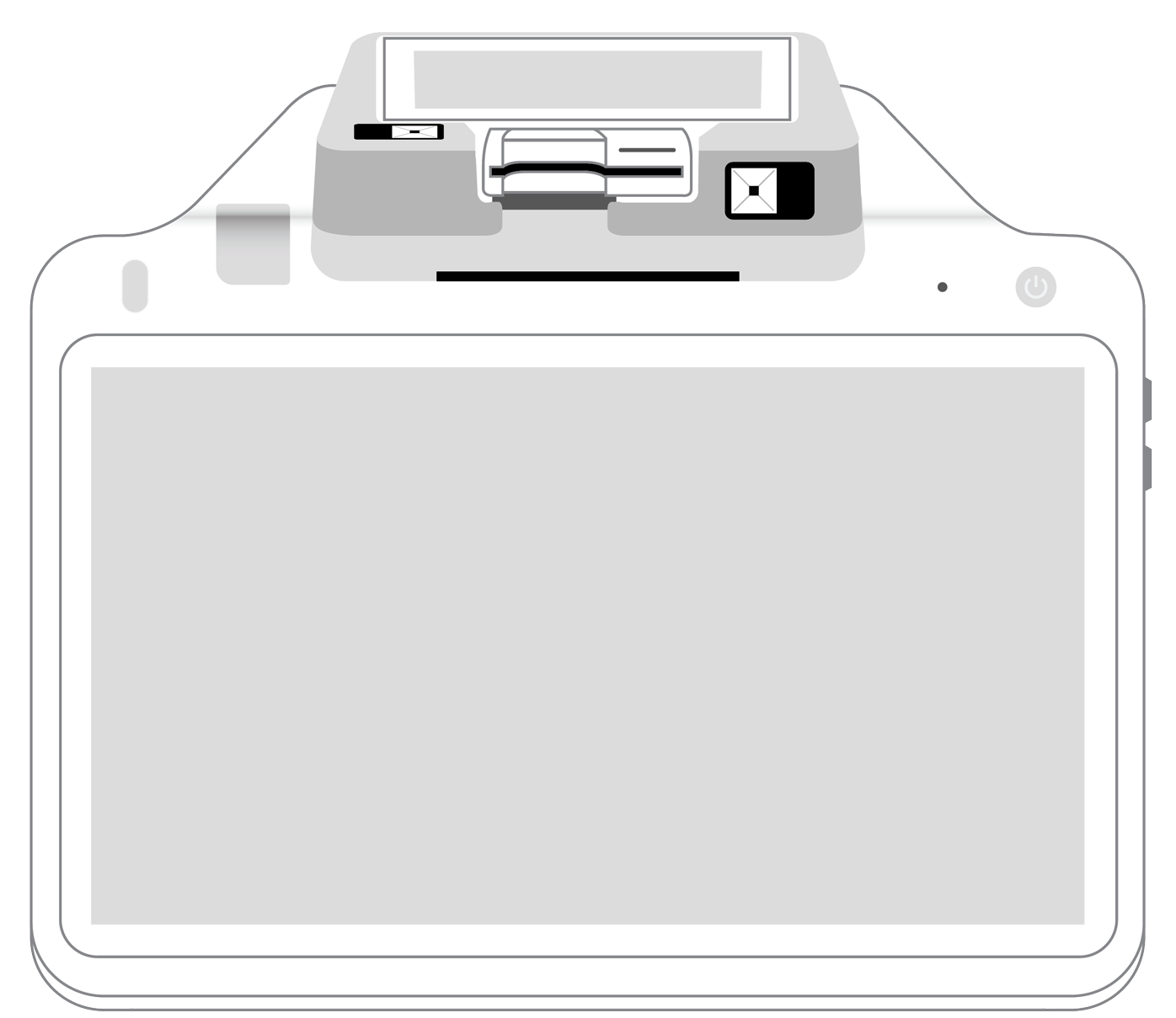

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||