U.S. Consumer Summer Spending Habits

During the first quarter of 2025, consumers enjoyed an economy that was bolstered by low unemployment rates and steady job growth. In fact, according to a recent McKinsey report, nearly half, 46%, were optimistic about current conditions.

Even so, the same document indicated that just over one-third of consumers had mixed feelings about the economy. The full spectrum of these various outlooks was reflected in the spending habits of Americans in the first three months of2025.

General spending habits are set to remain at a consistent level

Most people continued to have positive feelings about the economic direction in which the country is going. Consequently, consumer spending patterns this summer are expected to mostly follow those of the last three months .

Specifically, American shoppers do not plan to markedly lower or increase the amount of funds that they devote to basic items. The majority of the people surveyed, for instance, expect to be consistent about what they spend on basic necessities. These include produce, meat, dairy, gasoline, home-related supplies, and personal care items.

Travel spending to decrease in some areas, but grow in others

Although consumers remain solidly in favor of getting away from their normal routine this summer, this year marks some significant changes in the nature of the holidays they will take.

For instance, a KPMG summer 2025 summer pulse report indicates that Americans are focusing on costs, while simultaneously remaining committed to their trips.

The report sheds light on the expected behaviors of travelers this summer. 58% of consumers will be traveling this season, a figure that is up slightly from 55% last year. At the same time, consumers intend to tighten their belts, estimating that they will spend 7% less on each trip. Additionally, the majority – 62% - will keep their trips within U.S. borders.

Luxury purchases to remain, but with conscious spending

In spite of uncertainty about the economy, people remain set on treating themselves this summer. The difference is that they will be more intentional and careful about doing so in order to ensure that they spend every penny wisely.

For instance, budget-conscious Americans interested in flying or cruising might offset some of the cost by cashing in airline and credit card points, or cutting back on day-to-day discretionary items such as routine entertainment.

Specifically, the KPMG study highlighted consumers’ penchant for discounts: 49% are counting on tapping into promotions when making their purchases. Additionally, a significant number – 26% - are increasing their fast food spending, while casual dining has taken a 38% plunge. Even spending on alcohol is down by 38%, perhaps all in an attempt to shift funds to necessities and the occasional splurge.

The shifting mindset towards summer spending

Varying social conditions and economic uncertainty have led to a change in how consumers approach their budgets. Any retailer looking to succeed in this evolving environment must understand these factors and incorporate them into their business plans and marketing campaigns.

Perhaps most important is the drop in household income. A full 39% of the consumers surveyed reported a recent drop in their income.

Perhaps in an attempt to adjust, 25% of consumers have cut back on their contributions to savings. Another 25% are electing to take funds out of their existing savings accounts. In fact, it is anticipated that spending will rise this year only on groceries and automotives.

In spite of the belt-tightening, consumers are continuing to prioritize their physical and mental health. The same KMG study illustrates consumers’ ongoing prioritization of their well-being. All age groups are committed to increasing their physical fitness, while millennials and Gen Z people are continuing to focus on their mental health.

By contrast, baby boomers are choosing to instead devote their energy toward preventative medicine and nutrition.

In an era when every penny counts and buyers are becoming more selective about what and how they make purchases, digital shopping has become the norm. For instance, cost-cutting is increasingly involving buying from direct-to-consumer (D2C) sites for clothing, food and beverages, and personal care items. The D2C vendors experiencing the highest degrees of success are those that offer fast or free shipping, easy returns, and secure payment methods.

How can retailers thrive?

All is not lost for sellers who want to succeed this summer. However, retailers must be agile and continue to key in on the trends that are modulating consumer spending during these challenging times.

Ecommerce sites looking to court and retain today’s bargain-savvy customers need to find ways to incentivize purchases. In addition to creating a clear, transparent, and fast checkout process, merchants should make it as safe and friction-free as possible.

This can be done by offering shipping that is fast and preferably free, taking precautions to make payments secure, and facilitating easy returns.

Another way to attract and keep customers is to lock into their tendency to focus on apps and social media. To that end, establish a presence on the prominent platforms that your customers love to use, including YouTube, TikTok, and Instagram.

Be sure to feature a link that enables guests to make purchases without leaving the site, and allow people to buy from your dedicated app. This creates a positive environment of social proof and brand engagement that ultimately will lead to more referrals and higher sales.

Your social media profiles and website should also be places where you incentivize purchases with fun promotions and contests that drive traffic and convince budget-focused consumers to part with their dollars. Doing so helps to generate a sense of urgency and creates the belief that the customer has succeeded in obtaining items at an especially low price.

Particularly if you sell big-ticket merchandise, it can be challenging to persuade potential customers to convert interest into an actual purchase.

The good news is that you can help to remove some of the sting from the buy. For instance, be sure to offer recurring billing options that allow people to pay in more manageable chunks over time.

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.

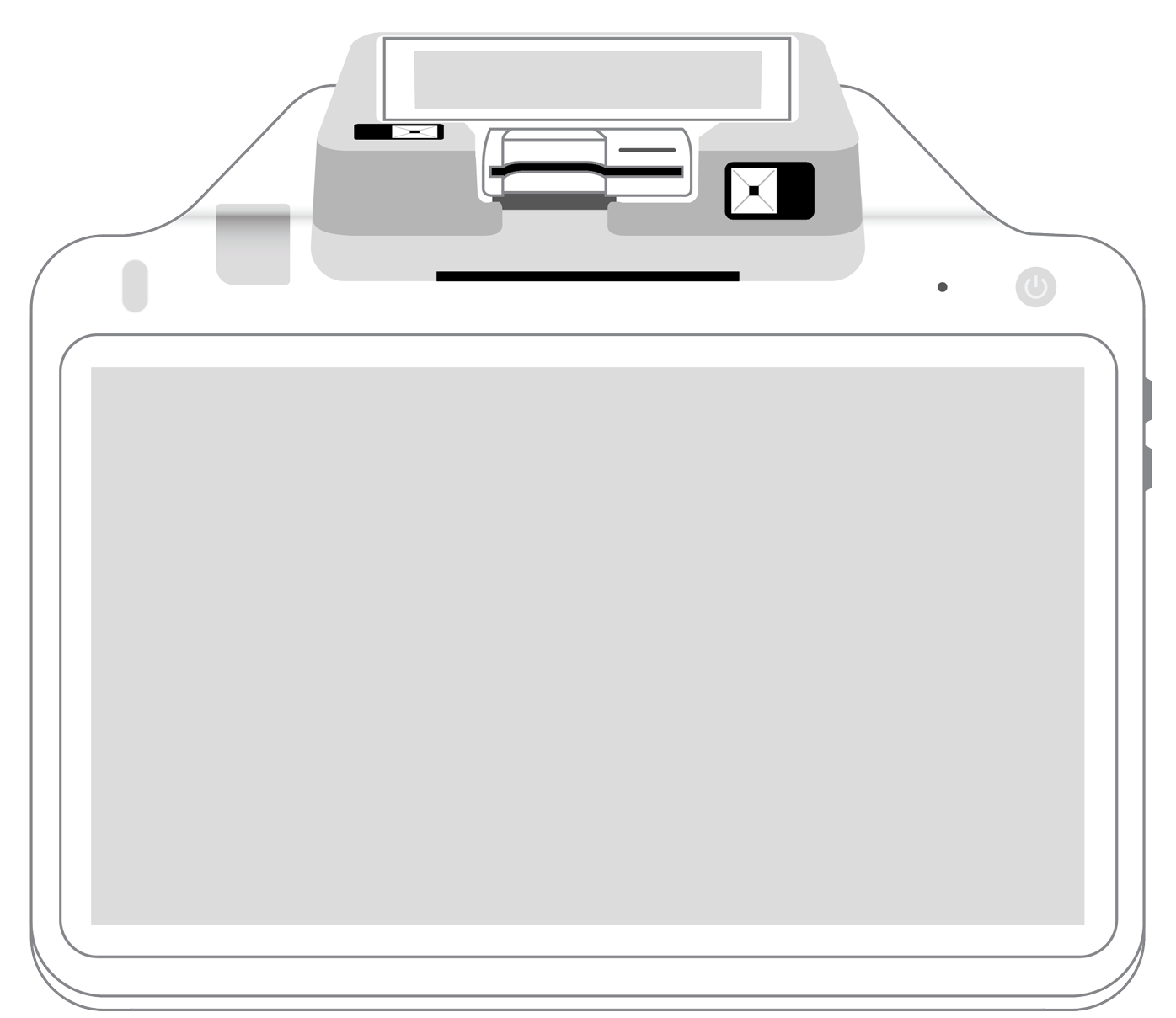

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||