How to accept in-person contactless payments with only a smartphone

Point of sale systems and credit card terminals offer two popular ways for retailers of all sizes to complete customer purchases. However, the explosion of the mobile phone into virtually every facet of our lives has also touched the payments ecosystem.

These days, you can accept credit cards, debit cards, digital wallet payments, and much more using only your mobile phone and a processing app.

If you’re wondering how this can be possible, take the next few minutes to learn the ins and outs of this cutting-edge innovation.

A vital partnership.

The first step you must take if you want to use your phones as contactless card readers is to establish a relationship with a payment processor that offers contactless card readers and the accompanying smartphone apps that can turn your iPhone or Android into a secure credit card terminal.

Download the app.

If you are going to use your cellphone to accept credit cards and other forms of payment, you will need to download your processing company’s payment app.

Once you do so and open it, you will be asked to furnish details about your business.

Obtain a mobile reader.

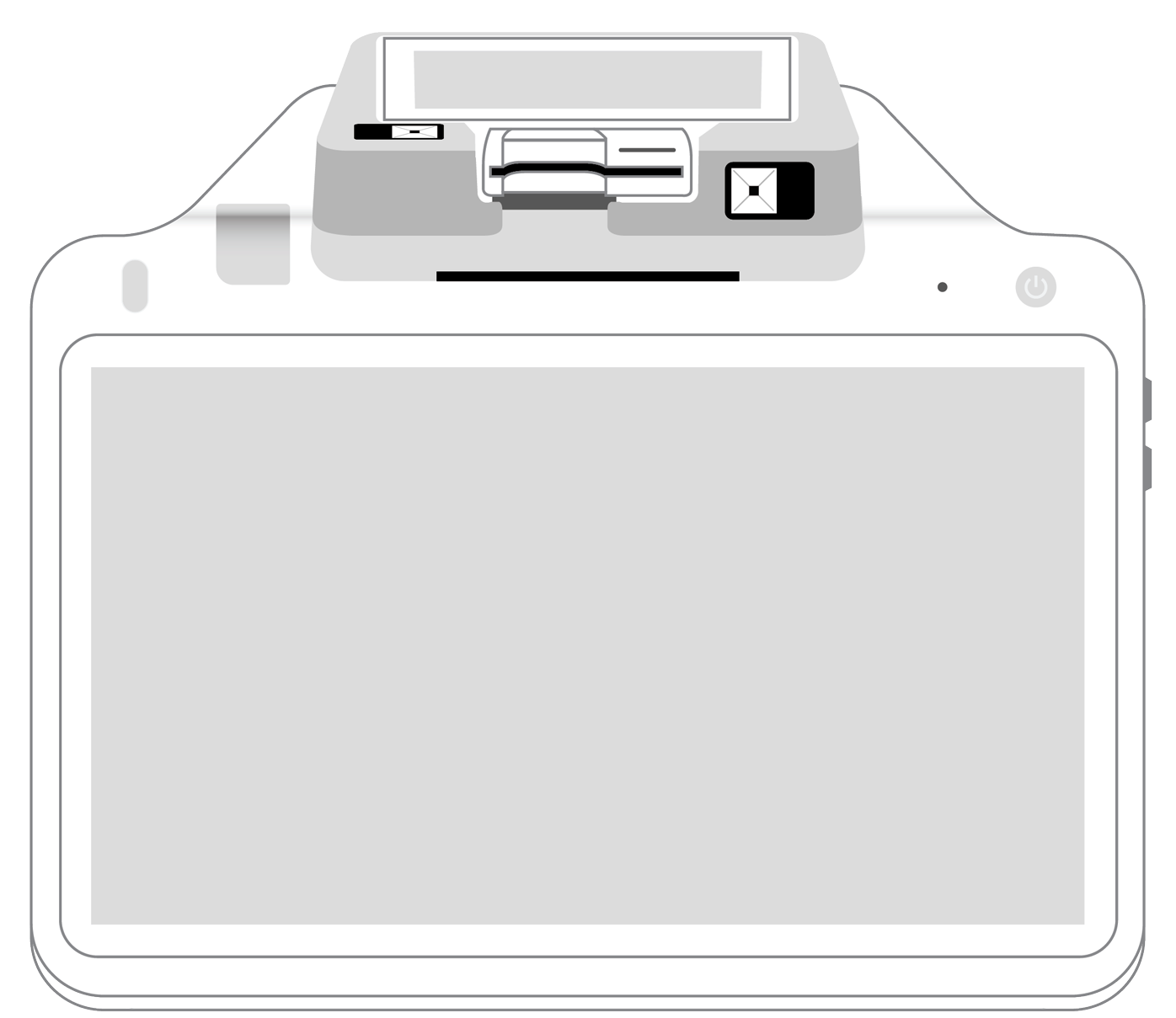

In many cases, payment processors give mobile credit card readers to their clients at no charge. These connect to your mobile phone via Bluetooth or wired headphone jack.

Be sure that the one you get accepts chip-enabled cards since these are more secure and help to deter fraud. Furthermore, specify to your processing company that you want a reader that takes contactless near-frequency communication (NFC) payments. This enables you to accept tap-to-pay cards, digital wallets, and Apple and Google pay as well.

Consider implementing a mobile terminal into your business model.

You don’t necessarily need to get a mobile reader, especially if you only make a few mobile payment transactions.

A virtual terminal provides you with a way to take phone or other remote orders by connecting to a secure web page hosted by your payment processor and manually entering the customer’s details.

Since this is considered to be a card-not-present transaction, your processor may charge you a higher fee.

Order entry.

Next, you need to enter the order into your virtual terminal. Alternatively, use the mobile card reader to process the customer’s payment. Then print out, text, or email a receipt.

Receive your funds.

It can take some time, usually a couple of days, for the transaction to be fully processed and settled. Once it is, you will receive your funds — minus processing fees — in your merchant account.

Benefits of accepting mobile payments.

There are several reasons why using your smartphone to take customer payments can bring advantages to your business.

For one thing, customers value and appreciate the convenience. These days, fewer people carry cash, particularly in large amounts. Allowing them to pay simply by placing their credit card or mobile device near your reader is fast, easy, secure, and even can lead to higher purchase amounts.

It also allows you to become more flexible. With the portability of your wireless phone as a card reader, you will be able to complete purchases anywhere and at any time. This can translate into endless possibilities for doing business across town or around the world.

Moreover, those frustrating checkout lines will be cut drastically. During busy times, your associates can complete purchases right on the sales floor as the natural conclusion to their interaction with the shopper.

If your business model requires that a client put down a deposit to initiate a contract, having a mobile phone handy to process the transaction can help to lock in the deal. This is common for companies that do home contracting, including roofers and window replacement professionals.

Getting paid right away also eliminates the need to go back to a customer requesting that they remit payment of their bill. Instead, the charge can be taken care of at the point of sale, leading to a more positive experience and a better overall relationship between buyer and seller.

Using your mobile phone to accept customers’ payments is a sure way to untether your business and simultaneously please your customers.

Long queues at the register will be drastically reduced, and customers can enjoy ultimate convenience and flexibility without needing to carry cash.

All the while, security remains high, and accurate record-keeping continues because purchases are chronicled in the app and sync with your other business software and processes.

Have we convinced you that using your smartphone to take payments just might revolutionize your retail operations?

If you want to hop on the mobile phone payment processing bandwagon, talk to your payment processor today.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||