Credit card processing for retail and brick-and-mortar stores: what you should know.

Accepting credit cards at your brick-and-mortar store is a no brainer, but to maximize the benefits and make paying with a card easy for your customers, you need to know how to choose an affordable payment processing solution. Credit card terminals and point-of-sale (POS) systems have evolved in recent years, making it possible to process physical cards more efficiently and offer new payment types to customers. Use this guide to help you pinpoint the perfect payment solution for your retail business.

The components of credit card processing.

A number of different parties and systems are involved in processing credit card payments. These include:

- Cardholders – A.K.A. your customers, who are ready to purchase goods or services from you.

- The merchant – That’s you and your retail business.

- Merchant bank –The bank where you have your business checking account, to which funds from transactions are transferred.

- Issuing bank – The bank that issues cards to cardholders, also referred to as a credit card company.

- Card networks or associations – Groups of card-issuing banks, such as Visa or Mastercard, who are responsible for setting transaction fees and approving transactions.

- Terminal or POS system – The hardware and software used to accept credit cards or contactless payments.

- Payment processor – The company processing credit card transactions for your business (either your merchant bank or a third party) which analyzes and transmits transaction information between your business and the issuing bank.

All the components work together to make it possible for your retail store to accept credit cards and mobile payments. Transactions begin when customers pay for purchases and end when payments are authorized. Funds from completed transactions are transferred to your business bank account and counted as profits or sales when you reconcile your books.

Retail credit card processing options.

Accepting credit cards is faster and less of a hassle than taking other types of payments. There are a number of reasons for this. For starters, you don’t have to go to the bank to make deposits worry about physical theft of cash or deal with bounced checks. Customers can pay for their purchases quickly, which increases the number of transactions you’re able to process per day while keeping lines to a minimum.

Which processing option can allow your business and your customers to benefit from the convenience of credit card payments? It depends on your budget, the size of your business, your typical transaction volume, and the demographics you serve. You can choose to:

- Set up a traditional countertop terminal connected via ethernet cables.

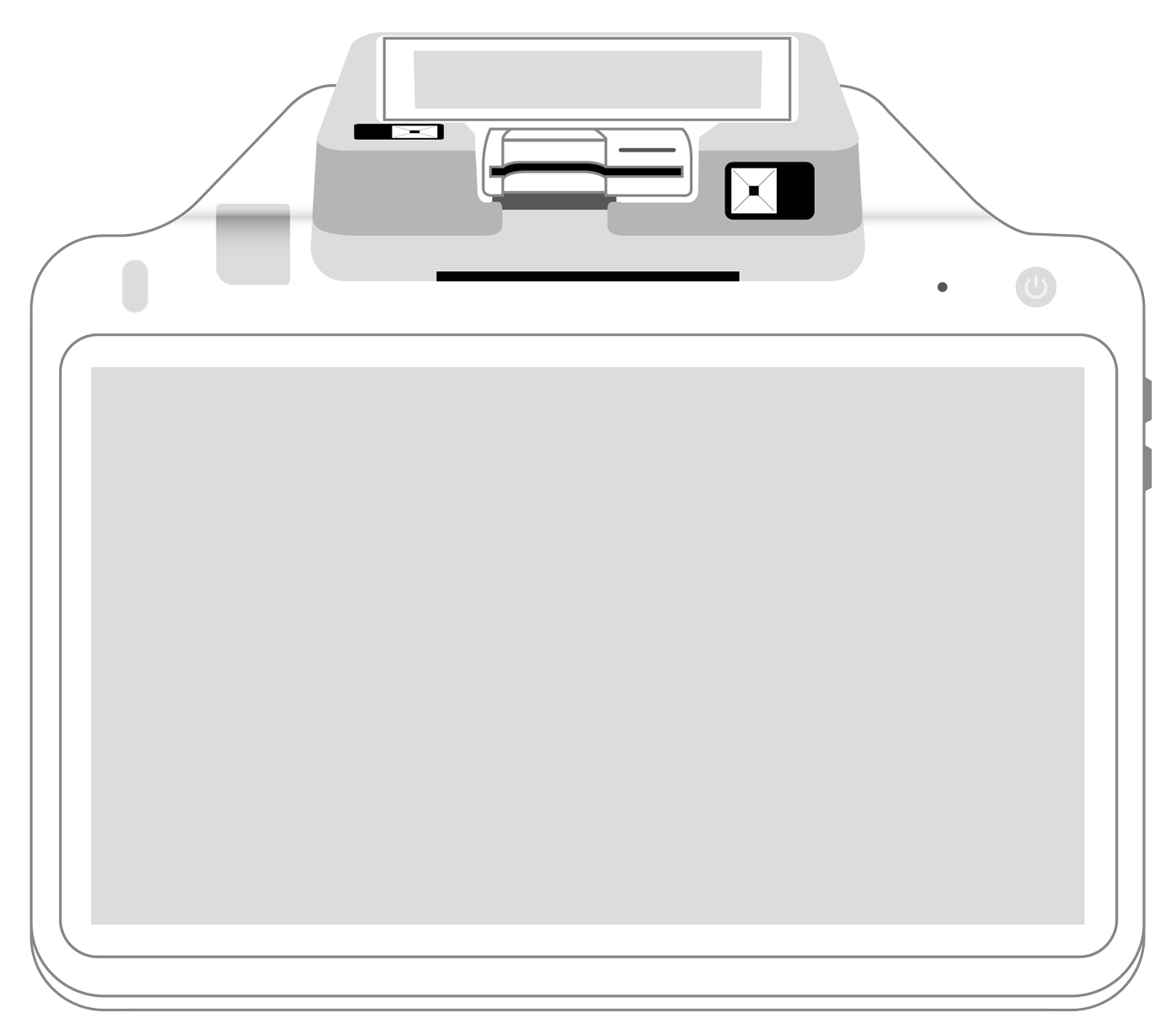

- Sign up for a Smart Terminal or POS system offering additional built-in features.

Your choice can affect the types of payments you accept. Newer POS systems may also include features beyond what a basic terminal can offer, such as employee and customer management.

Choosing the best payment types for your store.

The robust functionality of processing equipment makes it possible to expand payment offerings at your retail store without the need for multiple payment gateways or expensive add-ons. At the very least, your retail store should be equipped to accept traditional magstripe and EMV (Europay, Mastercard, and Visa) chip cards, which accounted for 62.3% of U.S. consumer payments in dollars spent in 2017. How much you branch out beyond physical cards is up to you. That said, offering more ways for customers to pay can give you access to a wider audience and increases your sales. If customers are already asking for more diversity in payment types, now is the time to give them new choices.

Most customers paying with credit or debit will still choose to use a traditional card, so small businesses can do well accepting this payment type along with cash and checks. However, if your retail outlet caters to a younger crowd or the majority of your customers come through the line glued to their cell phones, you should consider offering mobile payments, as well. Whether you accept popular mobile wallets like Apple Pay and Samsung Pay, or set up one of your own, you’ll give the tech-savvy consumers you serve a faster, more convenient option.

Cost can be a barrier to implementation, but many card processing services either cater to or offer affordable choices for small businesses. Devices equipped to accept chip cards and mobile payments can be purchased for less than $50, so if you already have a smartphone or a tablet, you’re one step away from being up and running! More complex POS systems may cost more, though you may be able to take advantage of free placement depending on your processor.

Finding the right credit card processing equipment.

Since customers are no longer limited to physical cards when making credit payments, you should look for a single platform through which you can process multiple payment types to simplify checkout and management. A robust solution is usually the best, but if you can’t afford a full-featured POS yet, look for a system designed to allow businesses to start small and scale up as needed.

Here are a few things to consider when evaluating credit card terminals and POS systems:

- Do you need only countertop terminals or a combination of countertop terminals and mobile credit card processing equipment?

- Would your business benefit from added features, such as invoicing or inventory tracking?

- Does the service you’re considering offer the types of hardware required to diversify credit card payment options?

- How long will it take to set up the equipment and configure any related software?

- What are the channels through which you can contact support? How often is support available?

- How does the provider handle fraud prevention and data security?

- Is the payment processor committed to the latest security standards?

- Does the payment processor have experience with the retail industry?

- Can you continue to use the same system as payment technology evolves, or will you need to switch to a new solution?

Compare pricing, security, features, and hardware with these questions in mind. Remember to check on payment processing fees as well, since both fees and fee structures can differ between service providers. You should only be charged card-present fees for in-store purchases, including those made when customers use mobile wallets.

A credit card processing solution should give you the tools to accept a wide range of payment types without a huge outlay of cash or exorbitant processing fees. With a flexible, scalable system in place, you can offer your customers a convenient payment experience and be ready to integrate new payment types as technology continues to evolve.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||