Getting Consumers to Use Mobile Payments

“Cash, check or charge?” The familiar refrain customers have heard for years when paying for goods and services has been forever altered with the decline of paper check use and the advent of mobile payments. Cash is still the preferred method of payment for many people, with credit not far behind. However, that is all changing, thanks to mobile payments. Despite the rise in mobile payments, especially in the last couple of years, most Americans have yet to make an in-store purchase using a mobile payment platform.

“Cash, check or charge?” The familiar refrain customers have heard for years when paying for goods and services has been forever altered with the decline of paper check use and the advent of mobile payments. Cash is still the preferred method of payment for many people, with credit not far behind. However, that is all changing, thanks to mobile payments. Despite the rise in mobile payments, especially in the last couple of years, most Americans have yet to make an in-store purchase using a mobile payment platform.

MasterCard is hoping to change that and get more people using mobile payments by making them more accessible to the masses. The credit card giant recently announced a partnership with 17 banks, including Citi, Bank of America, Fifth Third and Key Bank, which will allow customers to pay for purchases via the bank’s apps on their smartphones. This new feature, powered by MasterCard’s Masterpass in-app and online purchase service, will allow customers to wave their smartphones or a smartwatch over a payment terminal to make the purchase, just as with using Apple Pay or Android Pay, but bypassing those platforms and instead working directly through the customer’s card-issuing bank’s app. In the usual mobile payment set-up, the credit card must be uploaded to the mobile payment platform in order to be accessed. MasterCard’s partnership with these 17 banks eliminates that need. It is currently only available on Android phones that have built-in NFC chips.

MasterCard and the partner banks obviously believe this new Masterpass feature will encourage more people to use mobile payments, and it certainly does seem promising, as the banks believe it will allow them to better service their customers by offering everything from bank statements and balances along with mobile payments, right in their apps. But this is just one way merchants can get customers to pay with their phones and watches. Below are some suggestions that will encourage customers to put the cash and cards away when paying for goods and services:

Let your customers know you accept mobile payments. Your customers can’t use their mobile wallets at your business if they don’t know you accept mobile payments. Make sure you let it be known – posters and placards in your place of business, as well as announcements on your website and mobile site will help to alert customers that you accept mobile payments. There should be also be a notice in any advertising you do, as well.

Incentivize your customer’s use of mobile payments. It’s one thing to let customers know you accept mobile payments, but if you offer customers something beyond the convenience, like rewards and loyalty programs, they will be more likely to use mobile payments. These types of programs are easily managed with mobile payments technology, allowing your customers to keep track of their rewards, and providing you with better program management. Making your program mobile-only – or offering extra points for customers who pay with mobile – will further encourage customers to use mobile payments. Another bonus – no more membership cards/keytags to clutter pockets and wallets!

Become a mobile payments expert. Your customers will have questions about mobile payments. Many are still a bit skittish when it comes to mobile payments, and if you and your employees know all you can about them, you can put your customer’s minds at ease. The fact is that not only are mobile payments more convenient than other payment types, they are far more secure because they require fingerprint scans or passwords, which are needed to transfer the funds. Plus, confidential customer information is encrypted, replaced by a unique code, so the actual account numbers are never identified.

Mobile payments are still a new concept for many people, so be patient with your customers who aren’t using them yet or those who seem hesitant to give them a try. Take a little time to educate them and put their minds at ease by explaining the process and emphasizing the security and convenience of mobile payments. By letting the public know you accept mobile payments, encouraging your customers to use them through loyalty and incentive programs and becoming a mobile payments expert to help assuage their fears about using them, your mobile payments business will increase.

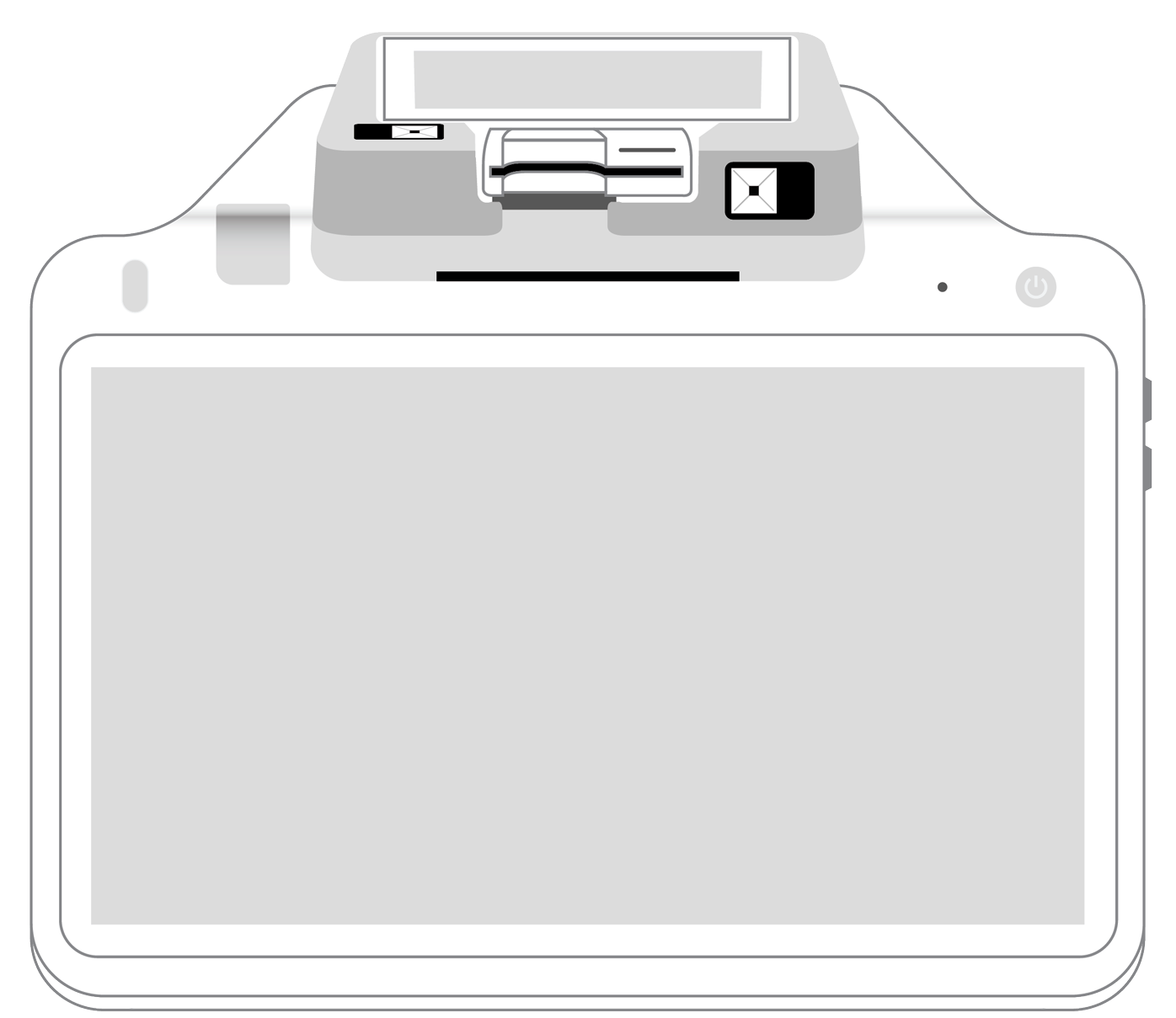

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||