How Credit Card Processing Impacts Revenue Cycle Management in Healthcare

In healthcare, as in any industry where funds change hands, it is crucial to keep track of the money. Many complications can occur between the time when a patient has their first appointment and when their final payment is received.

The good news is that effective credit card processing can lead to greater efficiency and a smoother client-provider relationship.

Accelerated cash flow

Credit card payments are processed more quickly, are posted automatically, and lead to less outstanding debt for your practice.

Medical bills can be prohibitively high, making paying them all at once difficult for the majority of patients. Fortunately, many clients are now opting to pay using their credit card, which enables them to divide the invoice into several more manageable chunks.

Modern payment systems can be configured to integrate with revenue cycle management (RCM) software, allowing the details to be automatically posted to the patient’s account. Thanks to this technology, manual errors are drastically reduced.

Taking credit card payments is also beneficial for your office. This is because they process more quickly than traditional methods like paper checks. This gives you faster access to your money and enhances your cash flow. Additionally, you can more quickly use these funds to pay down any outstanding debts.

Enhanced patient experience

Credit card processing for healthcare businesses is also instrumental in creating the personalized, patient-centered experience that is in such high demand today. When you give people multiple ways to settle their bill, including online, in-person, via credit card, and over the phone, they respond positively to the convenience.

Trust is further elevated by the transparency that occurs when clients make credit card and other types of non-cash payments.

Bills are clear and itemized and can be viewed and paid through the practice’s patient portal. This reduces confusion and lessens the likelihood of disputes that can lead to delays.

With on-time payments comes a proportional reduction in the need to send an invoice to collections, with all of the tension and funds hold-up that this involves.

Streamlined processes

Automated credit card processing minimizes manual work, reduces errors, lowers costs, and makes reporting and auditing simpler.

Running a healthcare-related business involves a great deal of administrative oversight. If mistakes are made, the effect on your bottom line can be profound. Taking credit card payments and implementing other automated systems can reduce mistakes, cut costs, and free up staff time.

When your staff handles patient payments manually, the errors that may result can lead to claim denials, delayed payments, and increased administrative burden. Implementing software that processes payments automatically cuts back on these repercussions. It also simultaneously simplifies your auditing and reporting systems.

Helps to overcome healthcare industry payment challenges

The modern medical system is riddled with problems, many of which are experienced directly by those receiving care. For one thing, patients are now expected to bear a larger portion of the cost of healthcare because of higher deductibles and copays. To add insult to injury, the bills that people receive are longer and more complex than ever.

Credit card processing can mitigate these issues by enabling clients to more effectively manage their payments.

Additionally, the transparency and streamlined procedures made possible with credit card processing can make the payment experience more palatable. It can also help to inspire open communications and greater trust.

Perhaps most important of all, modern credit card processing solutions are designed with HIPAA compliance and maximum security in mind.

As a result, patients are able to submit their payments with the peace of mind that comes with knowing that their data and sensitive medical information are strongly protected.

The healthcare payments landscape is more nuanced than ever. Even so, bringing credit card processing into your healthcare business represents positive benefits both for you and for your patients.

Related Reading

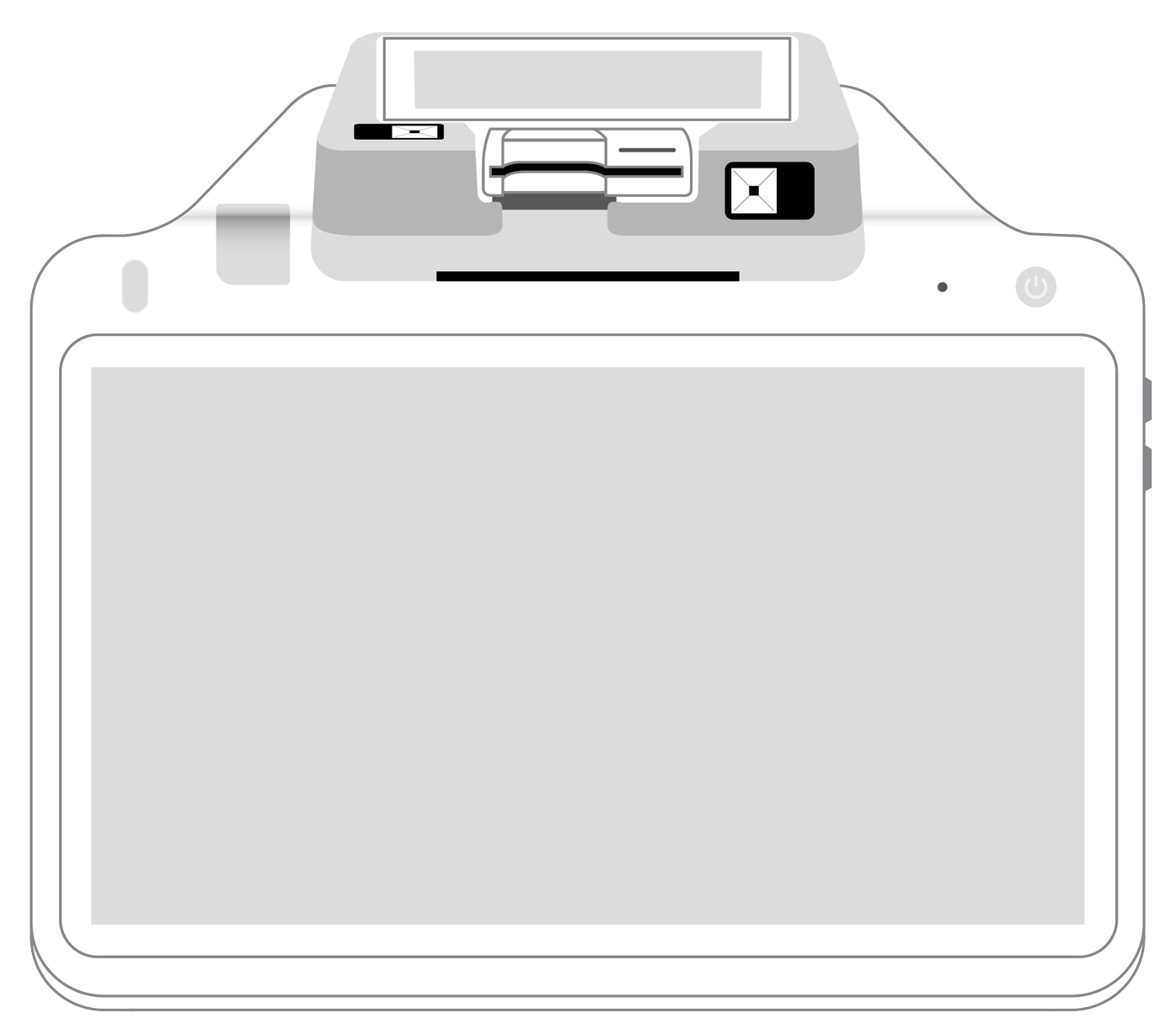

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||