How Mobile Payments Empower Service and On-the-Go Businesses

If your company is like many others these days, it is not tethered to one physical storefront. Instead, you are meeting the product and service needs of your customers from multiple venues, perhaps even at the location of your client’s choice.

In today’s fast-paced commercial landscape, mobile payments offer the most efficient way to accept all types of credit cards. They also unlock powerful tools within your point of sale system, enhancing both operations and customer experience.

Seamless transactions, on the spot

At its core, the power of mobile payments lies in its inherent convenience. For a plumber finishing a job in a client's home, or a personal trainer completing a session in a park, the ability to accept payment on the spot via a credit card reader is transformative.

This immediacy eliminates the cumbersome process of invoicing and the awkwardness of asking for cash or a check. The transaction is seamless and secure, often requiring just a simple tap of a credit card or smartphone.

This enhances the customer experience, leaving a lasting impression of professionalism and efficiency.

From payment to pocket faster

Furthermore, mobile payments dramatically improve a small business's cash flow. The days of waiting for checks to clear or making trips to the bank to deposit cash are over.

Mobile payment platforms typically deposit funds into a business account within one to two business days, providing a predictable and steady stream of income.

This rapid access to capital is crucial for purchasing supplies, paying for fuel, and managing the day-to-day operational costs of a mobile enterprise.

Never miss a sale

The flexibility offered by mobile payments also opens up new revenue streams. A food truck, for example, is no longer limited by the amount of cash its customers are carrying.

By accepting credit, debit, and contactless payments, they cater to a wider customer base and can see a significant uplift in the average transaction value.

Similarly, a craft vendor at a festival can capture impulse buys from customers who might not have cash on hand but are happy to tap and pay. The barrier to making a sale is significantly lowered.

Streamline Your Business Operations

Beyond simply processing transactions, many mobile payment solutions offer a suite of tools that help streamline business operations.

Integrated features can include digital receipts, basic inventory tracking, sales analytics, and customer relationship management. This allows a sole proprietor to gain valuable insights into their business performance without the need for complex accounting software.

For a service professional, this could mean easily tracking which services are most popular, while for a pop-up shop, it could mean identifying peak sales times.

In an increasingly digital world, the ability to adapt and meet customers where they are is paramount. Mobile payments provide the key to this adaptability, offering a secure, efficient, and professional way to do business on the move.

For the modern service and on-the-go entrepreneur, embracing mobile payment technology is no longer just an option; it's an essential tool for survival and growth.

Related Reading

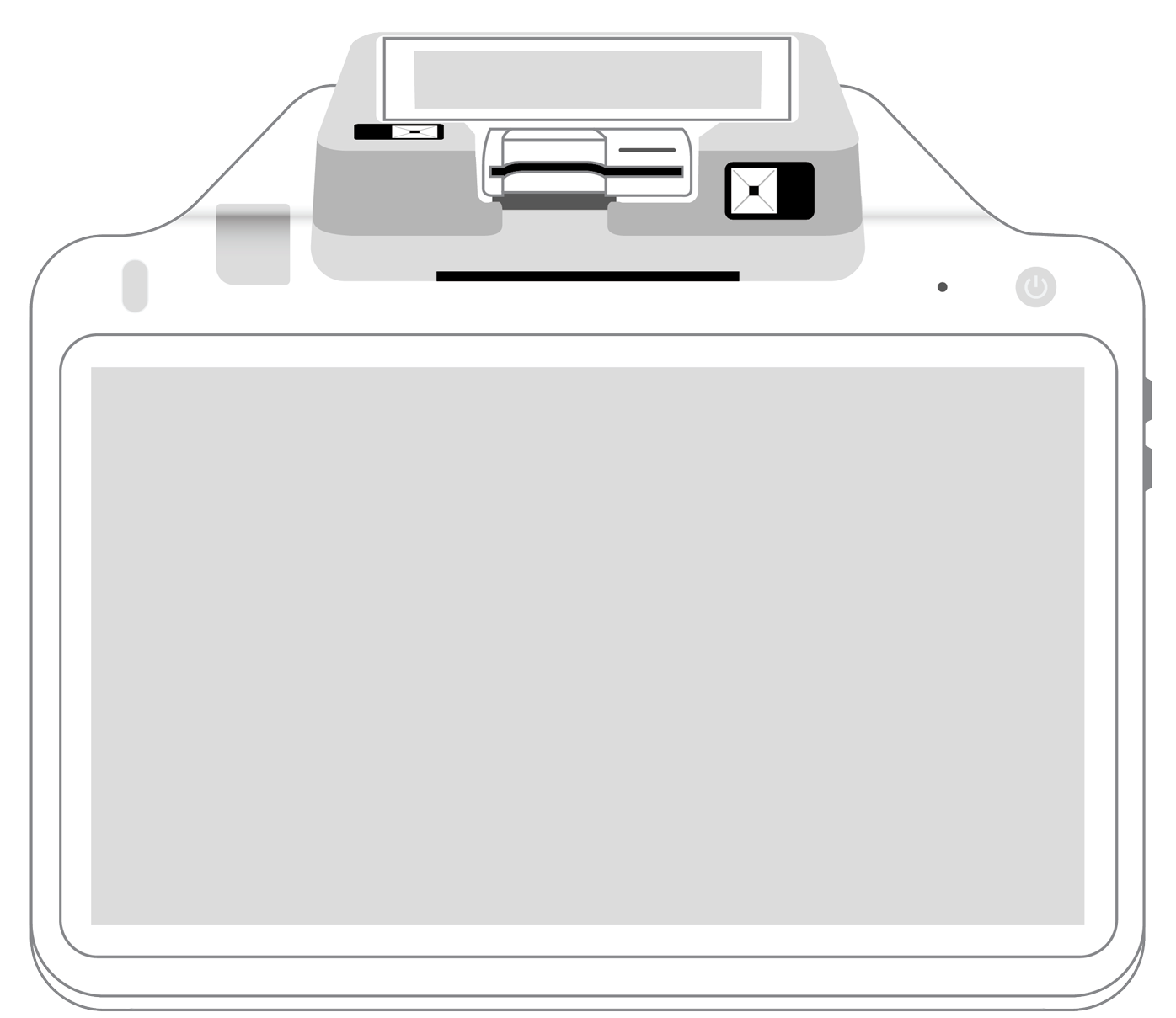

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||