How to accept payments offline with a virtual terminal

Success in today’s retail space requires that you are capable of completing purchases from anywhere. Although you probably process most payments via a POS system or ecommerce platform solution, there may be times when your usual payment terminals and systems are not accessible.

Virtual payment terminals can be lifesavers in these instances because they enable offline transactions anywhere, and for businesses of all types.

Virtual terminals defined.

A virtual payment terminal is a web-based software that contains everything you need to process payments electronically without needing to use a physical POS terminal.

Payments can be taken from customers via phone, fax, voice mail, email, or in person with the help of an internet-connected tablet, laptop, desktop computer, or smartphone.

In order to complete the transaction, you, the merchant, manually input the customer’s information into the system via the connected device. The terminal then sends everything to an integrated payment gateway through an encrypted connection.

The players in the payments process check for sufficient funds and ensure that the transaction is not fraudulent. The payment deposit to your merchant account is then arranged. All of this happens in a matter of seconds.

What businesses can benefit from virtual terminals?

Virtual terminals make it possible to complete those unexpected, less conventional phone or mail orders and are invaluable when you don’t have immediate online access. Businesses of all types have come to appreciate the flexibility and versatility, including restaurants for phone orders, small retailers who sell to friends or at niche markets and fairs, and freelancers or consultants who rarely see their customers face-to-face.

How to set up your virtual terminal.

Your payment processing company will provide you with the virtual terminal software that you need to process offline transactions. Once they have added this component to your POS package, getting started is simple.

Just open the virtual terminal URL on your web browser, log in, and process your payment. By definition, no hardware is required with this solution. Instead, your tablet, desktop, or smartphone instantly becomes your payment terminal.

The software will even email or text receipts both to you and to your customer.

Virtual terminals can even handle alternative payment models such as recurring billing. In just a few minutes, you and your customer can discuss the entire arrangement, including the details of the account from which the withdrawal will be taken, the frequency, the amounts, and the duration of the contract.

Putting this configuration in place helps to bring a high level of streamlined predictability to the billing process both for you and for your client.

Cautionary words about virtual terminals.

No system is perfect, and virtual terminals do have some downsides. Information is entered manually, leading to an increased risk of data entry errors and even security breaches. Additionally, virtual terminal transactions are card-not-present, which makes them more expensive.

Nevertheless, virtual terminals can play an indispensable role in your business. Incorporate them into your spectrum of solutions to provide you and your customers with an additional, useful payment option.

Related Reading

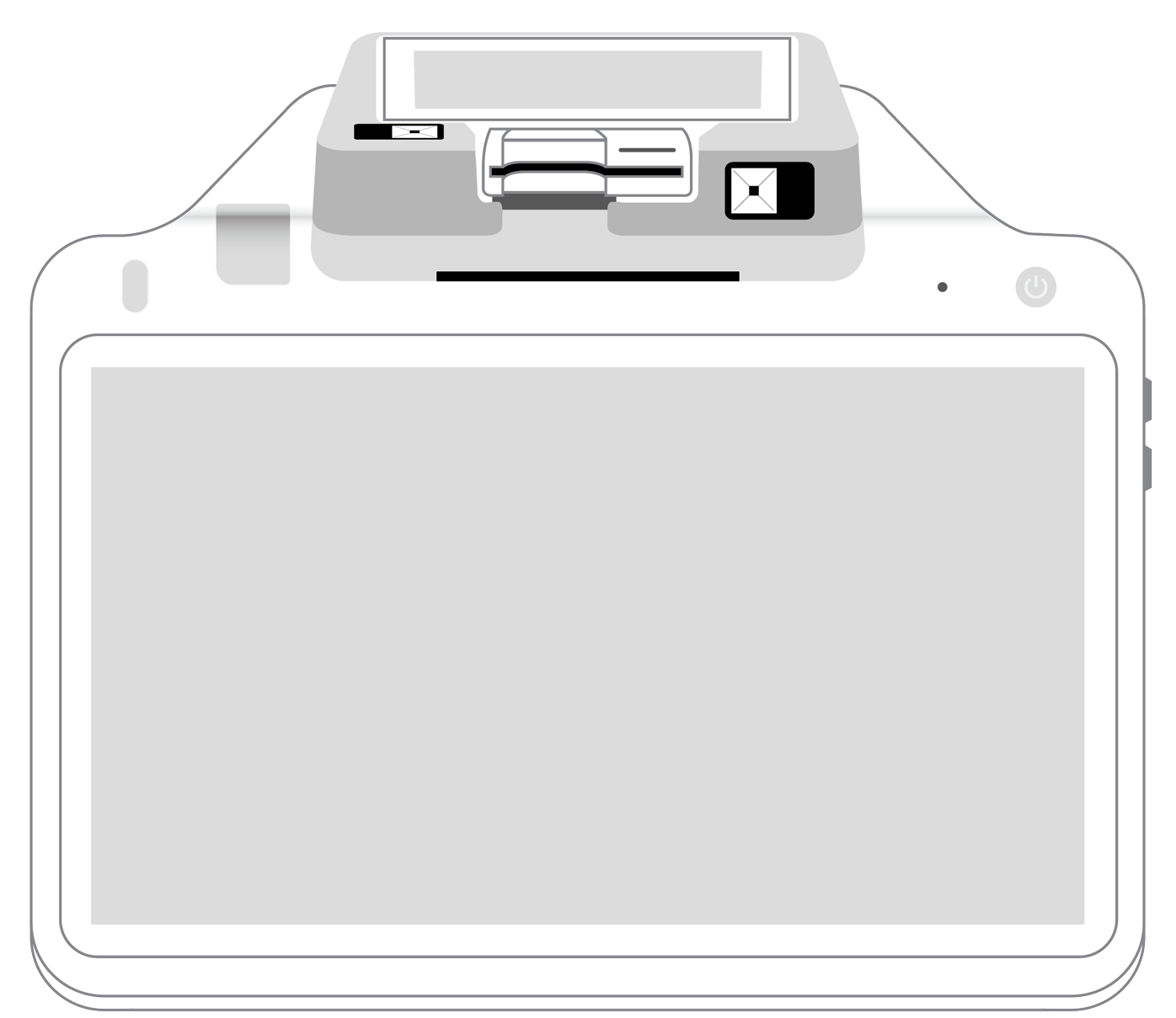

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||