How to choose the best credit card reader and terminal for your business.

With all the credit card processing options out there, choosing the right one can be challenging. You definitely want a fast, efficient solution designed to simplify administrative tasks and deliver a great experience to every customer. Here’s how to compare choices and find the best system.

Explore your options.

Everyone’s payment processing needs are different and several terminal styles are available to cater to various business models, including:

- Magstripe and EMV-ready machines — These are the most basic way to accept magstriped and EMV chip cards. Some newer machines also accept NFC contactless payments like Apple Pay. Countertop models connect via a phone or Ethernet line; wireless models need a W-Fi connection.

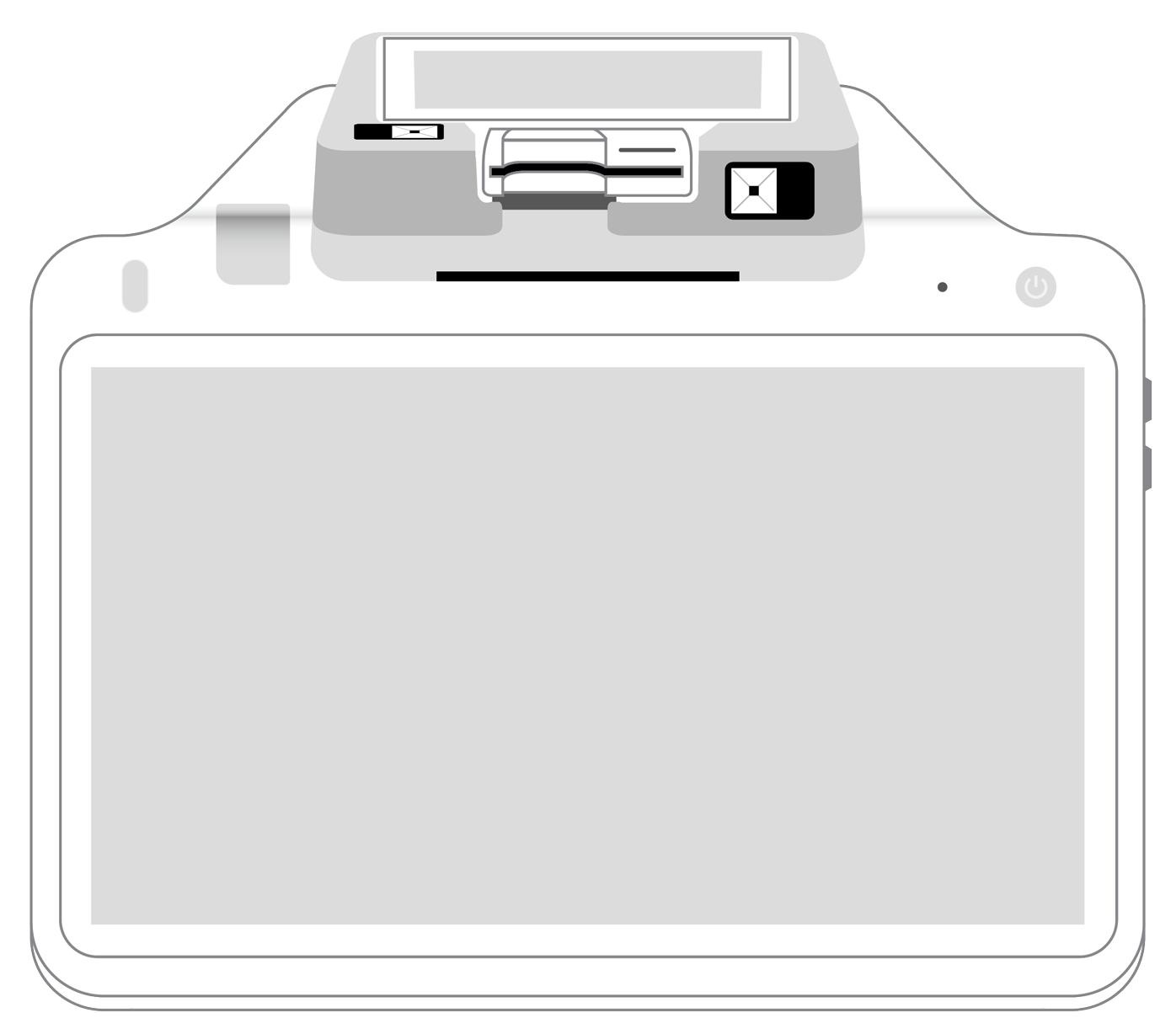

- Smart point-of-sale (POS) terminals — These usually have both a countertop and mobile option and can process contactless payments as well as magstriped and EMV chip cards. Most modern POS systems include software to handle accounting, inventory tracking, employee monitoring, and loyalty programs in addition to payment processing.

- Mobile terminals include card swipers you plug into your smartphone or tablet and handheld wireless swipe machines with keypads. Both allow you to process credit card payments anywhere in your store and at offsite locations using Wi-Fi or a good cellular connection.

- Virtual terminals provide solutions for businesses dealing mostly in card-not-present transactions, such as online, mail order, or telephone orders. Customers simply make a purchase or place an order. You then key in their card information on your computer or mobile device to complete the transaction. Some providers even allow you to perform card-present transactions on a virtual terminal as well.

Analyze your audience.

Consider the demographics your business caters to and their preferred payment options. Millennials and Generation Z like to pay with debit cards and mobile wallets. Therefore, if your audience is mostly made up of young consumers, you need a terminal designed to accept both. However, a standard swiper might be enough if you cater to baby boomers and Generation X, since these consumers rely more on credit cards and cash.

Where your customers interact with your brand makes a difference, too. Do you operate primarily out of a traditional brick-and-mortar location, or is your time split between a store and events like festivals and trade shows? Do customers place a lot of orders online to be picked up in the store? Do you do most of your selling at farmer’s markets and pop-up events? Depending on your primary customer touchpoints, you may need a credit card terminal with countertop and mobile options, a POS with an online payment integration, or a purely mobile solution.

Know how much you’ll need to scale.

Don’t consider only your current or short-term needs when shopping for a credit card reader. A swiper or POS solution compatible with your existing business systems might be fine for now, but what happens when you grow? You should be able to add features and integrations to support other processes as your business expands so that you don’t have to invest in another new system.

Your hardware options should also be scalable. Many businesses starting out as pop-up shops or festival regulars wind up establishing physical locations, which means upgrading from a mobile card reader to a system with one or more countertop terminals. Make sure that this type of hardware is readily available for your chosen solution and can be added seamlessly to your setup.

If your terminal or swiper is part of a package deal from a payment processor, find out if the price increases as your needs change. Per-transaction fees usually stay the same, but some providers charge a higher monthly fee for additional user accounts, integrations, or services.

Consider usability.

Everything about processing credit card payments should be easy for you and your employees. Swipers with keypads are simple to set up and use, so teaching your team how to use one should be pretty straightforward. However, the setup process for a POS system is more complex and can be a hassle if you don’t have help. To configure the system properly right from the start, look for a provider offering free on-boarding services.

An intuitive interface speeds up transactions and reduces the time you need to spend training employees to use your new system. If you choose a POS solution with additional options, such as loyalty programs, make sure information can be added to the system quickly. The goal is to keep lines moving by offering fast, efficient service to every customer. Data should be recorded and updated automatically within the system so that customers get loyalty points or credits for every purchase they make at the store, online or at events.

Verify connectivity and reliability.

Customers expect to be able to pay with their credit or debit cards for any purchase, so you need a terminal with reliable uptime. Interruptions in service due to poor connectivity or hardware problems cause delays, which can lead to lost sales. Repeated issues may even drive some consumers to competitors with faster, more convenient checkout options. The terminal you choose must also be compatible with all the connections you’re likely to use, whether it’s Wi-Fi at events or cellular data when Wi-Fi is unavailable.

Compare uptime for different card terminals and POS solutions. You want an uptime as close to 100% as possible to ensure consistent service. Good support is also essential, preferably featuring a team that is available day or night to answer questions and troubleshoot problems. Since all technology experiences occasional glitches, it’s important to be able to connect with support staff right away and get your terminal up and running before customers lose patience. Make sure you have a viable alternative in the event the terminal fails or you experience a prolonged issue with your payment processor.

Determine your budget.

Prices for card readers and POS systems vary widely depending on the amount of hardware you need and the features offered. You may be able to get basic hardware for free if you sign up for a complete payment processing solution, and investing in a swiper or basic terminal to link to an existing merchant account should only set you back a few hundred dollars at the most.

Things can get costly when you need a more robust credit card terminal or multiple sets of hardware. Equipping your employees with mobile credit card readers and scanners incurs additional charges. Expect to pay several thousand dollars for an extensive setup.

Complete POS solutions include payment processing services, which always carry additional fees. These may be charged according to one of four pricing models, including:

- Tiered.

- Interchange-plus.

- Subscription.

- Flat rate.

Interchange-plus is the most common, in which you’re charged a small markup fee along with a percentage of each transaction. Some providers also charge a monthly fee to use their services.

Compare security features.

A data breach could cost your small business as much as $177 per lost or compromised record and destroy the trust you’ve built with your customer base. It’s a risk you can’t afford to take, so don’t skimp on credit card terminal security. Compliance with PCI standards is mandatory for all businesses handling or processing card information. In fact, failure to comply can incur a penalty of $5,000 to $500,000. Most payment processors handle PCI compliance for you, so if you already have a merchant account, you should be covered.

However, if you’re looking into a complete POS solution, make sure PCI compliance is part of its security protocol. Since the software for these systems is usually based in the cloud, providers should also be diligent to preserve the privacy of customer information collected along with payment data.

For added protection, choose a card reader or POS system with point-to-point encryption. This ensures data is encrypted the moment a card is swiped or card data is keyed in and can’t be decrypted until it reaches the intended destination. No card data should ever be stored on the devices you use to accept payments.

Read the contract.

When you find what seems like the perfect payment solution, make sure it’s just as perfect on paper. Some contracts have additional fees or termination penalties buried in the fine print. You don’t want to get a nasty shock when your first bill comes, so be sure to look for:

- Contract length and whether or not the agreement will renew automatically.

- Early termination fees.

- Rate increases following introductory offers.

- High prices accompanying “free equipment” offers.

- Equipment leasing fees.

Your best option is to find a provider with month-to-month contracts and no termination penalties. A trial period is even better since it gives you a chance to see if the hardware and software meet your needs without paying anything upfront. Don’t hesitate to negotiate better terms as providers are generally willing to make concessions to sign on more businesses as customers.

If you’re just purchasing hardware to use with an existing merchant or payment processing account, there won’t be a contract agreement to worry about. However, you should still look for options with solid warranties and good support to protect your investment.

It’s okay to be picky when comparing credit card readers and scanners. You want a system you can use comfortably in the long term to simplify payment processing and deliver better customer service. Do your research and compare options from different providers to find the most appropriate combination of hardware and software for your unique business.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||