Mobile Payments and the Marketing Mix

If you have decided that accepting mobile payments makes sense for your business, then you must include them as a key part of your overall mobile marketing strategy. Unfortunately many consumer mobile marketing strategies fail to include the actual purchase part of the path to purchase, and as a result, mobile payments get left out.

If you have decided that accepting mobile payments makes sense for your business, then you must include them as a key part of your overall mobile marketing strategy. Unfortunately many consumer mobile marketing strategies fail to include the actual purchase part of the path to purchase, and as a result, mobile payments get left out.

Part of the reason EMV embedded-chip cards have struggled with acceptance out of the gate is the lack of understanding and convenience. Many businesses of all sizes still do not have the proper equipment to accept chip cards, and when they do, customers are finding EMV transactions take much longer to complete than traditional magnetic stripe transactions. Payments need to be convenient and fast, plus they need to be trustworthy – customers do not want to have to worry about fraud every time they pay for goods and services. Mobile payments help to solve both of these issues, as they have the quickness of traditional magnetic stripe transactions and all the security – and then some – of EMV cards.

Taking the time to include mobile payments in your mobile marketing mix is your chance to be seen as an early adopter, showing customers you care about the mobile payment experience. It’s also a great way to help customers create a strong relationship between you and their mobile experience. Below are some easy ways to integrate mobile payments into your mobile marketing mix that will be beneficial to both you and your customers:

Think mobile from the start. When looking at your overall marketing plan, make sure it is optimized for mobile and that it includes mobile payments. More people than ever are mobile these days, and the sales of tablets have outpaced PC’s for a couple of years now. There are approximately 2.08 billion smartphones worldwide, and that number is constantly growing. In the United States, there are 234 million smartphones, and while every owner of those smartphones is not likely to be your customer, with a market saturation like that, it would be remiss to not look at your overall marketing plan from a mobile perspective. The entire marketing plan should include a comprehensive mobile optimization plan – in other words, don’t just decide to add mobile payments and call it a day. You also need to make sure your website works well on mobile devices and that your social media promotions aren’t overly content-heavy for mobile users.

Don’t focus exclusively on mobile payments. Getting consumers to use their mobile wallets to make payments is part of an overall mobile marketing strategy, but it shouldn’t be the only part, nor the biggest. Today’s consumers want a better and faster overall shopping experience. Offering the security and speed of mobile payments is great, but consumers also want the ability to manage their relationship with the business on their smartphones, including viewing the balance on their stored value or gift cards and loyalty/reward club points and payment receipts. In fact, access to loyalty rewards programs is the least integrated into mobile wallets, yet it is the number one feature customers want within a mobile wallet.

Integrate your mobile payments with social media. Consumers no longer need to go to a brick and mortar store during business hours in order to do their shopping. In fact, customers are often shopping 24/7 – any time of the day or night, any day of the week. As a merchant, you need to be where your customers are and they are increasingly on social media sites. A Google survey found that 90 percent of smartphone users check social media for reviews and other information about a product or service before purchasing. These new buying habits have merchants rethinking traditional marketing plans and looking at mobile strategies to reach consumers at multiple times during the day, even if they are nowhere near the store. Integrating your mobile program with social sites like Facebook, Twitter and Pinterest can help you see better consumer engagement and more successes.

Track your customer’s behavior to improve your mobile marketing mix. Tracking the behavior of customers can give you some excellent insight into what they actually do, as opposed to what they say they do. Mobile payments automatically collects data that shows how often and when customers purchase from you, what your best selling products are, how well promotions are working, and, perhaps most importantly, how you can improve your business. You will also discover what time of week, month or year certain products sell best, so you can make sure you have good stock levels of those products, and even plan promotions, discounts or coupon offers around them. The data can also be helpful for deciding which products to continue offering to customers, and which to discontinue.

Thinking mobile and including mobile payments in your marketing mix is a smart decision, as more people than ever are using smartphones and the popularity of mobile payments continues to increase. Promoting your business’ mobile payment technology shows your customers that you are a forward-thinking, customer-oriented business that is up to date on current technology, including the latest in mobile payments technology, and that will help them feel more comfortable and secure when using a mobile wallet at your business. Because of that security, as well as convenience and flexibility, including mobile payments in your overall mobile marketing strategy creates a win-win situation for both you and your customers.

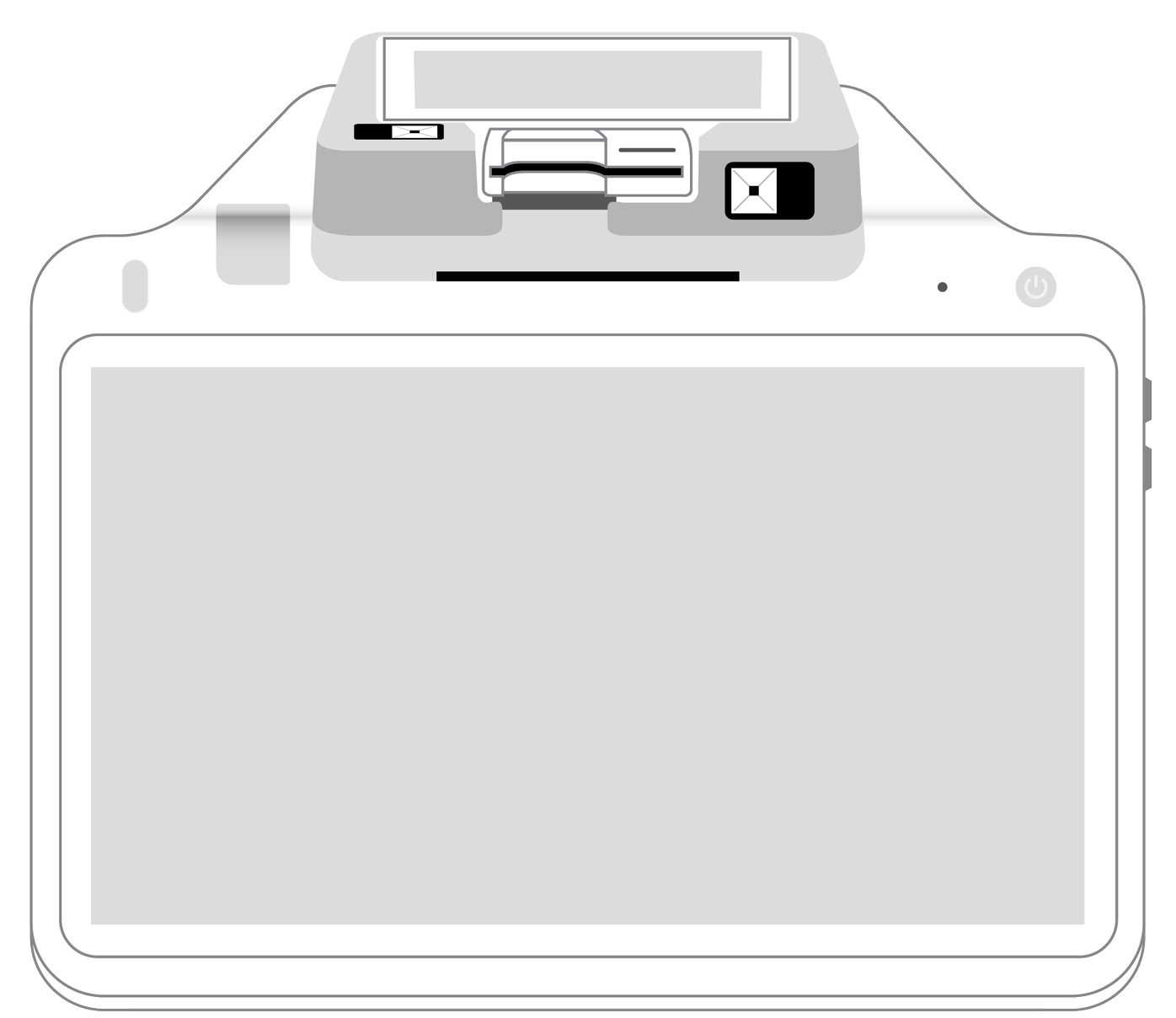

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||