Mobile Wallets: Striking a Balance with End Users

Numerous studies show that while an increasing number of consumers are giving mobile payments a try, few are using the technology on a continual basis, for two main reasons: they forget to use it and they are not sure what merchants accept mobile payments. Both issues can be attributed to a lack of value added services (VAS), a theory that many experts believe could be the driving force to mass market adoption of mobile payments. Despite this apparent setback, mobile payments and mobile wallets have, for the most part, been developing as expected, becoming the dominant marketing channel for a variety of companies, particularly those who want to reach out to new customers with simplicity, speed and scale.

Numerous studies show that while an increasing number of consumers are giving mobile payments a try, few are using the technology on a continual basis, for two main reasons: they forget to use it and they are not sure what merchants accept mobile payments. Both issues can be attributed to a lack of value added services (VAS), a theory that many experts believe could be the driving force to mass market adoption of mobile payments. Despite this apparent setback, mobile payments and mobile wallets have, for the most part, been developing as expected, becoming the dominant marketing channel for a variety of companies, particularly those who want to reach out to new customers with simplicity, speed and scale.

While that is all well and good for merchants, the customers may be asking, what’s in it for me? Everyone doesn’t use their smartphones in the same way, and beyond the sheer convenience of mobile payments, customers can personalize their mobile wallets to suit their needs, loading preferred credit cards and loyalty/rewards cards – and even keep track of receipts – into whichever platform they use, be it Apple Pay or Android Pay, or perhaps a bank-based wallet. Customers can pretty much ditch their physical wallets in favor of their smartphones, which they already take with them everywhere they go.

Mobile payments and mobile wallets can benefit both merchants and customers. Merchants gain more customer data with which they can develop increasingly targeted marketing programs; customers get the convenience of not carrying a physical wallet as well as the added incentive of discounts/bonuses from loyalty programs.

But just what, beyond discounts and bonuses, will lead more customers to use mobile payments on a regular basis? Studies have shown that consumers are open to the idea of using mobile payments, regardless of gender, age and location. But they want brands to engage with them through the mobile wallet, offering sales, coupons and loyalty/reward programs available only to those who use mobile payments. Merchants, in turn, must take advantage of this increased consumer interest by providing content that is relevant and personal while at the same time simple and efficient. Done properly, these efforts can lead to higher in-store traffic and more participation in loyalty/rewards programs. This goes back to the VAS mentioned earlier – offering incentive for consumers to use mobile wallets, and for merchants to accept mobile payments.

Banks also have an interest in increasing VAS through connecting with customers via mobile wallets and mobile payments. Many big banks now have their own payment apps, like Chase, Fifth Third and Capital One, not to mention the card brands’ own payment apps, Masterpass and Visa Checkout. Many of the bank apps are designed to help customers manage their financial lives, from providing budgeting tools designed to help them keep more of their money instead of wasting it on unnecessary things, to encouraging savings, investments and financial planning for retirement. Not only do these features help customers become better money managers, they also elevate the reputation of the banks, as they are seen as a valuable partner in the customer’s financial planning. Other bank app VAS may include incentives given for savings account deposits, and special services or loyalty points awarded each time a customer checks her balance or views a statement.

Both merchants and banks would be wise to look at mobile wallets and mobile payments as ways to incentivize the consumer experience, but care must be taken to ensure what they offer as incentive will be useful and important to the consumer. By looking at incentives as value added services, both the merchant/bank and the consumer benefit, resulting in more mobile wallet/payment use by the consumer and a more loyal customer for the merchant/bank. It’s a mutually beneficial relationship.

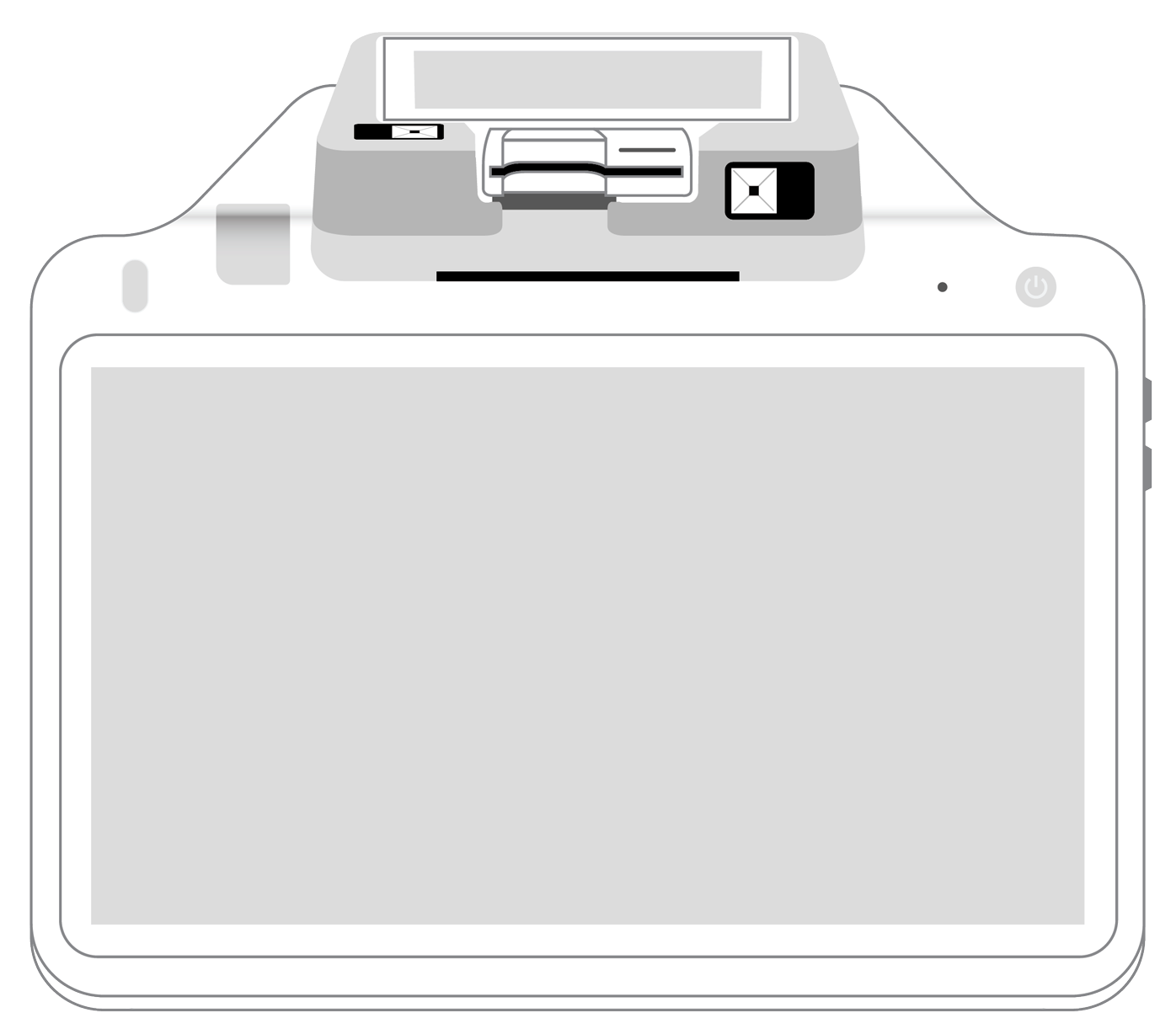

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||