Must-Have Payment Features for On-the-Go Businesses

Many of today’s entrepreneurs are leveraging the power and flexibility that technology affords, taking their companies into their communities and directly to customers’ homes. If you are one of these motivated sellers, you need your payment infrastructure to be equally nimble and in keeping with the times. As you work to modernize your payment systems and protocols, be sure that your updates include the following vital features.

Multiple payment acceptance

To succeed as a portable business, you must accept mobile payments from various sources. In addition to conventional credit and debit cards, you should also take funds from mobile wallets like Google Pay and Apple Pay. These methods use near-field communication (NFC) to enable a customer to merely tap or wave their phone or wearable device near your mobile reader. Best of all, the process occurs within seconds and keeps sensitive data secure.

Another very popular method involves sending payment links. These are unique URLs, buttons, or QR codes that, when clicked upon, redirect the customer to a secure checkout page. These links enable people to pay their bills securely from anywhere, raising the likelihood that you will get your money quickly.

Finally, you might choose to link your business to a peer-to-peer application, such as Venmo or Zelle. These allow customers to pay in a way that they may have already used with friends and family.

Designed for mobility

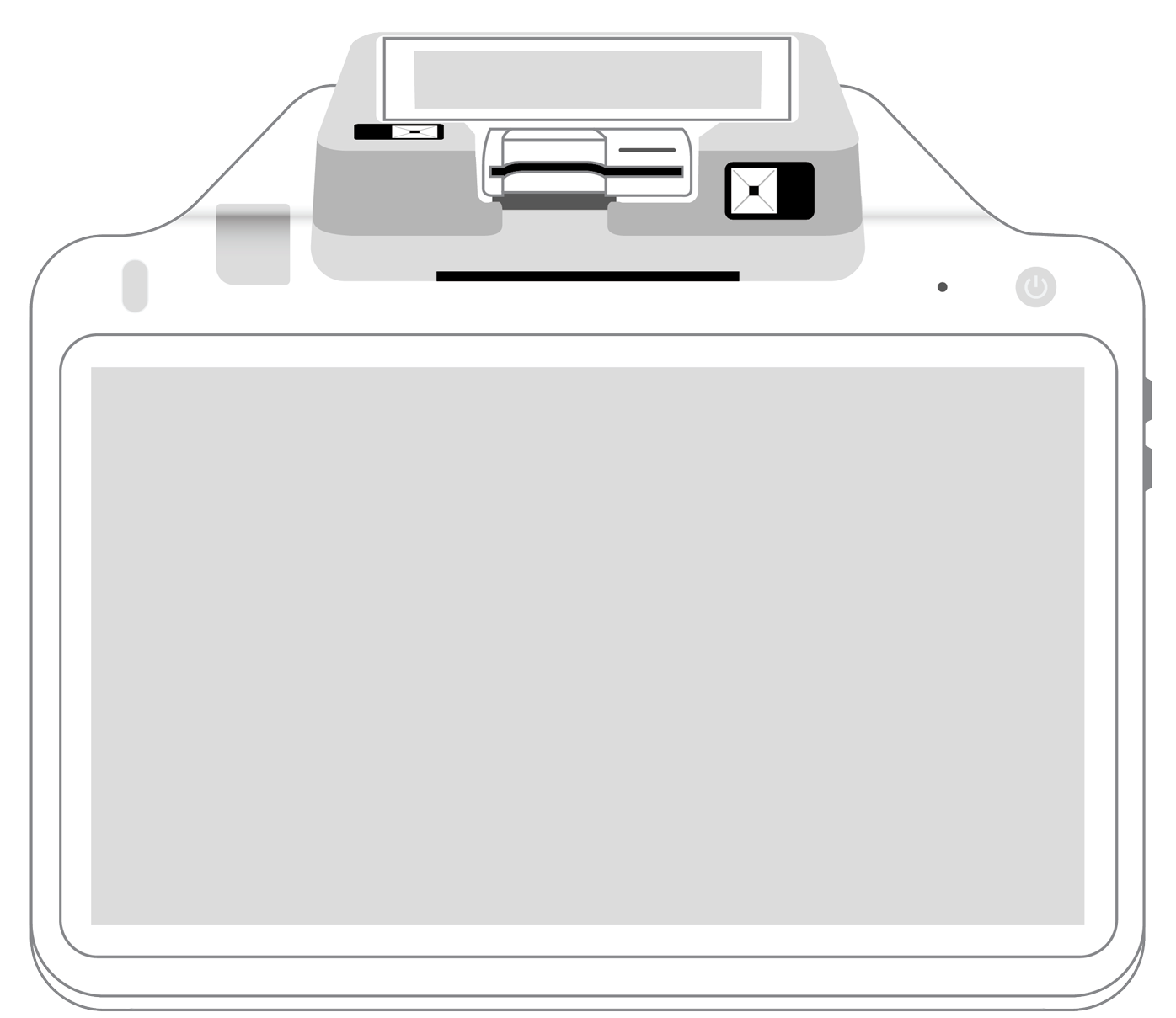

The smartphone or tablet that you already have can easily be transformed into a virtual payment terminal. Use it to manually key in payment details given to you over the phone. In addition to that software, you can purchase a light and portable card reader that easily connects to your device to accept credit and debit cards as well as digital wallet payments. Having several ways to input payment details increases the chances that customers will complete a purchase with your company.

When you use your tablet or smartphone to take payments, it does so via an app. Be sure that this app is easy to use. Moreover, it should allow you and your staff to process payments, manage inventory, and track various datapoints.

Emphasis on security

Although digital wallets and contactless payments have gained predominance in recent years, many customers still prefer to pay using a credit card. For this reason, it is crucial that your systems adhere to compliance standards, including EMV and the Payment Card Industry Data Security Standard (PCI DSS). These mandatory measures have been designed to protect cardholder data and, when followed, remove the liability from merchants’ shoulders in the event of a data breach.

Built-in fraud protection is another essential element for your payments infrastructure. These tools scan each potential purchase in real-time, letting you know if any unusual buying patterns or behaviors have been detected so that you can take the appropriate action.

Reliability and connectivity

When you are not constantly wired to a terminal in a fixed location, it is crucial that your systems support your wandering lifestyle. Especially if you travel to rural places, you will want your system to have an offline mode. This lets you take transactions and place them all in a queue that can be processed as soon as you have a connection once again.

Your sales days are long and busy. For this reason, your hardware needs to be powered by a strong battery that will make it through. This, along with reliable Bluetooth, wifi, or cellular connectivity, helps to ensure that sales always go through smoothly.

Integrated business management tools

While taking payments is an essential element of your system, it should also be packed with other features that can be used to run your business more efficiently. Make sure that your system also comes with inventory management tools that check product levels and automate re-ordering. Furthermore, the software should allow you to create reports on sales trends and customer data, and buying patterns. These insights help you to create accurate forecasts and arrive at intelligent marketing plans.

Additionally, make sure that your system is capable of sending out digital receipts. This saves on paper while giving both you and your customer an electronic record of the purchase. Finally, your mobile device should be able to send digital invoices directly to the buyer via text message or email. This encourages on-time payments.

If your business never stops, your payment infrastructure should be able to keep up with it no matter what. Implement these strategies, and you will be providing customers with the safe, comprehensive purchasing options that they have come to expect.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||