Retailers Racing to Embrace Mobile Payments

Throughout the retail sector, merchants both large and small are sensing the onslaught of the mobile age. With the ease provided by mobile apps and wireless Internet, things like checks and mechanical registers are starting to seem like dinosaurs.

Mobile solutions allow retailers to accept payments at storefronts via readers that attach to smartphones and tablets. With the addition of data analytics and promotional tools, the vast benefits of mobile are drawing thousands of new converts each month. As more and more merchants adopt mobile readers for credit card processing, consumers by and large are coming to favor the option.

By accepting payments through mobile devices, businesses make money thanks to multiple factors. Chief among them is the speedup of lines and the greater ease of payments, which allow customers to lose their spending inhibitions. During the busiest hours of the day - when customers are often limited to five-minute stops during lunch breaks - the speed afforded by mobile card processing can increase the overall sales volume.

Mobile payment solutions also offer the greatest flexibility in terms of POS. In large department stores, a salesperson can ring up customers directly from the floor Ð securing sales on the spot while sparing customers of long, sluggish lines. With mobile devices on hand, merchants can also give customers the options of digital receipts, which save on paper while providing permanent verification of every sales transaction.

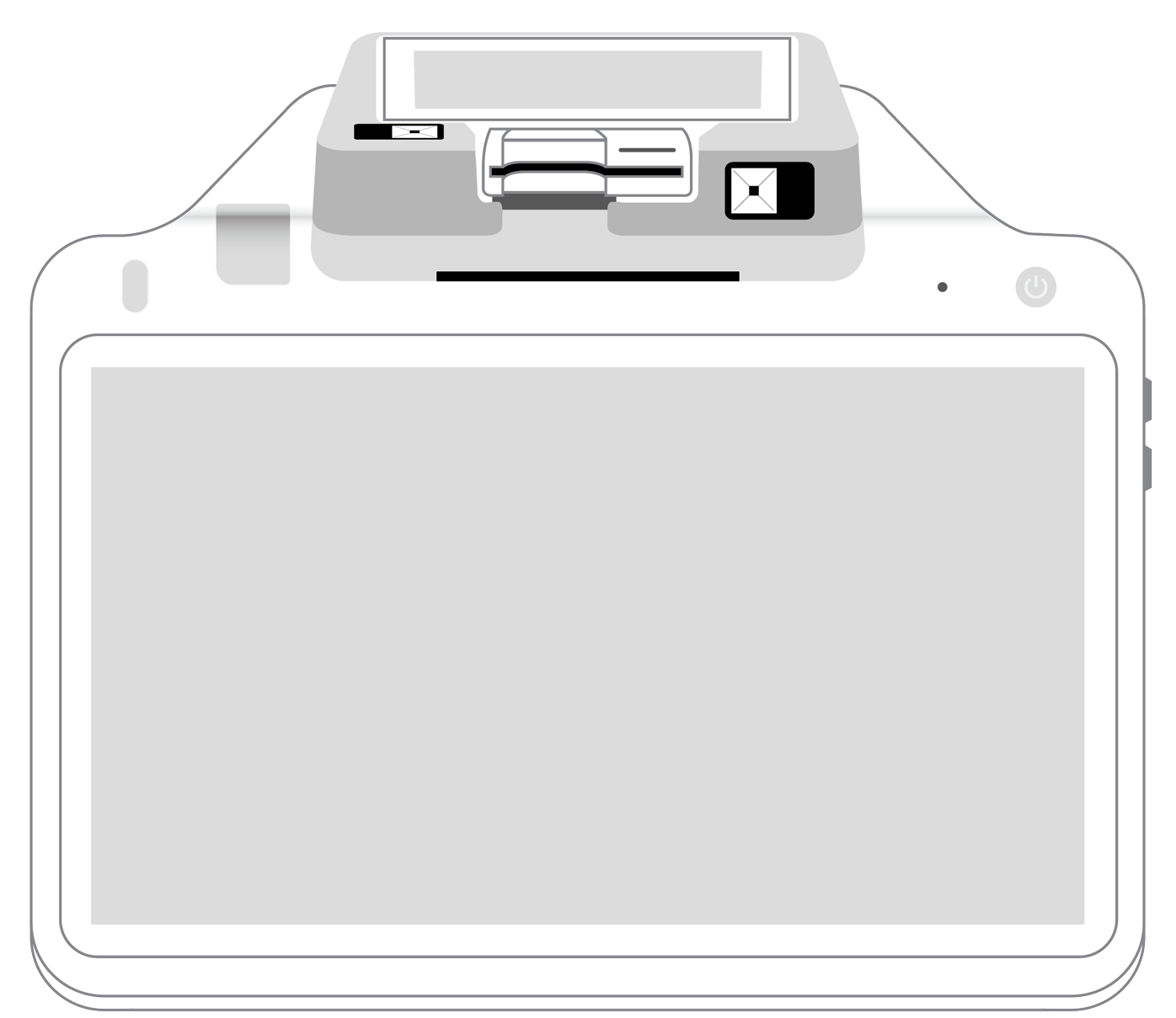

Of all the great benefits that merchants gain from the mobile revolution, the most important of all is the ability to accept credit card payments on iPhones, iPads, Androids and BlackBerrys. The best device for this very function is the PayAnywhere reader, which works as a clip-on device for smartphones and pads. Along with its namesake app, PayAnywhere can process sales in any indoor, outdoor, business or residential setting.

The PayAnywhere app is also a superior tool for reporting on sales activity. Merchants can use the app for daily, weekly and monthly tallies on sales, refunds, discounts and voids. Log onto the PayAnywhere Merchant Portal and merchants can view additional sales reporting, print extra copies of receipts, and even refer their friend to the newest method in mobile credit card processing.

Best of all, PayAnyhere is an extremely safe device that keeps information digitaly protected. Lost or damaged readers can simply be replaced while vulnerable data stored on stolen units can all be erased through third-party apps. Backed with PCI encryption, PayAnywhere is the optimal choice for POS in the mobile payment industry.

More from News

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||