Start preparing for this year's holiday shopping with contactless card readers.

With summer in full swing, even autumn may seem like a world away. However, the frenetic holiday shopping season that represents the annual bread and butter for many retailers is right around the corner! If you haven’t already done so, consider incorporating a contactless card reader into your offerings to get a leg up on your competition.

What are contactless payments?

Once you learn the answer to this question, you’ll probably realize that you not only already knew about tap-and-go payments, but also that you yourself use this convenient, safe, and secure option as a consumer. Contactless payments use near-field communication (NFC) technology that allows customers’ cell phones, wearables, and chip cards to communicate with your mobile card reader.

Ahead of time, the consumer enters their payment information into their smartphone’s secure digital wallet. Alternatively, they can obtain a credit card that is embedded with a chip that contains encrypted details. Then, at the time of purchase, the shopper simply opens the digital wallet on their phone or takes out their “smart” credit card, placing it less than two to three inches from the merchant’s NFC-ready reader. Within seconds, payment details, as well as the acceptance or declination response, are communicated securely thanks to certified, point-to-point encryption and single-use tokenization.

Why you need mobile payments for the holidays.

During these sleepy summer days, it may be hard to recall just how crazy those lines at your checkout counter can get. Remember how they led to frustrated customers, harried staff, and data entry errors? Because touchless payments are much faster than cash or even standard credit card transactions, you can keep that line moving. Additionally, the portable nature of mobile card readers allows you to accept customer payments from anywhere in your store, including right on the sales floor. With just a bit of staff relocation, many of your shoppers can avoid the lines altogether.

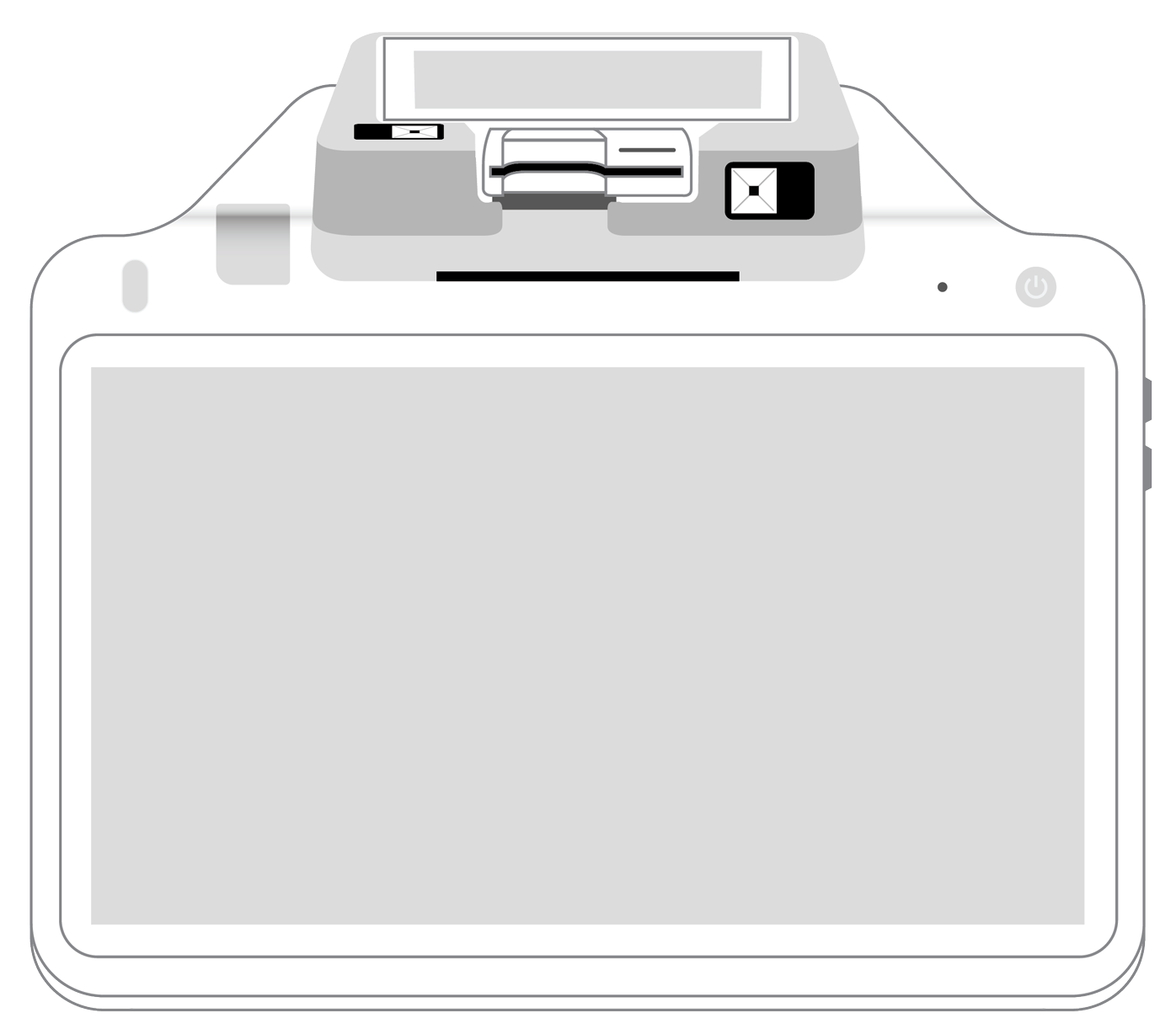

The flexibility of mobile payments can also give your sales team a way to provide help and additional product information to shoppers while they are browsing your shelves. An associate armed with a handy tablet attached to your point of sale system has access to item details and reviews and can even make recommendations of ancillary products that can enhance the customer’s purchase.

Another compelling advantage of touchless card readers is their enhanced safety features, which provide patrons a way to make purchases with minimal physical contact with your payments hardware and staff. With the coronavirus pandemic still very real and concerning, anything you can do to enhance your commitment to hygiene will be noticed favorably. What’s more, you can use your mobile card reader to accept payments curbside, on your customers’ doorsteps, or even over the phone using virtual terminal software.

Rising above your competitors during the busy holiday season happens when you offer the products people want, at prices they can afford, and with that unique brand of customer service you base your brand upon. With a contactless card reader added to your capabilities, you can demonstrate your dedication to the customers who have led to your success. Why not talk to your payment processing company about adding one today so that you can be up and running long before Black Friday?

More from Business tips

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||