The Faster Payments Initiative – What is it and What Does it Mean?

The road to faster payments in the United States has been a slow-moving one, and it is still a work in progress. So why is it taking so long to implement? The reasons may be complicated, but once complete, it will be transformative for the payments industry, merchants and consumers alike.

The road to faster payments in the United States has been a slow-moving one, and it is still a work in progress. So why is it taking so long to implement? The reasons may be complicated, but once complete, it will be transformative for the payments industry, merchants and consumers alike.

The Faster Payments Initiative is a system that will help to ensure customers get their money on the same day that a transaction takes place. For example, when a customer pays for a purchase with a credit card, there are a number of steps that payment must go through before it lands in the merchant’s account. These steps can sometimes delay the payment for a day or longer. The Faster Payments Initiative will enforce new rules and regulations so that the payment reaches the intended party much faster, ideally on the same day. A report from the Federal Reserve Bank called Strategies for Improving the US Payment System, states that rapidly changing technology is putting the US payment system at a critical juncture. “High speed data networks are becoming ubiquitous, computing devices are becoming more sophisticated and mobile, and information is increasingly processed in real time. These capabilities are changing the nature of commerce and end-user expectations for payment services.”

NACHA, the Electronic Payments Association, has worked over the last few years to get the United States up to speed on faster payments, also known as same day ACH. The first in a series of rules, which will usher in three phases designed to ease the implementation, will go into effect on September 23, 2016. This first rule will enable same-day processing of nearly any ACH payment. Most ACH payments are currently settled on the next business day. Many businesses and consumers will benefit from same-day processing, that, until now, was not always possible. “This NACHA rule change will enable ACH originators that desire same-day processing the option to send same-day ACH transactions to accounts at any receiving financial institution (RDFI). The rule includes a ‘Same Day Fee’ for each same day ACH transaction, so that RDFIs would recover, on average, their costs for enabling and supporting Same Day ACH. This rule enables the option for same-day ACH payments through new ACH Network functionality, without affecting existing ACH schedules and capabilities,” a release about the rule states.

Transactis CEO and Chairman Joe Proto, a 30-year payments industry veteran, says the key to all faster payment transactions is keeping the data and the dollars together. He says because of the straight-through processing nature of same day ACH, there is a less time consuming and labor intensive manual processing. This can potentially solve many customer service issues and save costs in the system.

Proto also believes Millennials are key to the success of faster payments, as they are used to what is called “single button” capabilities – when the button is hit, they know their transaction is complete. This expectation will cause one-touch ability to continue evolving and moving into the consumer bill pay space, because ease of use drives adoption.

Same day ACH is not a magic silver bullet that will solve all the problems in payments today. It will help to create a faster and more efficient domestic payment system, and bring the United States on par with many other countries that already have such systems in place. Same day ACH is a huge step towards the goal of faster and more secure payments. It will be exciting to see what the future brings.

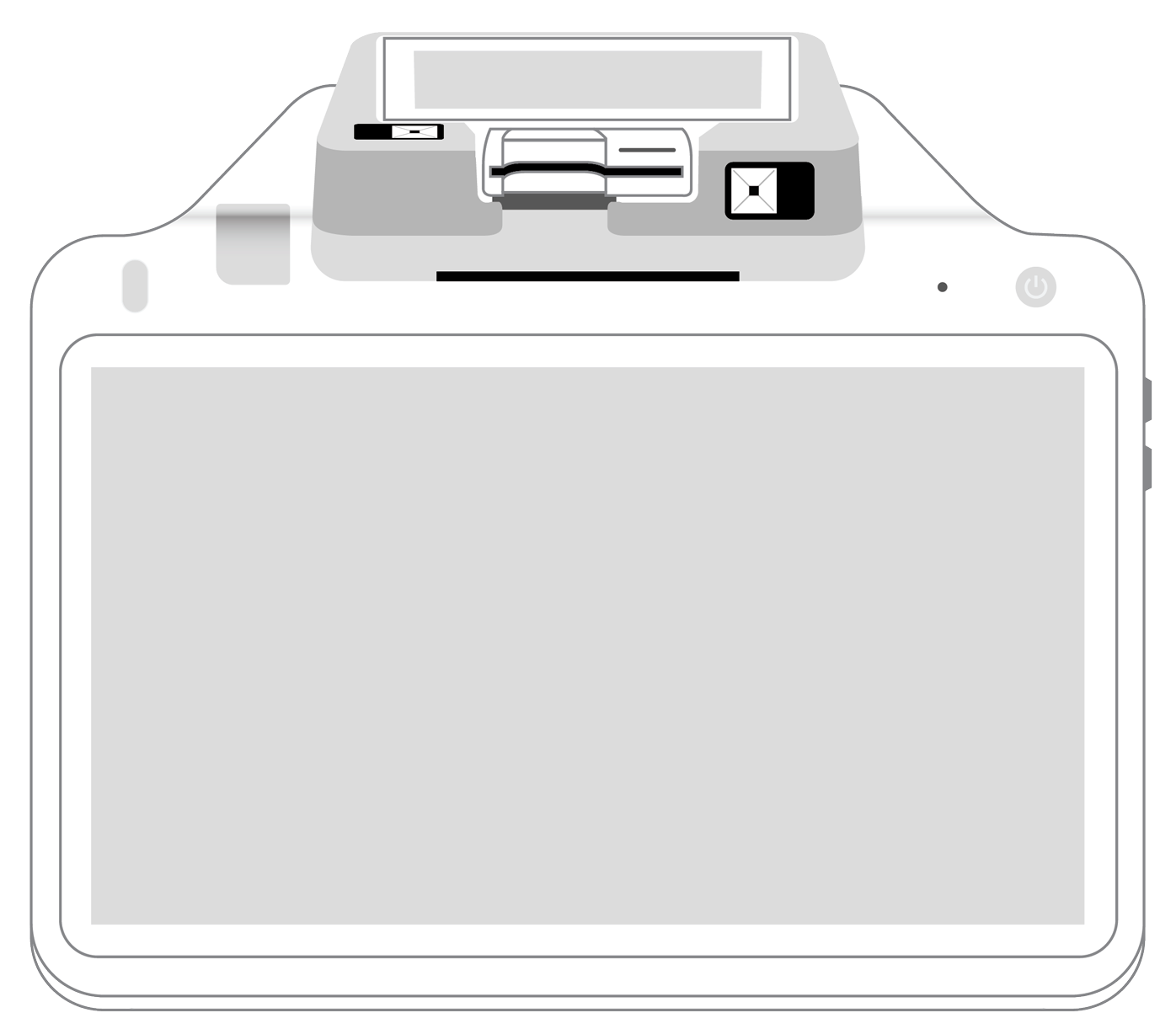

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||