There Is No Jingle to This Coin

As the adage goes “necessity is the mother of invention,” but when it comes to the Coin electronic card its convenience is the “mother of invention.” Coin is a sleek, black logo-free electronic card that has the look and feel of a standard credit card but with one slight difference — it can hold the information of up to eight cards (credit cards, gift cards, loyalty and membership cards) in one single card. But how does it work at checkout?

As the adage goes “necessity is the mother of invention,” but when it comes to the Coin electronic card its convenience is the “mother of invention.” Coin is a sleek, black logo-free electronic card that has the look and feel of a standard credit card but with one slight difference — it can hold the information of up to eight cards (credit cards, gift cards, loyalty and membership cards) in one single card. But how does it work at checkout?

First, the consumer needs to download the Coin app and use the provided card reader to swipe their existing credit cards onto the app. After syncing the cards via Coin and the app, the information is available for purchases. A consumer just has to press a button, pick the card they want to use and swipe to pay. Each Coin electronic card is password protected by Tap Code, which is a series of six long, or short, button pushes - similar to Morse code.

The functionality of the card itself is the same as the standard magnetic-stripe credit card. The consumer selects which of up to eight cards to use and either swipes the card themselves or hands it to the merchant to swipe. Coin believes that not requiring a change in what the cashier is already doing is one of the beauties of this new technology.

They do offer the following tips to make sure the transaction goes both smoothly and securely:

- Customer names are permanently engraved on the back of Coin if cashiers are trained to check ID.

- If you require that a cashier verify additional pieces of card data, such as card network (e.g. American Express) or expiration date, that information can be found on Coin's display. Cashiers should check that the display is on before swiping.

- If Coin does not work on the first swipe, cashiers should try again at a different speed. Coin tends to transmit data better when swiped at a normal speed versus very fast.

So, how will Coin work in an EMV-capable world? The people at Coin say, “Merchants should have no problem accepting Coin after the liability shift as Coin stores and transmits only the information from a card’s magnetic stripe. Coin does not currently have an ‘EMV chip’ and does not transmit chip data. However, Coin will continue to work in today's market as it transitions towards full EMV adoption.”

With the technology being both new and similar, how has Coin been performing in real-world situations? In a recent article on cbsnews.com, the writer had a success rate of more than 90 percent. He went on to say that he experienced some hesitance from cashiers that didn’t recognize the all-black; no-logo electronic card and had less success when they were swiping the card.

Coin electronic cards started shipping mid-spring of this year, so these cards will become more common as time goes on. You’ll need to be ready when one of your customers comes through the door with Coin in hand. For more information on how Coin can affect the merchant, click here.

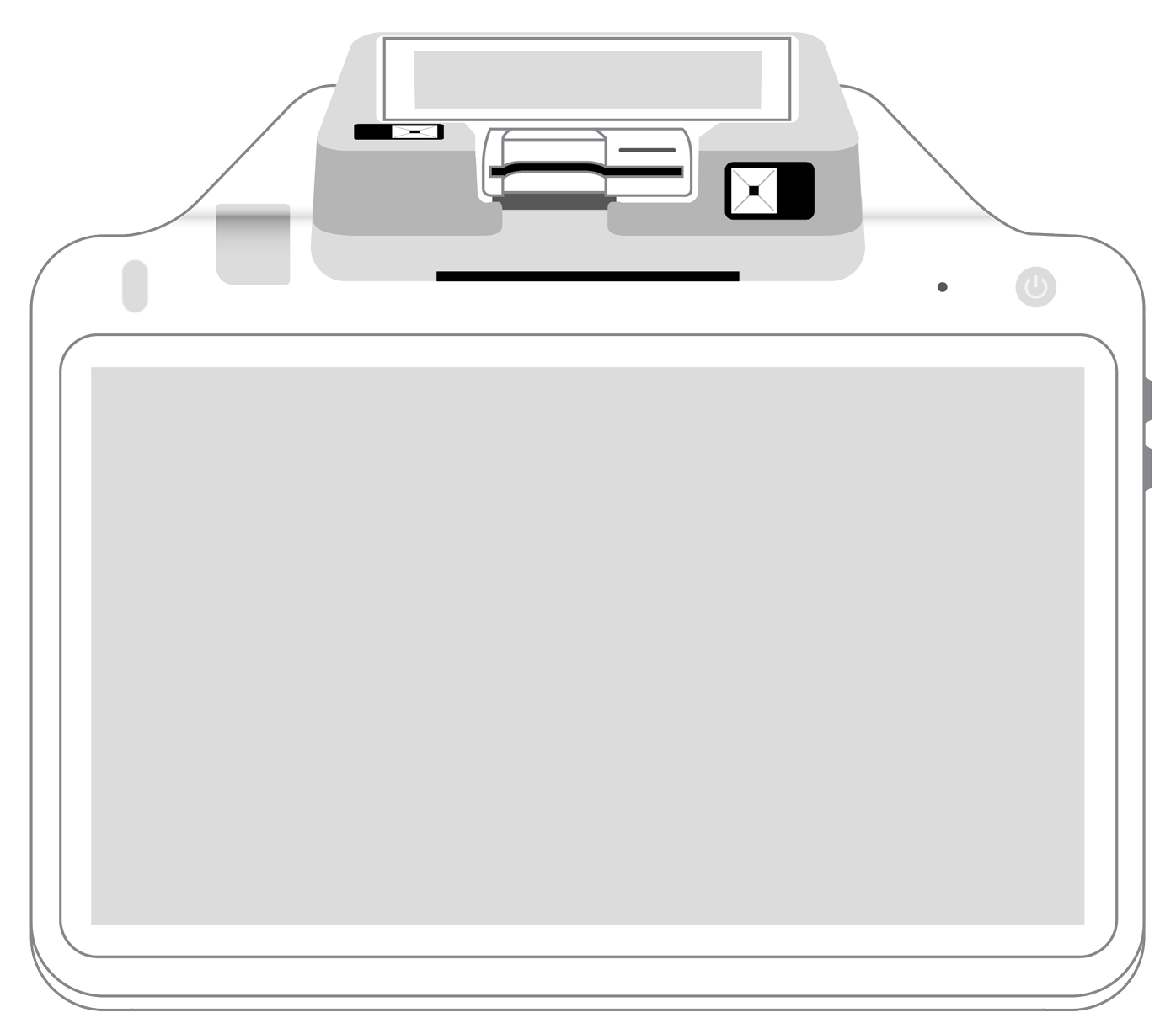

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||