Tips for Keeping Up with Expensing Business Travel

If you did any traveling for your small business throughout the last financial year, you may be eligible to deduct some of your travel expenses. The key to keeping up with expensing your business travel is to remember to enter any costs you incur into your bookkeeping software and retain receipts.

If you did any traveling for your small business throughout the last financial year, you may be eligible to deduct some of your travel expenses. The key to keeping up with expensing your business travel is to remember to enter any costs you incur into your bookkeeping software and retain receipts.

Here is a brief look at what items may qualify as a travel expense deduction:

Transport Fares

If you travel by airplane, train or bus between your home and your business destination, any travel fares you pay may be deductible. However, keep in mind that if you're riding free after redeeming frequent traveler points the IRS considers your travel costs to be zero.

If you incur travel costs as a part of acquiring or starting a new business, your expenses aren't deductible as business expenses. Instead, the costs can be added to your startup expenses.

Transit Fees

If you pay any fares for taxis, ferries or any other type of public transport between the airport or train station and your hotel, or between the hotel and your place of business, the costs may be deductible.

Baggage and Shipping

If you need to ship any baggage, samples or display material to your place of business or a temporary work location, the costs you incur may be deductible.

Rental Car Use

If you rent a car for business use while you're on business-related travel, you may be able to deduct the business-use portion of your expenses. The IRS will expect you to keep a log of any personal use driving you do in the rental car.

Automobile Expenses

You should be able to deduct some or all of the costs you incur for using your own automobile while at your business destination. It's up to you whether you deduct the actual expenses, or whether you choose to calculate your costs using the standard mileage rate. Any tolls or parking fees you pay in relation to business are also deductible, as are the costs of gas, oil, washing and repairs.

Dry Cleaning and Laundry

Keeping your business uniform or attire clean is a deductible expense.

Accommodation

The cost of your business-related accommodation at a hotel or similar lodgings is also a deductible expense.

Meals

You can deduct your meal expenses while you're traveling for business purposes, but the deduction for business meals may be limited to 50% of the unreimbursed cost. In some cases, instead of keeping records of your meal expenses and deducting the exact cost, you may be able to deduct the standard meal allowance.

Any tips you pay for services related to your business meals, accommodation or other services may also be deductible.

You can learn more about expensing business travel here.

The IRS is quite specific about the types of small business travel expenses you're able to deduct, so be sure you keep up with what you can and can't include. It's also worthwhile calculating any standard mileage or meal allowances and comparing them to the actual costs you intend to discuss to see what works better for your individual situation. If you're uncertain about what travel-related expenses you can deduct, speak with a good accountant or discuss your options with an IRS representative.

Related Reading

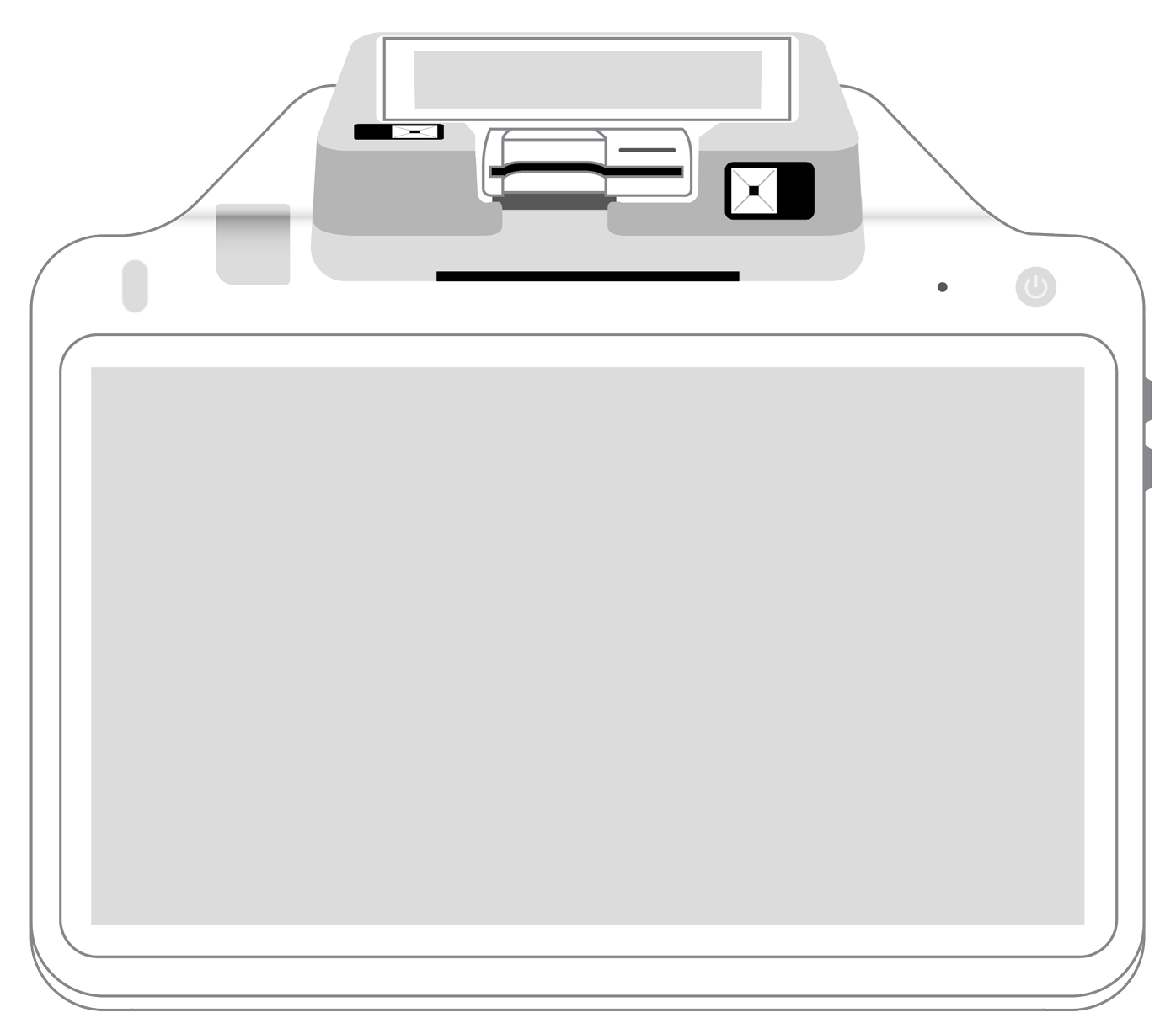

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||