Top Security Benefits of Portable Card Readers for Retailers and Shoppers

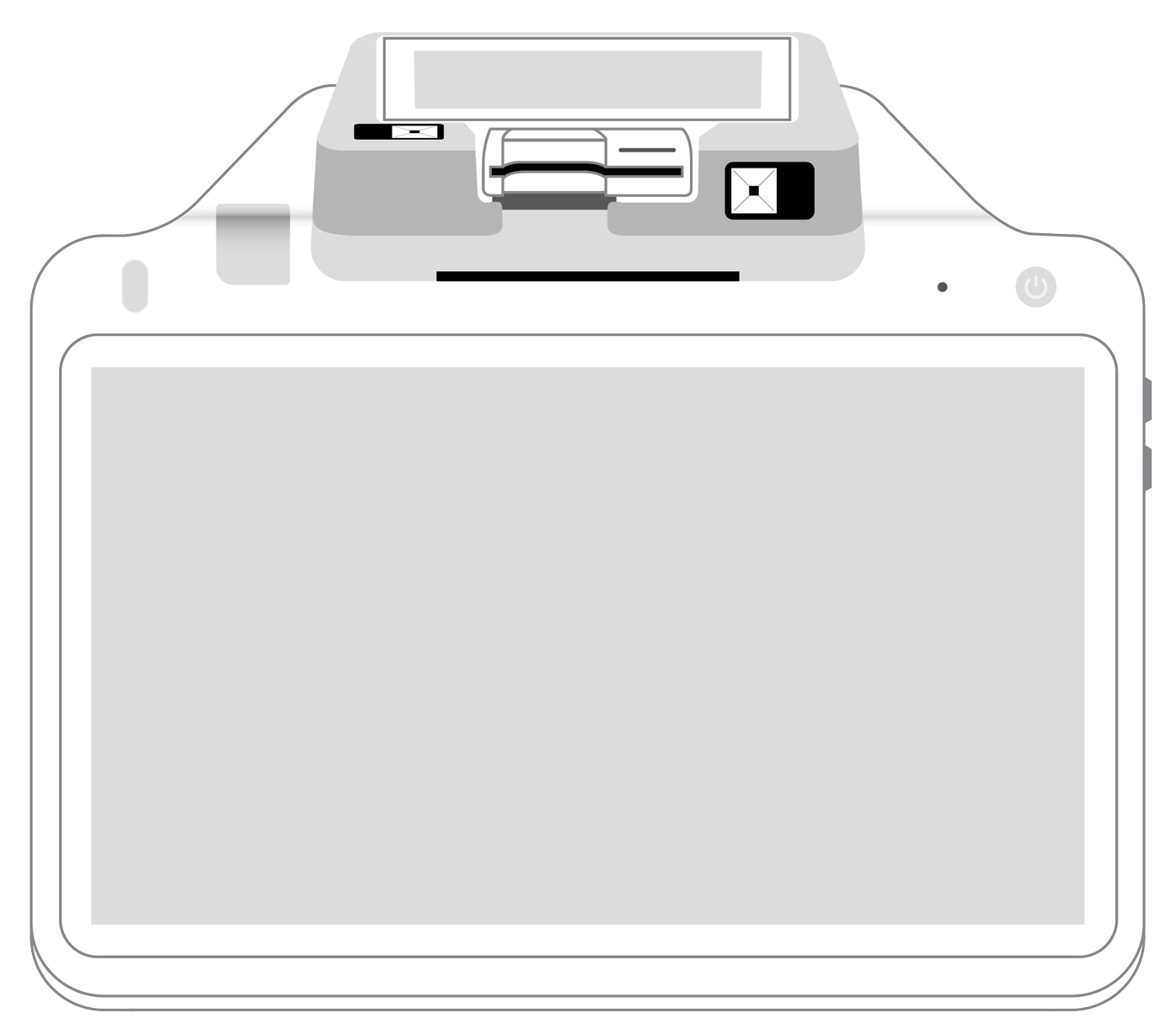

Today’s agile businesses need to find ways to process customer payments using a variety of methods, ideally from anywhere. Portable credit card readers make this flexibility and versatility possible.

Security benefits for retailers

Advanced technologies allow mobile card readers to provide several benefits for sellers.

These include reduced risk of data breaches, tokenization to mask information, and protection through end-to-end encryption. You’ll also get compliance with security standards, anti-fraud measures, and real-time digital reporting.

A mobile Bluetooth card reader might seem simple, but it’s surprisingly powerful. It allows retailers to connect with their entire point of sale system, including all payment processing and business management features.

Reduced risk of data breaches

Among the reader’s most important benefits is its focus on ensuring top-of-the-line security that protects customer data at every point of its journey through the payment process.

As a result, your business will face a much lower risk of a data breach. This protection helps prevent criminals from accessing the digital information you store, manage, or transmit.

Tokenization

The system safeguards this data by using tokenization, a procedure that replaces sensitive card digits with a unique, random series of numbers for each transaction.

Even if a hacker succeeds at intercepting this token, it cannot be reverse engineered and is only readable by the end user. This, along with other types of end-to-end encryption, is vital in protecting the integrity of data at every step of its voyage through the payment process.

End-to-end encryption

The Payment Card Industry Data Security Standard (PCI DSS) further strengthens the protection of this information. It sets mandatory security measures designed to safeguard cardholder data.

The mobile card readers and other systems you use must fully comply with PCI DSS standards. This ensures customer confidence and helps you avoid the financial penalties and reputational damage that can follow a data breach.

Anti-fraud protection

The mobile card readers provided by your retail merchant account company are also designed with fraud protection in mind. Their design contains physical security features that identify tampering as it is happening, making it possible for the system to erase sensitive information or shut down to prevent theft.

Built-in real-time fraud detection technologies monitor transactions as they happen. They can identify abnormalities and red flags, giving you the chance to halt a payment before it’s completed.

Real-time reporting

Because the mobile reader is directly connected to your POS and its database and accounting features, it effortlessly creates a digital record of every transaction.

As a result, tracking sales and reconciling your accounts can be accomplished with speed and accuracy every time. Should a security incident occur, any audits or investigations can be streamlined and will be virtually error-free.

Security benefits for customers

Customers also gain advantages when sellers use mobile card readers.

Customers benefit from keeping their physical card in hand, along with data protection through tokenization and encryption. They also gain security through verification, reduced risk of identity theft, and greater convenience and trust.

Skimming and cloning are reduced by keeping the card in hand

In addition to giving customers added payment options and a faster checkout experience, portable card readers are furnishing buyers with gold-standard security. For starters, shoppers never need to relinquish physical possession of their card.

As a result, the risks of skimming, cloning, and other theft-related behaviors are drastically reduced.

Add to that the benefits that tokenization and encryption bring, and consumers can rest much easier in the knowledge that their sensitive payment details do not fall into the wrong hands.

Reduced identity theft

Furthermore, merchants can configure their mobile readers to require verification from biometrics or by entering a PIN to safeguard the transaction. This is also the case when buyers complete a purchase using a digital wallet with PayPal, Apple Pay, or Google Pay.

When consumers can see these visible measures, this will serve as proof that your company views security as a high priority. Consequently, you will gain credibility, and their levels of trust and confidence will rise.

Increased trust

Sending digital receipts by email or text message adds an extra layer of convenience. It provides customers with easy-to-retrieve proof of purchase if questions or disputes arise later.

With their versatility, flexibility, and security, portable credit card readers are here to stay. Integrate them into your business today, and both you and your customers will reap the numerous rewards that they can provide.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||