Understanding Common Small Business Operating Expenses

Every business encounters ongoing costs that are required in order to keep operations running. These are known as operating expenses, sometimes abbreviated to OpEx.

These costs are not tied to the buying or selling of your products, and instead are routine and repetitive.

Common types of operating expenses

In many respects, operating expenses are the silent backbone of your company. If, for any reason, you are unable to pay these bills, your doors would close quickly.

Operating expenses can vary according to the industry in which a company conducts business. However, there are several common ones.

They include property rent, bank, legal, and accounting fees, office supplies, fees for marketing-related tasks, utilities, payroll, and cost of goods sold (COGS).

Before starting a small business, all aspiring entrepreneurs should formulate a business plan that outlines all of the operating expenses they anticipate facing, as well as a roadmap that clearly identifies how the funds will be raised to accomplish this priority.

Minimizing the sting of operating costs

Companies can limit operating expenses in several ways. Tactics include moderating spending with data analysis, conducting firm negotiations, nimble budgeting strategies, employee engagement, a commitment to continuous improvement, and benchmarking.

Cutting operating expenses without compromising a company’s infrastructure is the holy grail for most entrepreneurs. While these expenses can never be eliminated altogether, there are things you can do to pare them down when expanding a small business.

Start by creating data-driven reports with the help of your smart payment terminal that take a close look at trends and patterns in your spending. If you spot excesses or anomalies, root them out.

Through it all, work constantly to plan your budget, remembering that it is important to be nimble in the event that unanticipated events or costs force you to make changes on a dime.

Next, focus on the advantages that you can gain from clear communication. Negotiate with ongoing vendors to obtain better prices, fairer payment terms, or lower discounts. After a regular review of your vendors, explore finding alternatives if the ones you are using are not providing transparency and fair pricing.

As you work to keep costs low, remember that your employees can offer a gold mine of ideas and potential solutions. Sincerely solicit their input about how to cut costs, transforming them into crucial members of your financial team. In the end, your success will be their success.

During times when operations are humming along smoothly, it is tempting to rest on your laurels. However, this is the perfect opportunity to bring home the importance of making continuous improvements.

Strive every day to get better, and your employees will respond in kind.

Like it or not, operating expenses are unavoidable aspects of doing business, no matter your size or industry. However, once you understand what they are and how they affect your store, you can take strong steps to keep these costs fair and reasonable.

Related Reading

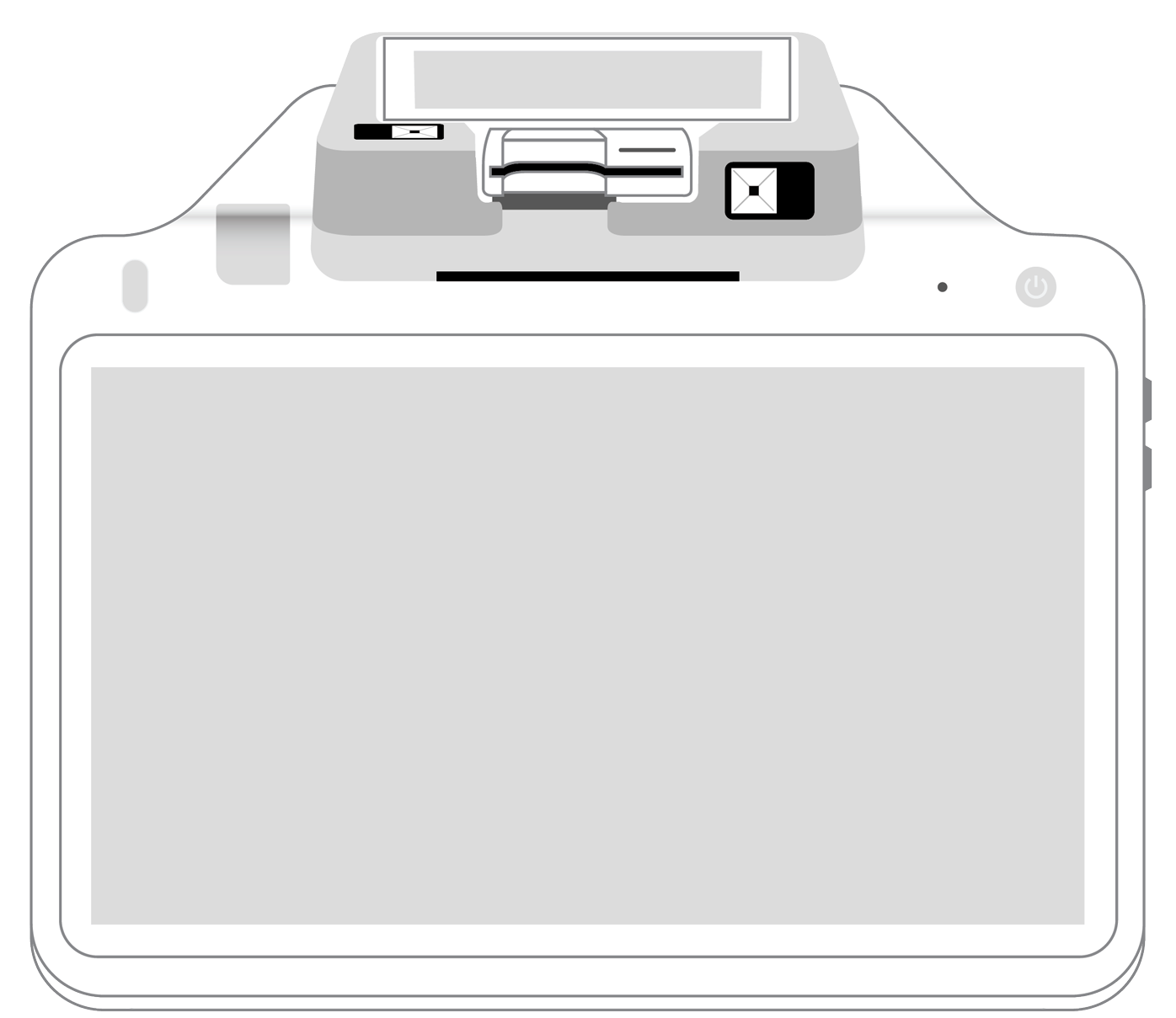

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||