EMV: A New Way of Doing Business

The payment card industry is making a dramatic shift from the standard magnetic-stripe card to the new EMV card that comes equipped with a chip that will be used to authenticate transactions. The major credit card companies called for the switch because the EMV technology protects consumers, and reduces fraud and the costs associated with it.

The payment card industry is making a dramatic shift from the standard magnetic-stripe card to the new EMV card that comes equipped with a chip that will be used to authenticate transactions. The major credit card companies called for the switch because the EMV technology protects consumers, and reduces fraud and the costs associated with it.

So what does a merchant need to know when accepting EMV-chipped cards?

Not as fast as a swipe. EMV cards are processed just like magnetic-stripe cards: reading and transaction verification. But, the EMV transaction will take a bit more time to complete than the typical magnetic stripe. Because they are read a different way, the EMV card needs to be inserted (called card dipping) into the credit card terminal and you need to wait for it to process. When the chip makes a connection, then and only then, can the transfer of information happen and the transaction be completed.

If a customer inserts the card and quickly removes it from the credit card machine, it is more than likely to deny the transaction even if the cardholder has the funds to cover the transaction. Customers will have to understand that this brief inconvenience of a few extra seconds is made up for with the added security an EMV card provides.

Faster than swipe. Card dipping isn’t the only way to process an EMV card. Many EMV terminals will support contactless card reading, commonly know as near field communication (NFC.) Simply stated, NFC allows two devices, the EMV card and terminal in this case, that are placed near each other to exchange bits of data. For this to work, both the card and terminal will have to have an NFC chip. These transactions are considered safe because it creates a unique digital signature.

American Express has put together a comprehensive FAQ section for their users on how to get the most out of their EMV-equipped cards. One of the first questions in the section is “How do I use my chip Card?” Their answer is as follows:

Related Reading

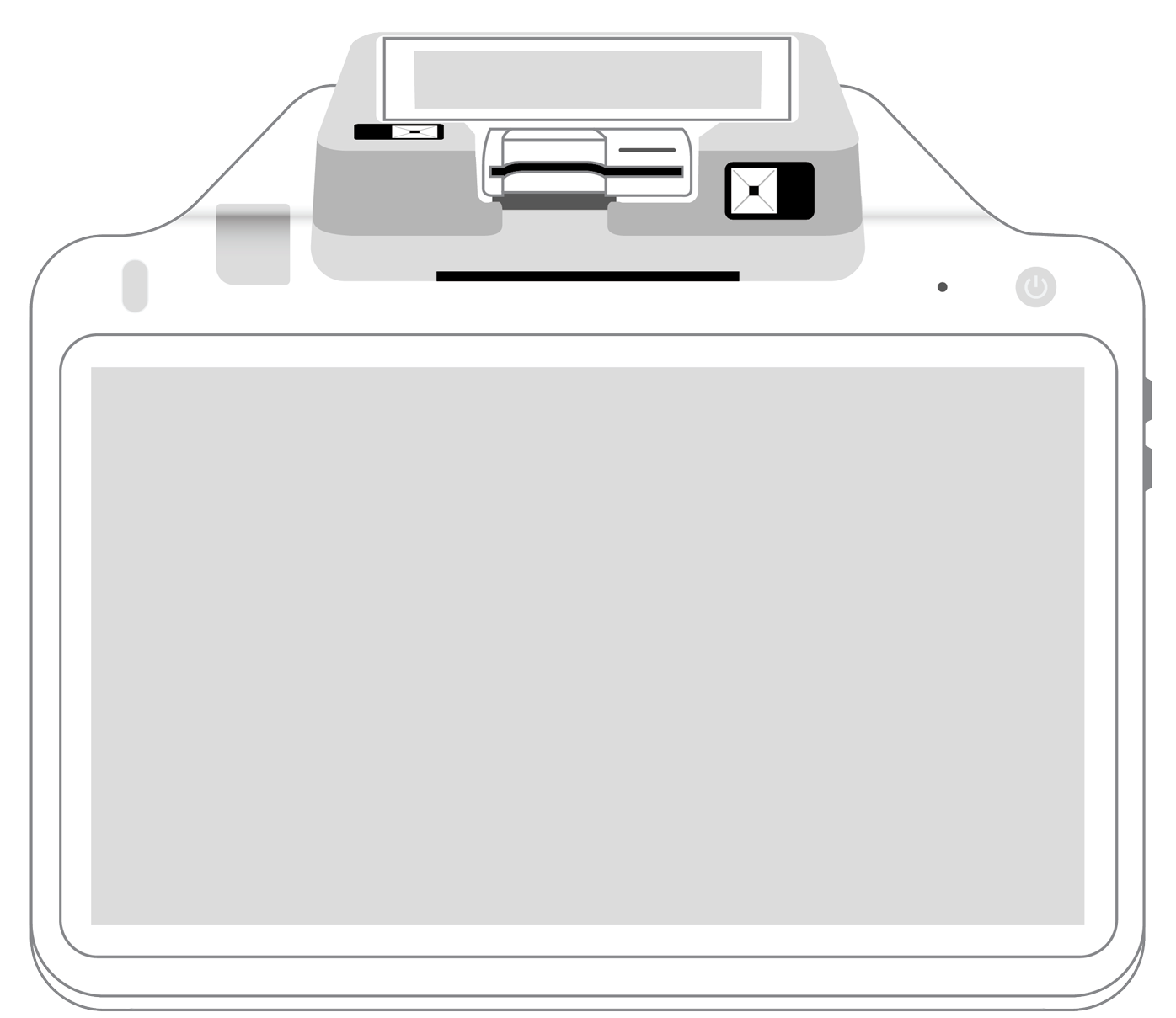

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||