3 tools needed to ready your small business to accept digital payments.

Although cash shows no signs of dying out altogether, it is no longer the most desirable way for customers to pay for goods and services. Regardless of the type of business you own (or if you make your sales at a brick-and-mortar location, online, or a combination of the two) it pays to incorporate digital payments into your business model. Here are the three major tools to focus on to give you and your customers the security and efficiency you’re looking for.

Your point of sale system.

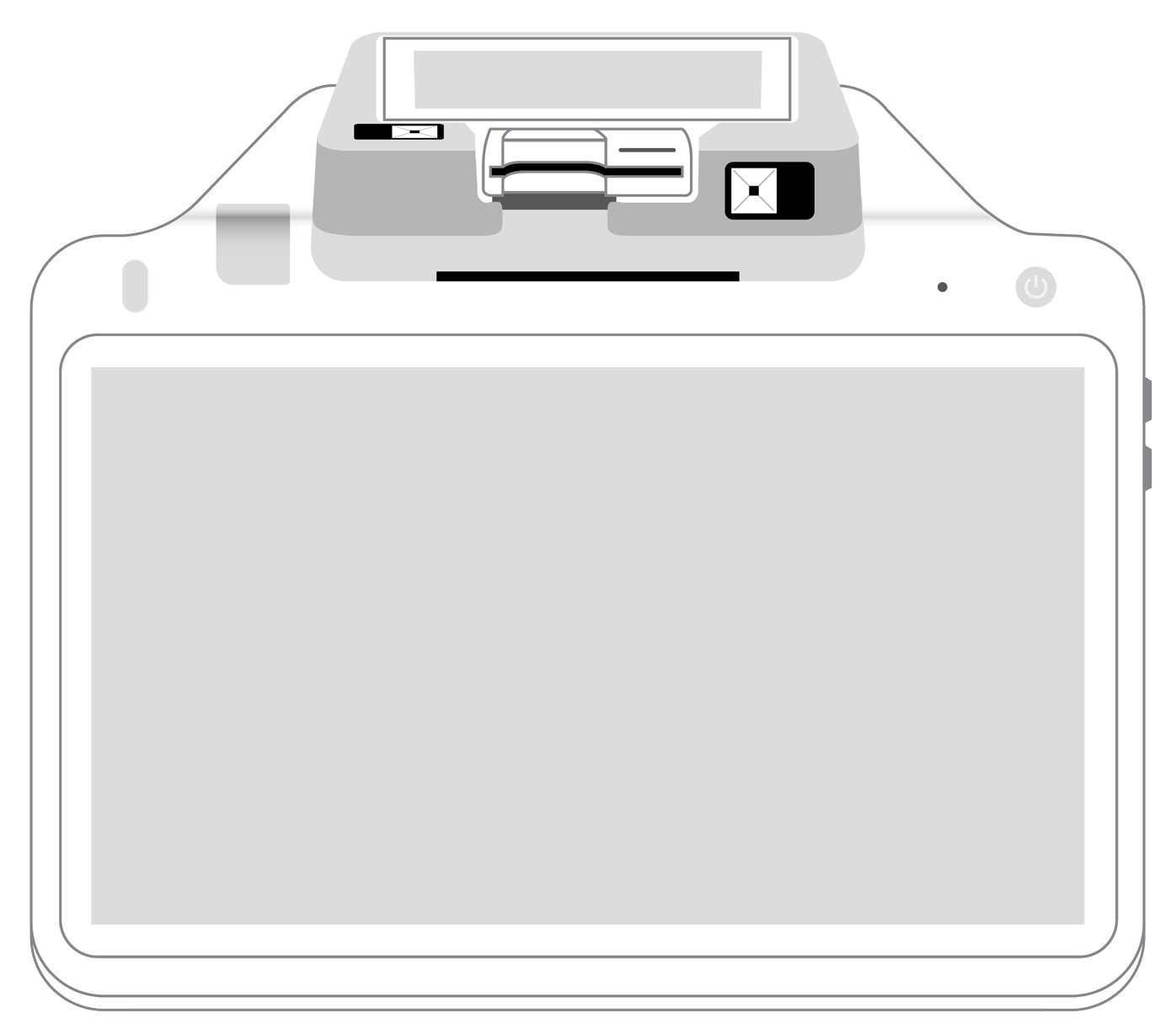

If you are going to accept payments from customers who use plastic debit or credit cards, you will need some type of point of sale (POS) solution. This might come in the form of a dedicated hardware terminal containing the point of sale software. Alternatively, transactions can be conducted through the use of a card reader that connects to a smartphone or tablet.

NFC contactless credit card readers.

As a consumer, you may already use so-called touchless payments to purchase items or services. These can take place either with the help of a credit card embedded with a special chip or through the use of a smartphone equipped with a digital wallet. In either case, as a merchant, you must invest in a reader that contains Near-Field Technology (NFC) to accept digital wallet payments like Apple Pay and Samsung Pay.

Security software.

Whenever you handle customer data in any way, you must take comprehensive steps to ensure that all data will remain protected and safe from hackers. It should go without saying, but make sure that you regularly update all software and install any updated security packages that are released. You’ll also want to conduct periodic research to ensure that the network you use continues to be secure. Train your staff thoroughly on the use of strong passwords, while restricting access to your back office to as few people as possible.

In addition, invest in robust security products. That includes an effective firewall and antivirus protection. Plus, the conducting of regular self-assessments that will evaluate whether you are in compliance with security standards such as those set forth by the Payment Card Industry (PCI compliance).

These days, accepting digital payments is a must for most merchants. If you fail to offer customers the option to make purchases using the methods of their choice, you run the risk of losing them to your competitors. Taking the digital payments plunge with the use of these valuable tools should help to take your operation to the next level.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||