5 Ways Payment Links Can Boost Your Sales and Customer Experience

In these busy times, customers are gravitating toward businesses that offer choice and convenience in all things, including when it comes to how they resolve their invoices.

Payment links explained

Payment links, sometimes called checkout links, provide a direct and uncomplicated route that your customer can use to submit their payment. They are unique URLs made possible through your merchant account provider and created by your business.

When the time comes to collect a payment from a customer, you generate the link through your payment platform or gateway, inputting relevant transaction details. The link can then be sent to the client via your website, email, text message, messaging apps, or social media.

Upon receipt of the link, your customer simply clicks on it and is immediately redirected to a secure payment page.

They choose their preferred payment method, enter their details, and complete the transaction. Confirmation of the successful transaction is then forwarded to both you and the customer.

Payment links sound easy to set up and use, and the good news is that they are as effortless as they appear to be. They also offer a host of other benefits for today’s business owners.

How Payment Links Can Boost Your Sales and Customer Experience

1. Universality

One of the biggest advantages of using payment links is their accessibility. Anyone with an internet connection can send or use this payment vehicle without the intervention of an intermediary.

The result is that you are more likely to receive what you are owed in full and on time, padding your profits. Meanwhile, the customer’s purchasing experience is made fast and secure, increasing satisfaction rates.

2. Convenience

In just a matter of seconds, customers can click on a link, provide their details, and resolve an invoice – from anywhere and on their own time.

This ease of use leads to more completed sales and lower shopping cart abandonment rates for your business.

3. Security

In spite of their fast turnaround and intuitive structure, payment links are designed with security in mind.

In fact, the payment providers and secure gateways that host the links ensure that all sensitive data is shielded from hackers. They do this by means of encryption technologies that mask details and make them only readable by authorized entities.

When customers have peace of mind regarding how their payments are protected throughout processing, they will react positively toward your brand. They may even recommend you to their friends and social contacts.

4. Customizability

Shoppers are now demanding to be given choices throughout their journey with your brand, and that includes their preferred payment methods.

Payment links give you the flexibility that enables you to feature numerous payment types: credit and debit cards, and digital wallet options such as PayPal, Apple Pay, and Google Pay.

Moreover, you can enhance your checkout page with additional product details, discounts, and promotions that further serve to add to the buyer’s experience.

5. Tracking capabilities

Because payment links are digital, they can be tracked in real-time. As a result, you can use them to analyze sales data, reconcile your books, and monitor transactions.

This ability to keep your finger on the pulse of your potential income gives you control over your operations. You can then use the insights gained to detect potential problems before they occur so that you are able to furnish the best possible buying experience to your valued customers.

Payment links are a convenient, flexible, secure, and diversified 21st-century funds transfer method that businesses of all sizes are embracing.

Now that you know the advantages of using payment links, isn’t it time to incorporate them into your business model? When you do, you will be rewarded with revitalized sales and an enhanced customer experience.

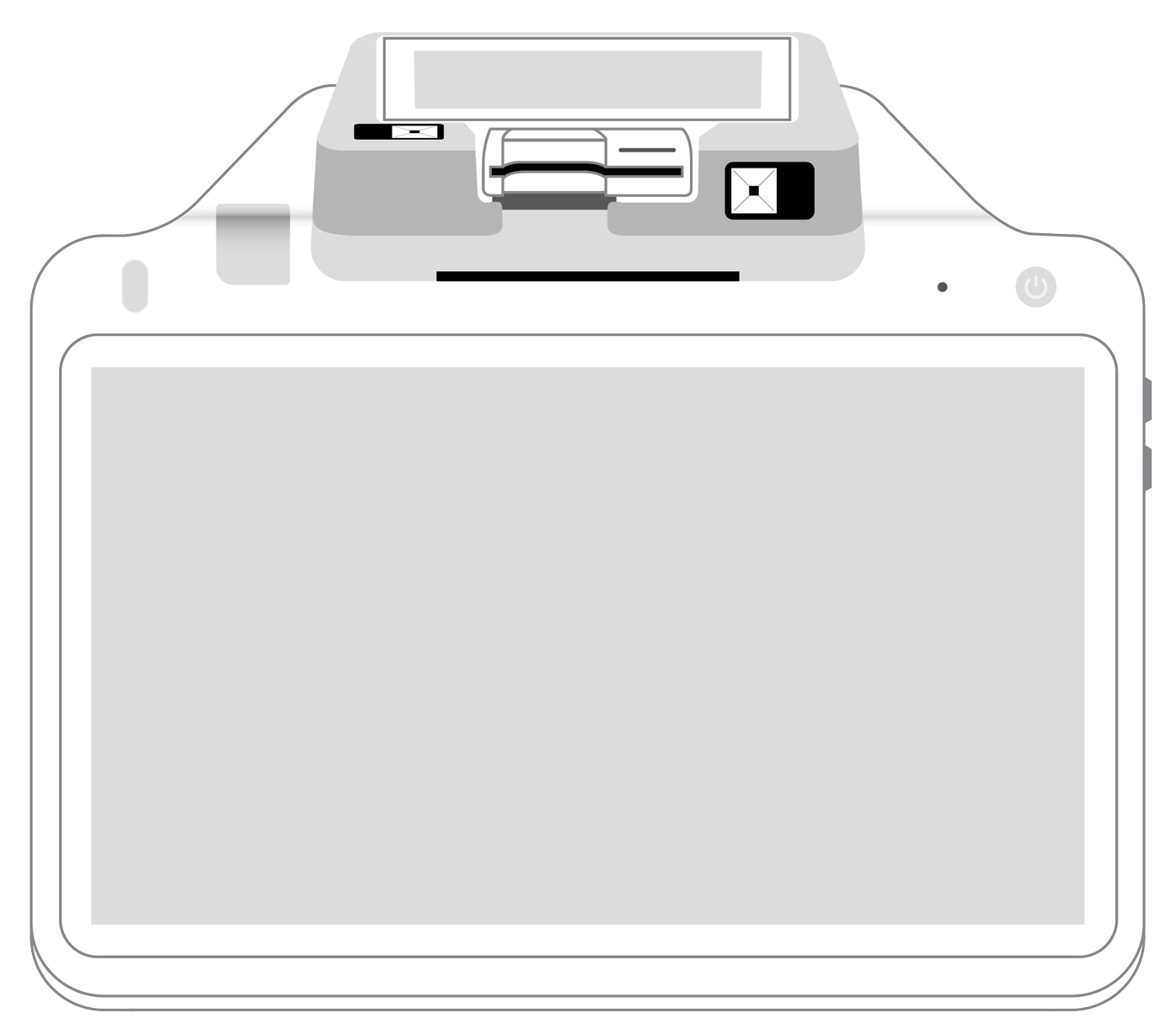

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||