As digital wallets gain in popularity, here's how to stay ahead of the curve.

Walk down any city street, and you will notice that a majority of the people you see are interacting with their smartphones. Getting driving directions, socializing with friends, reading the news, taking selfies, and checking updated weather conditions are just a few of the numerous tasks that their hand-held devices help them to perform. As a business owner, you need to keep up with this trend by integrating digital wallets into your company’s payments processing landscape.

What are digital wallets?

Although the term may sound impossibly futuristic and difficult to understand, digital wallets are already everywhere. Even now, they come built into all modern Android and Apple smartphones, providing shoppers with a safe and seamless way to buy goods and services. Here’s how these deceptively simple virtual wallets work.

First, the user opens the wallet application that is already preloaded onto their phone. They will then be prompted to add the credit or debit card of their choice. In terms of payment options, this will involve inputting card numbers, expiration dates, and security codes, all of which will be encrypted for safekeeping. The wallet app then verifies the data with the financial institution. Once this is accomplished, the card that is safely stored in the digital wallet is ready to be used at the point of sale.

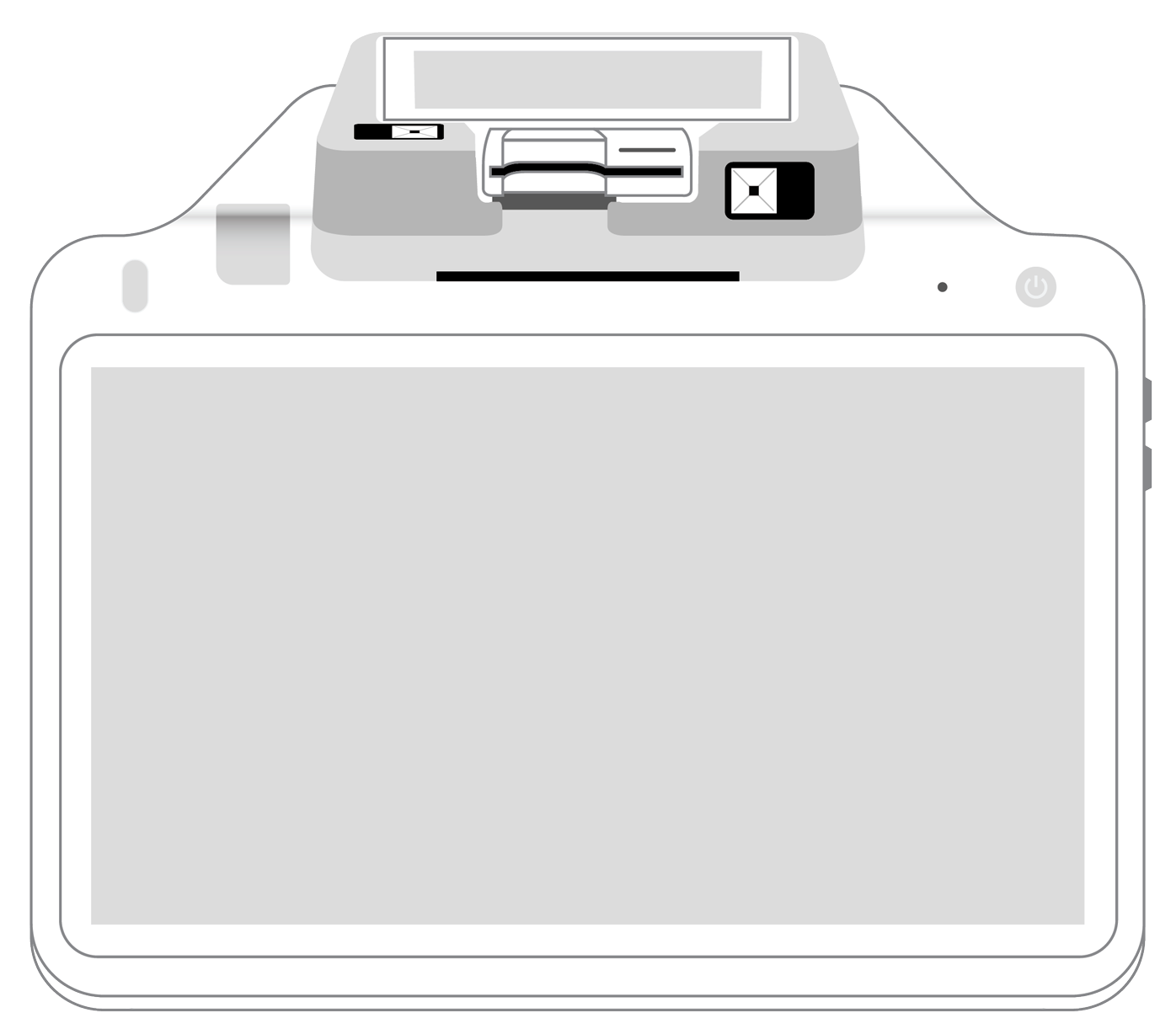

That means shoppers no longer even need to bring plastic cards with them when they leave home. At the register, they simply open their digital wallet and bring their smartphone or wearable device close to the merchant’s special near-field communications (NFC) reader. The two devices are then able to communicate, securely exchanging sensitive payment data and then transmitting the message of whether the transaction is accepted or declined. In total, this complicated process usually takes no more than a few seconds to complete.

Best of all, security is never compromised. That’s because the wallet masks and tokenizes the user’s credit card number and other information before providing it. Because of tokenization, the randomly generated 15- or 16-digit numbers can only be used for that particular transaction and are therefore useless to hackers looking to hijack them to make future purchases. These are just some of the reasons why customers love digital wallets.

The advantages of touchless payments.

In the spring of 2020, the COVID-19 pandemic radically accelerated a trend that had already begun to trickle into the payments landscape. Because shoppers and merchants alike instantaneously became concerned about the need to keep physical contact with surfaces to a minimum, touchless payment methods took on added importance. As it turned out, digital wallet technology was well-positioned to integrate with this emerging need.

That’s because smartphones already come with NFC technology built into their circuitry. Without ever laying a hand on a reader or inserting or swiping a card, payment details can be safely and securely exchanged in a matter of just a few seconds. Even long after the pandemic has been vanquished, it appears quite likely that buyers will continue to expect the enhanced ease and hygiene of contactless payments.

How to optimize the use of digital wallets in your business.

Now that we’ve covered the benefits that smartphone digital wallet payments and a contactless card reader can bring to your retail operations, it’s time to get started. Jump on the bandwagon to harness the power of this innovative and increasingly popular way to buy.

- Simplify your loyalty program. Retailers such as Starbucks have already proven that integrating their customer loyalty program into their company app leads to greater brand allegiance. If you have an app customized for your brand or company, consider ditching those old-fashioned and easily lost loyalty cards in favor of tap-and-go technology. The result will be less frustration at the checkout line and more accurate record-keeping.

- Create an omnichannel shopping experience. By making your branding consistent across all platforms, including the smartphone that contains your customer’s digital wallet, you’ll enhance the shopping experience and increase the likelihood of a purchase.

- Integrate digital wallets and mobile apps. Browsing and shopping with smartphones is another way that patrons are learning about and purchasing your products. Be sure that you not only have an online presence but also that it is optimized for tiny screens. To accomplish this, start by making your content as concise as possible. Remove extraneous images that slow down your webpage’s download speed. Make buttons easy to see and press and, in general, do everything possible to simplify your mobile customer’s shopping experience.

- Incorporate digital wallets into your website’s shopping cart software. Abandonment of a virtual basket of items is one of the biggest hindrances to ecommerce success. Although you can never eliminate this entirely, creating a fast and secure one-click payment experience that includes your customers’ digital wallets can markedly reduce incidences of abandoned carts and lost sales.

- Take advantage of other digital wallet capabilities. Facilitating purchases isn’t all that your customers’ digital wallets can do. They can also notify customers about sales and other promotions, store loyalty points, and let buyers know that one of their coupons is about to expire. Some wallet vendors, including Google and Samsung, also sometimes offer special deals that can translate into more money in your pocket.

- Attract Millennials and Gen-Xers. These demographics are much less likely to carry large amounts of cash with them and frequently have nothing more than their cell phone on them at any given time. As a business owner, you can’t afford to lose the sales that this ever-increasing percentage of potential buyers represents.

The reality is that digital wallets are a safe, secure, and lightning-fast method of payment that is here to stay. So what are you waiting for? Start reaping the rewards that digital wallet payments have to offer!

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||