As restaurant business booms, so do touchless payments.

As 2020 dragged on and the country languished under the pall of the coronavirus pandemic, businesses of all types suffered. None were more devastated, however, than those in the restaurant industry. Now, more than a year later with some of the restrictions having been lifted, eateries of all sizes are experiencing a mass revitalization that encompasses not only the food they serve but also the methods they use to accept customers’ payments.

Lingering effects of the pandemic.

Although deaths in the United States from COVID-19 have dropped precipitously in recent months and some of the municipal, state, and federal safety restrictions are lifting, the virus has not left us. Even once it disappears, some of the trauma and precautions associated with it are likely to remain. One of the most prominent of these is our collective wariness of coming into contact with contaminated surfaces.

In an era when most checkout counters contain the obligatory bottle of hand sanitizer, the shared desire of consumers and merchants alike to remain hygienic continues to be strong. Many businesses have adopted strategies that minimize the contact between buyer and seller, focusing on online purchasing, providing curbside pickup, and offering third-party delivery services. They have also embraced mobile technology to promote safe and easy financial transactions via the use of contactless card readers for restaurants.

Touchless payments defined.

As the name implies, touchless payments allow purchases to be made without the need for any physical touch between buyer or seller. These touchless transactions are accomplished thanks to near-field communication (NFC) technology. This innovative technology can be found in both the card readers modern merchants use to process payments and the chip-enabled credit cards or mobile devices carried by today’s customers. Once in place, this technology facilitates contactless payments that are efficient and frictionless for all.

What is involved in touchless payments?

To make a contactless payment, a customer must either have a “smart” credit card with an embedded chip or a digital wallet connected to their smartphone, smartwatch, or wearable fitness tracker. Security measures within both card and wallet ensure that these details are encrypted and unavailable should theft occur.

At the time of purchase, the customer doesn’t need to rely on carrying large amounts of cash or even producing a plastic credit or debit card. Instead, they can simply pull out their smartphone, open the digital wallet built into it, and place the device three inches or less from the merchant’s touchless card reader. They can then authenticate their identity with a fingerprint or facial ID. Within a matter of two or three seconds, their payment details are seamlessly captured, sent to the payment processor, and verified.

Behind the scenes, the process is lightning-quick yet complex, employing both the previously mentioned NFC technology as well as radio frequency identification (RFID). NFC-enabled credit cards use RFID frequencies to send information to a point of sale (POS) system that features an NFC-equipped card reader. Similarly, the consumer’s NFC-equipped smartphone can easily interface with your contactless POS solution to facilitate safe and fast purchases.

Restaurants in the new touchless world.

Restaurateurs are doing all they can to promote the recovery of their food businesses after one of the most disruptive and difficult years in history. Adopting a contactless approach wherever possible is one of the most effective ways to help wary consumers feel comfortable venturing out to eat with friends and families once again. In this post-COVID age, eatery entrepreneurs are embracing the following technologies.

- Transitioning from re-usable menus to disposable paper or digital ones. This can be accomplished via QR codes that diners can scan with their smartphones or via digital or print signage at each table.

- Digital ordering options. Having guests place orders from their own mobile devices is another way to reduce contact with potentially contaminated surfaces.

- Contactless payments. Precautions should also extend to the checkout process, which can either occur at a traditional register or even at the table. The software built into your Restaurant POS should enable diners to tip their server for a job well done.

- Embracing third-party delivery solutions. Diners have grown accustomed to the convenience of ordering food from their favorite eateries that is then delivered within minutes right to their door by popular services such as Uber Eats, DoorDash, and Grubhub. Customers simply download the third-party service’s app, input their payment information or link it with their digital wallet, and select the restaurant they want to order from. Once the customer chooses from your delectable menu items, you’ll be notified, prepare the order, and place it in the hands of one of the company’s drivers for immediate delivery. Although this process can represent a hefty cost to the eateries involved, it removes the need to hire dedicated delivery staff. Furthermore, many owners have found that, as expensive as it is, delivery has become an increasingly important contributor to their bottom line.

In the big picture, this contactless environment makes for enhanced safety, efficiency, and security while offering more convenience and choice to diners.

The benefits of contactless card readers for restaurants.

Even at the best of times, running a café or diner often involves razor-thin profit margins. As we slowly recover from the devastation of the pandemic, the need for frugality could not be more pressing. Why then should a restaurateur like you take on the added expense of changing over your systems to allow for contactless payments? Let’s take a look at just some of the advantages.

- Greater security. Once people begin to pay touchless, they will no longer need to hand over a credit card, enter a PIN, or sign a receipt. Instead, the NFC-equipped devices are adept at encrypting and tokenizing the sensitive payment information, ensuring that it will not be compromised by hackers.

- Faster transactions. Although capacity limitations may have been lifted in your area, you still want to do all you can to avoid pile-ups in the front area of your establishment that could make people feel claustrophobic or uncomfortable. Besides, increasing table turns and minimizing checkout lines can assist you in successfully serving more customers each day.

- The potential for increased spending. Believe it or not, consumers tend to spend more when they use contactless payments than when they pay with cash or plastic. Because of how fast and easy contactless transactions are, consumers may harbor less guilt about paying for goods and services in this way and are thus more likely to make spontaneous purchases.

- Ease of implementation. Although many business owners fear that setting up contactless payments will be overwhelming and expensive, this could not be further from the truth. In reality, all that is needed is a payment terminal from a processor that accepts mobile wallet and other contactless payments. The most important task of any restaurateur interested in contactless payments is to take time to research the various processing companies, focusing on the rates and fees that each charge. Although some of these are non-negotiable, many others are up for discussion. Best of all, most solutions can integrate seamlessly with other business systems that are already in place in your restaurant(s).

- Processing fees are low. When every penny counts, it can make a positive impact on a restaurant’s bottom line when payments are made touchless. That’s because they carry lower processing fees than their manually entered counterparts since fraud rates are lower with these more secure forms of payment.

- Customers are more comfortable than ever with contactless payments. Thanks to the pandemic, many people’s hesitancy about checking out using this method has been overcome. In this post-pandemic age, most buyers appreciate the fact that restaurants are offering this as a choice.

- Adding a tip is possible using the following steps: the server or employee sanitizes the payment terminal, placing it near the guest. The guest then reviews and confirms the payment total that has been entered automatically or by the staff member, enters their tip amount, confirms it, and taps their card or mobile device.

In the end, contactless payments provide your guests with a greater feeling of control and safety as a result of the peace of mind that no one else is handling or potentially contaminating their credit card or mobile device.

Providing excellent food and a welcoming ambiance are essential to your success as a restaurant owner, but you need to do even more in this post-pandemic world. Offering your customers the option to make contactless payments demonstrates your commitment to their health and safety. Doing so also helps to put you ahead of the curve when it comes to competing with other establishments in your area. Since providing excellent service in the cleanest and safest environment possible should be one of your highest priorities, accepting contactless payments is a step you should seriously consider taking.

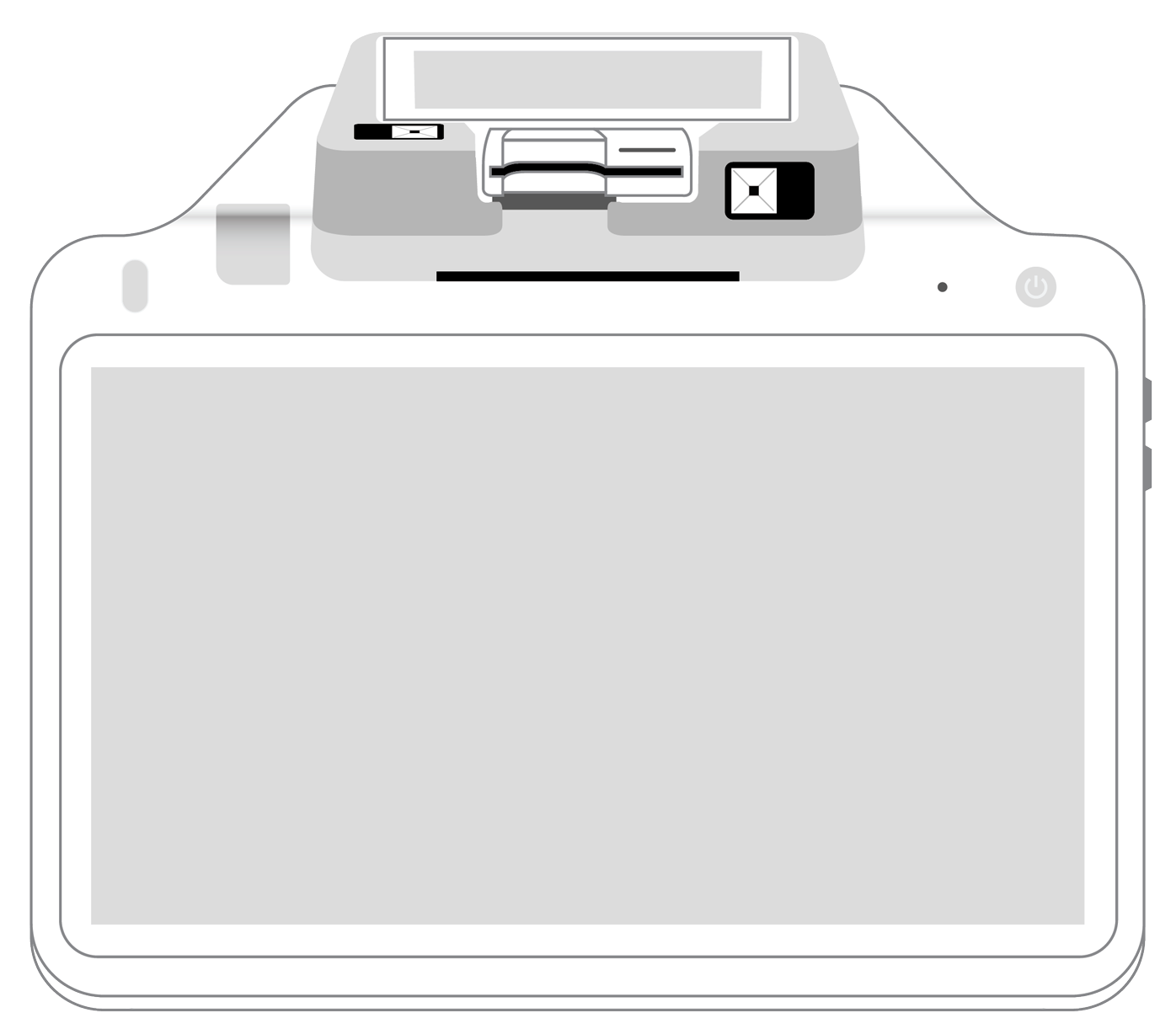

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||