Business on the go? Here's your guide to contactless mobile payments.

In our increasingly busy and tech-oriented world, the idea of carrying cash or credit cards is becoming more and more outdated. Instead, contactless mobile payments are supplanting other payment methods for modern consumers. As a small business owner in this climate, you cannot afford to be left behind.

What are mobile payments?

In general, mobile payments are those made using a phone, tablet, wearable device, or even a “smart” credit card that has a special chip embedded into it. These carryable or wearable devices feature a wallet app they can pre-load with their payment information. That sensitive data is stored securely in the wallet until it is needed. At that point, the shopper simply places the device near the merchant’s stationary or portable card reader. Within just a few seconds, their identity is verified, and the funds securely flow from their account to the payment processor and ultimately, your merchant bank account.

Why you should accept them.

Particularly in these difficult economic times, it is tempting for business owners to stick with what they know. However, customers are embracing mobile payments more and more with every passing year. Add to that the current emphasis on contactless innovations to improve convenience and promote safety, and the reasons to accept these types of payments are even more compelling. Below are just a few of the most convincing.

• Boost sales. It stands to reason that if you let people buy your items with their preferred payment method, they will be more likely to make bigger and more frequent purchases. While you likely won’t want to eliminate cash, checks, and traditional magstripe cards altogether, offering mobile payments and contactless checkout options may pull in a segment of buyers who would otherwise shop elsewhere.

• Heighten and streamline the customer experience. When checkout moves quickly and without hiccups, consumers appreciate the efficiency. Instead of their last memory of shopping in your store being of waiting in an endless line while fellow shoppers fumbled for nickels and dimes or the right credit card, they will recall a fast and frictionless checkout with customers simply waving watches or phones near your NFC-enabled reader, taking their purchases, and going happily about their days.

• Free up staff. When lines flow faster, you may not need as many cashiers. Instead, you can send them to other parts of the store where help is needed, thus providing an even more positive experience for customers and employees alike.

• Accept payments affordably. The ability to accept mobile payments (including NFC contactless ones) could be built into the hardware and software that you already have in place. If not, you may need a new payments partner.

With these thoughts in mind, you might be ready to do some more in-depth exploration into the mobile payments universe.

Considerations when picking a mobile payments provider.

With the booming popularity of mobile payments, it’s no wonder that the market is saturated with options. Opting for a provider based solely on their low costs could leave you with inferior or ill-suited solutions. Not to mention, substandard customer care and technical support that will not serve your business well in the long run. For that reason, ask the questions below as you go through the mobile payments provider decision-making process.

• Do you already have a merchant account? (This is where the money from your mobile payments will be sent. If you don’t, take some time to look at your many options.)

• Do you have repeat customers who pay with the same method? If so, make sure your processor lets you associate payments with each customer.

• What types of flexibility do you require? For instance, do you plan to process all payments via a portable card reader attached to a mobile device, or do you have a physical store as well? Do you want to be able to take payments from anywhere using any computer?

• Does the mobile POS provider allow you to send invoices to customers via email, as well as to generate sales and inventory reports?

• Does your mobile payments software sync seamlessly with other systems and software, particularly those for payroll and accounting?

• Can the potential vendor demonstrate that they are PCI compliant for secure transactions and safe data storage?

• How long does it take for deposits to be forwarded to your account?

• Is their pricing affordable and transparent?

While these inquiries may seem time-consuming and difficult to investigate, arriving at satisfactory answers will help you find the right partner for your business. It will also help you meet your business goals both now and in the future.

Like it or not, smartphones are here to stay and more and more customers are taking advantage of the convenience and security that paying with them affords. For you as a business owner, providing maximum flexibility and safety to your valued shoppers should be one of your highest priorities. Whether your store is located in a physical building, online, or a combination of both, adding mobile payments to your payment offerings is a move that everyone will appreciate in the long run.

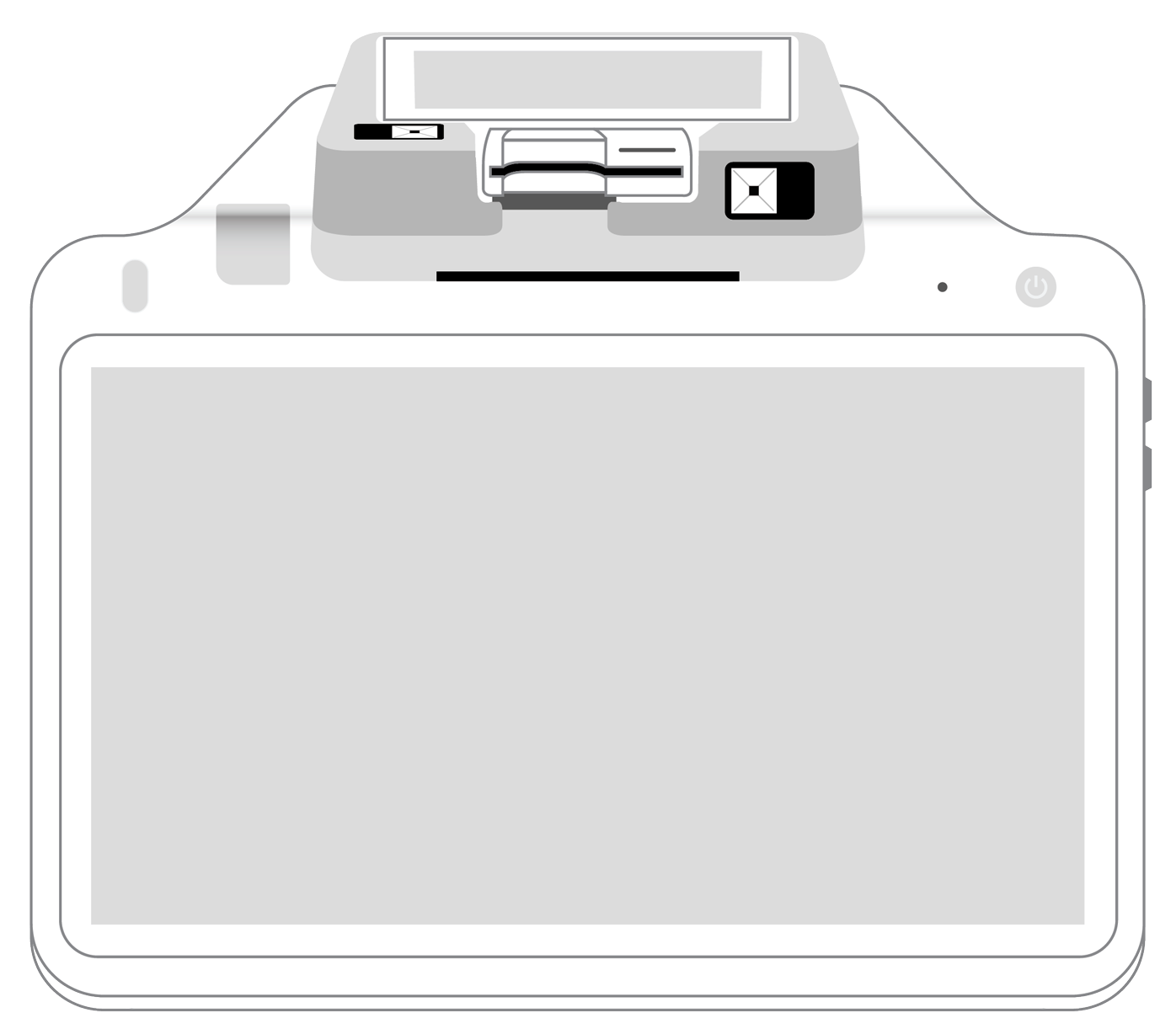

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||