Confused about POS credit card processing? Here’s what you need to know...

Why is there so much hype about point of sale (POS) systems? Simply accepting credit cards has great benefits when it comes to expanding your customer base, but a POS solution goes beyond payment processing and puts the power to manage your entire business at your fingertips.

More than a terminal.

Credit card terminals allow you to process payments from credit cards, debit cards, and mobile wallets, but the functionality pretty much stops there. This might be enough if you’re just starting out or don’t have a complex business model, but if you want something designed for scalability and to offer more as you grow, you’re better off with a POS system.

In addition to processing payments, today’s comprehensive POS systems allow you to:

- Print, email, or text receipts.

- Collect and analyze customer data.

- Create and maintain loyalty programs.

- Track and manage inventory.

- Manage employees.

- Unify online and offline shopping experiences.

Platforms may be tailored to specific industries and may even offer additional features, such as self-service options for placing orders or checking in.

Works anywhere.

Using a POS provides flexibility in where you can accept payments. Customers can bring items to a traditional checkout counter or complete their purchases elsewhere in the store by checking out through an employee’s mobile device. Restaurants seeking to adopt a pay-at-table model can take advantage of this feature to offer easier payment options to customers and increase table turnover. Mobility allows you to take your POS solution offsite as well, which helps maintain continuity in your records and takes some of the hassles out of keeping the books balanced.

Brings everything together.

Traditional credit card processing options require a terminal, a merchant account, and a payment processor, but you can bypass this complex chain by opting for a point-of-sale system from a provider offering all three – in one package. You simply pay a monthly fee for the software and a standard per-transaction fee to a single provider in exchange for payment processing services and all the extra features available in the POS system. These integrated solutions take a streamlined approach to simplify payments for you and your customers.

Secures payment data.

Any POS solution worth using must employ reliable security measures. PCI compliance is mandatory if you’re accepting credit card payments, but you should also look for a system with end-to-end encryption. Also called point-to-point encryption (P2PE), this security feature protects card data from the moment it enters the system and during transmission until it reaches the intended recipient. No card information is ever stored in the POS system itself, which prevents hackers from stealing large amounts of customer data. Even if encrypted data is intercepted, it can’t be decrypted without the proper key.

With a point-of-sale system in place, you’ll be equipped to not only accept multiple payment types, you’ll also be positioned to leverage additional features to grow your business. Check out the features available in your price range and choose the most robust solution for fast and efficient payments.

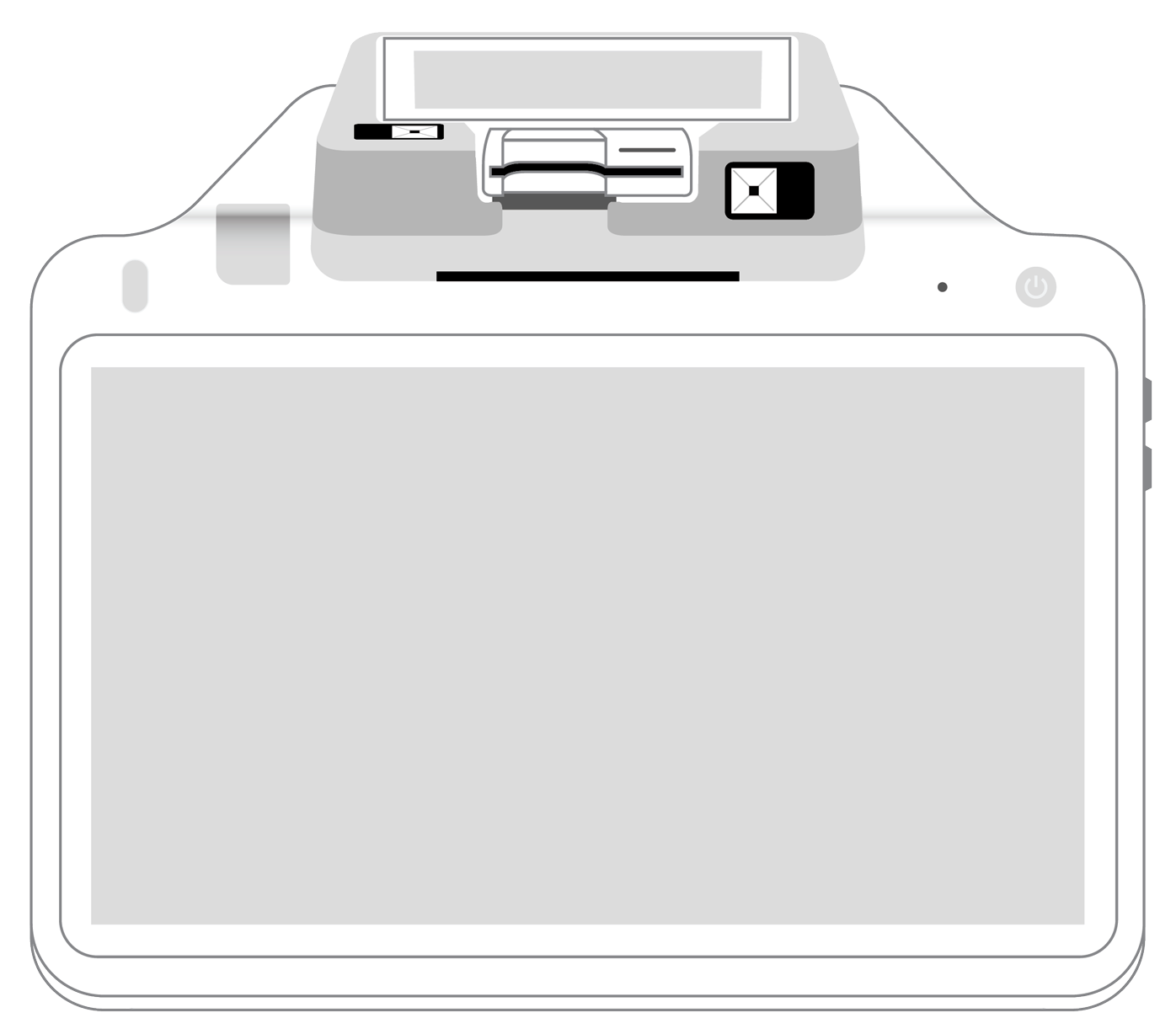

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||