Getting the right credit card reader for your business (2020 guide).

Plenty of companies offer credit card readers, but how do you choose the best one for your business? You’ll want a device with features that give your customers a fast, flexible, and frictionless payment experience. Use these four questions to guide your search.

Countertop, mobile or POS system?

To start, consider your current business model, as well as your plans for growth. Many businesses do well with basic countertop or wireless credit card terminals. These terminals offer simple, straightforward payment processing and come with options like customer facing stands and receipt printing.

A mobile credit card reader is a more modern alternative. Available for both smartphones and tablets, mobile readers allow you to process credit cards anywhere.

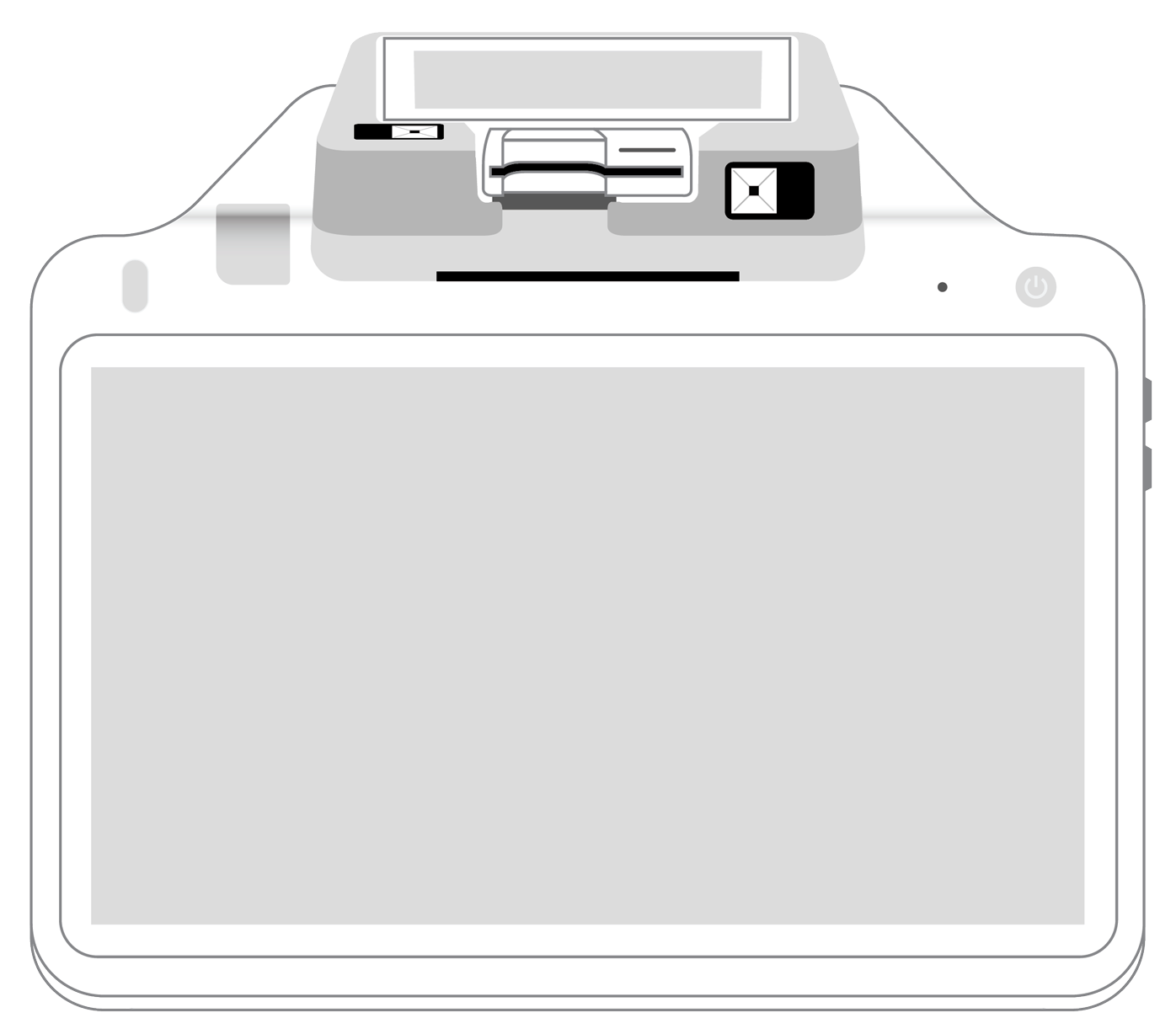

Full-featured point of sale systems offer the most flexibility for you and your customers. A POS system may be as basic as a tablet mounted on a stand with a card reader attached, or it may include a monitor, cash drawer, receipt printer, barcode scanner, and business software. This setup is preferable if you run a well-established business and have to manage inventory and employees in addition to processing payments.

How many payment options?

At the very least, a credit card reader should allow you to accept magnetic stripe and EMV chip cards. Most consumers prefer these payment methods, but a growing number are also opting to use NFC contactless payments like mobile wallets. If you cater to a younger audience, it’s worthwhile to invest in a card reader equipped to take multiple payment types.

What are the fees?

You need to consider more than just the price of the hardware when comparing credit card processing options. In addition to what you’ll spend on the card reader itself, there are also fees for each transaction. Some companies charge monthly use fees, and if the solution includes software, you may have to pay both a monthly fee and individual transaction fees. Compare these fees based on the number of card readers or checkout stations you need.

Are the features adequate?

Very small businesses can manage payments with a simple card reader connected to a merchant account. However, such a setup can be difficult to scale in response to growth. Consider whether you need software to integrate your reader with other business systems, such as accounting software and inventory management, and look for a solution with the appropriate features.

A reliable credit card reader enables you to offer diverse payment options and a better checkout experience to every customer. When a solution has the right features and integration tools to support your business model, you can start processing credit cards with speed and ease!

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||