Here’s how to use customer payment plans to improve sales.

Are you looking for a way to attract more customers and improve sales? Try payment plans. Eighty-four percent of consumers prefer the flexibility of paying in installments. Offering to break up the price of large orders into smaller installments can actually prompt people to buy more.

The best news is that setting up customer payment plans is easy! Get started with this quick four-question guide.

What are the benefits of payment plans?

Customers are wary of high prices. Most people are looking for bargains, and it’s easier to sell big-ticket items or expensive services if you can somehow sweeten the deal. Offering a payment plan may be just the thing to ease any possible sticker shock.

With payment plans, more customers are able to afford products or services they’d pass up on purchasing otherwise. Instead of needing to have all the money upfront, they can enjoy their purchases while paying in smaller amounts over time. Selling this way can expand your audience to include people with lower budgets and those who prefer not to spend a lot of money all at once.

How can customers pay with installments?

You’re in control of how your installment plans work. If you’re selling services, you may choose to ask for a percentage of the total price as a down payment and let customers pay off the rest in increments. To sell products, you can either take a percentage upfront and split the remainder into payments or divide the total cost of the product into a series of equal payments.

No matter what structure you use, be clear about your policy. Give customers a full list of payment amounts, and let them know in intelligible terms what the payment schedule will be.

How much does a customer payment plan cost?

You should be able to set up a payment plan for customers using the payment processing software you already have. Most popular platforms include monthly or recurring payment options. You choose the amount and the interval and enter your customer’s payment information. There’s no need to manage invoices for every payment; collection occurs automatically on the due date.

Are payments guaranteed?

Unfortunately, you can’t be sure you’ll get all the money for products or services purchased with installment plans. Customers may run into unexpected financial trouble. Some may simply stop paying, even if you use software to manage invoices. In either case, you have to decide whether to pursue collection or just let it go.

Missed payments can also be a problem if a customer gets a new credit card and forgets to update his or her information. This causes automatic payment collection to fail, which affects cash flow until the problem is fixed.

Give payment plans a try to see if the format helps sales and boosts profits. Pay attention to customer feedback, and monitor your cash flow. You know you’ve found a good addition to your payment options if you start selling more and customers seem satisfied with your payment plan.

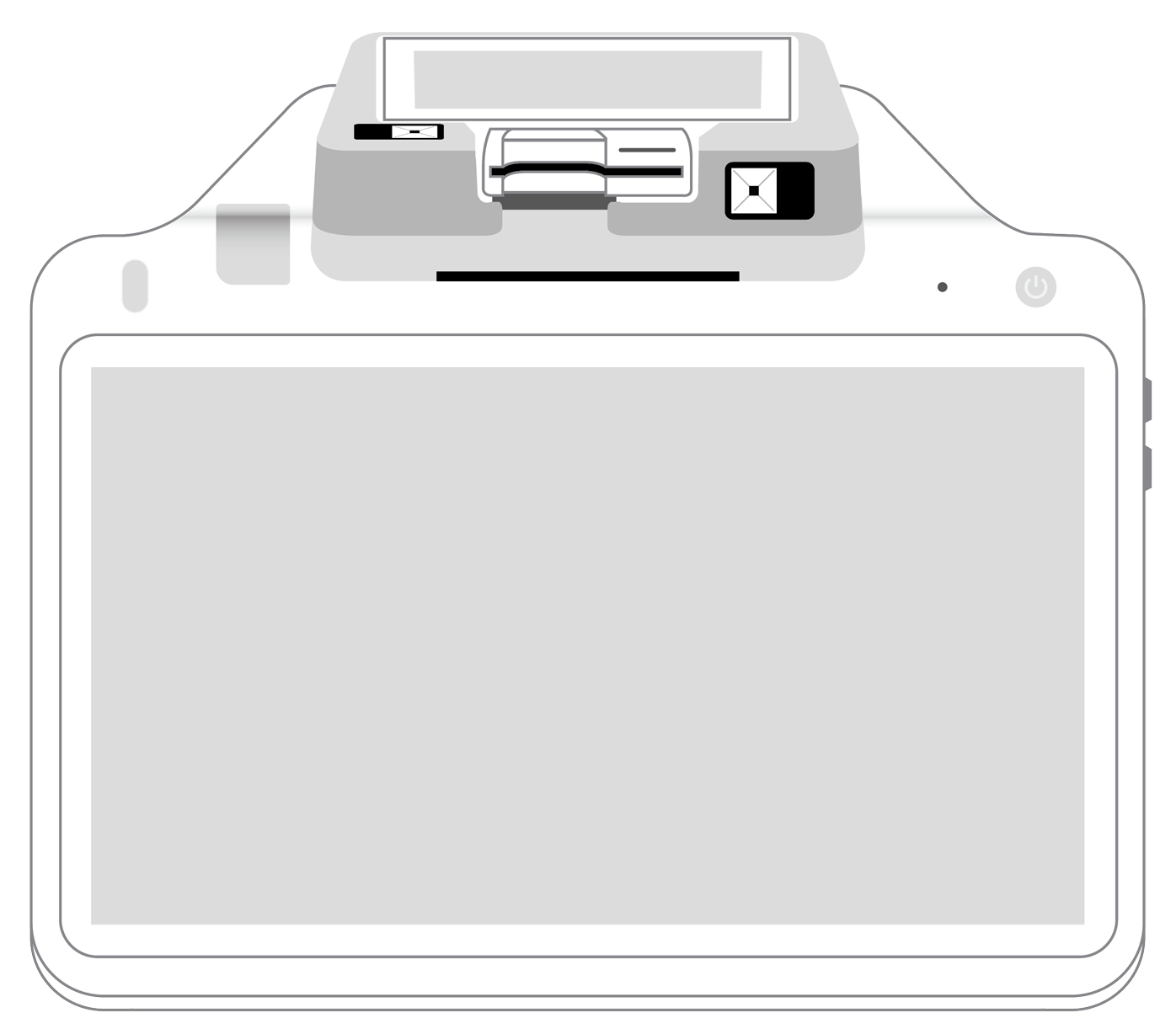

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||