How consumers and merchants have adapted tap to pay as part of their daily business.

The need for proper social distancing during the coronavirus pandemic has resulted in numerous transformational changes in the lives of consumers and sellers around the globe. In addition to changing the ways that people obtained their products and how far apart from each other they stood in the checkout line at the grocery store, COVID-19 has modified, perhaps forever, how people pay. Notably, many who had never used or even heard of a tap to pay card reader were suddenly using them on a daily basis.

Benefits for consumers.

Particularly in the initial weeks of the pandemic when little was known about the transmission of the coronavirus, fear ran high. As a result, shoppers were reluctant to come into physical contact with surfaces, including cash and credit card readers. Fortunately, touchless payment technology had already been developed and was being used by early adopters. Safety-conscious buyers quickly embraced this technology as the perfect solution as well.

This innovation utilizes near-frequency communication (NFC) technology that wirelessly connects a customer’s contactless credit card or smartphone to the merchant’s contactless credit card reader. Securely and within a matter of seconds, the payment information pre-stored in the buyer’s digital wallet or on the card is encrypted, tokenized, and transmitted to the processing company for verification. The entire process could not be more seamless or safe.

Shoppers also benefit due to touchless payments’ efficiency. Checkout lines are much shorter since fewer customers are fumbling for bills and coins. Receipts can be emailed, further decreasing time at the register.

Benefits for sellers.

Merchants have also realized the upsides of NFC contactless payments, particularly in relation to their efficiency. Now that queues at the register move faster, fewer customers are irritable, making for a much more peaceful shift at the register for cashiers.

Along these same lines, enhanced checkout efficiency provides management with a greater degree of flexibility when it comes to assigning tasks. Team members who once spent their entire day stuck behind the counter may now be freed up to take on different and potentially more challenging and enjoyable responsibilities. Ultimately, this may lead to greater job satisfaction and enhanced staff retention.

Touchless payments may also offer greater versatility as businesses begin to emerge from the effects of the pandemic. The same mobile POS readers that employees are carrying to the curb to facilitate customer payments may also be taken on the road to venues such as fairs, farmers markets, food trucks, and trade shows. In many respects, contactless payments are helping merchants to realize that neither they nor their staff need to be tied to the checkout counter to accept payments.

The global pandemic devastated economies and shattered lives. It also inspired pivotal changes in the ways that people live, work, shop, and socialize. While the virus led to terrible fear and disruption, it also spawned an accompanying sense of transformation and innovation that have forever altered the business landscape. In the case of contactless payments, this sea change may actually turn out to be for the better.

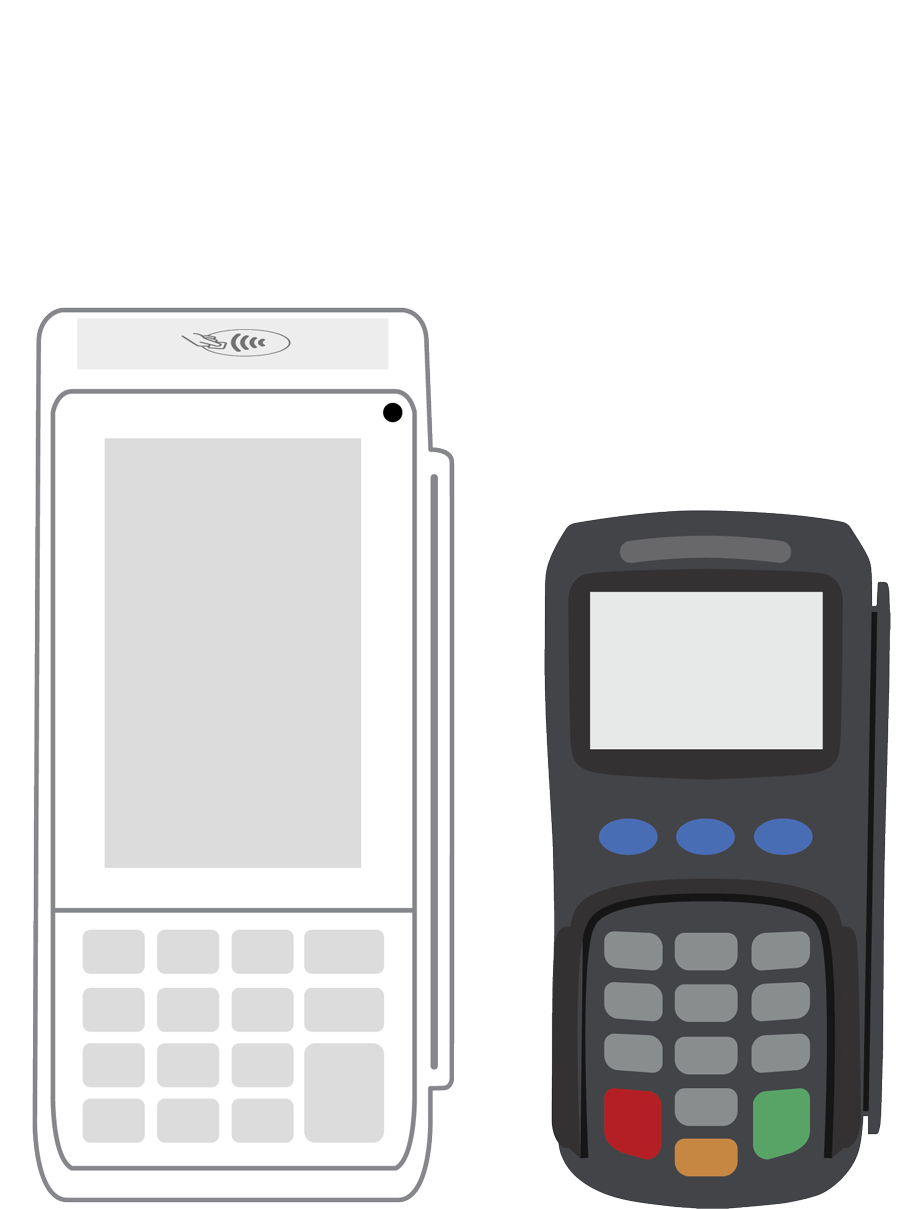

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||