How Credit Card Processing Simplifies Fee Collection for Early Education Centers

Providing care and enriching content for every preschooler at your early education center is your highest priority. But did you know that it is equally important that payments are collected efficiently, ensuring that your facility has the resources it needs to function?

Today’s automated credit card processing transforms clunky, old-school cash and checks into streamlined transactions that shore up your center, while satisfying families.

Recurring payments

Your daycare POS system contains childcare management software that makes it possible to schedule regular withdrawals from a family’s credit card or bank account. These weekly or monthly deductions let you receive what you are owed on a predictable basis, allowing for optimized cash flow and budgeting.

Families also see the advantages because they never need to worry about remembering to pay and can avoid those long billing lines at pick-up time.

Lighter workload

If your center is like most, all of your staff members juggle multiple tasks. Adding credit card processing and other automated features puts much of the manual labor into the capable virtual hands of your daycare management software.

While the program handles jobs like invoice generation and streamlined payment reconciliation, your employees can focus on the many duties that require their special human touch.

Convenience

No one enjoys standing in a long line to resolve a bill, whether at a supermarket or a daycare center. Digital processing enables caregivers to settle their invoices from anywhere using their smartphone or desktop computer. Even more appealing to many are the rewards that they can accrue when they pay using their premium credit cards.

Enhanced security

Your merchant account for early education centers providers can set you up with an integrated payment processing system equipped with cutting-edge security measures. It uses anti-fraud tools and technology such as encryption and tokenization to mask customers’ payment details, rendering them useless to hackers. This results in greater trust toward your center while furnishing added layers of protection for your business.

Streamlined record-keeping

When a parent makes a payment with their credit card, it is immediately registered and recorded by your software. A record is created that can be referred to for auditing purposes or by your accounting staff whenever they need a picture of your transactions and outstanding balances. This clarity leads to intelligent budgeting as well as providing an accurate view of your past fiscal history.

Collecting fees from families is a necessary reality for your early education center. Instituting streamlined digital payments takes much of the drudgery and potential for errors out of the process. The result is a lighter administrative burden, more accurate records, and happier families.

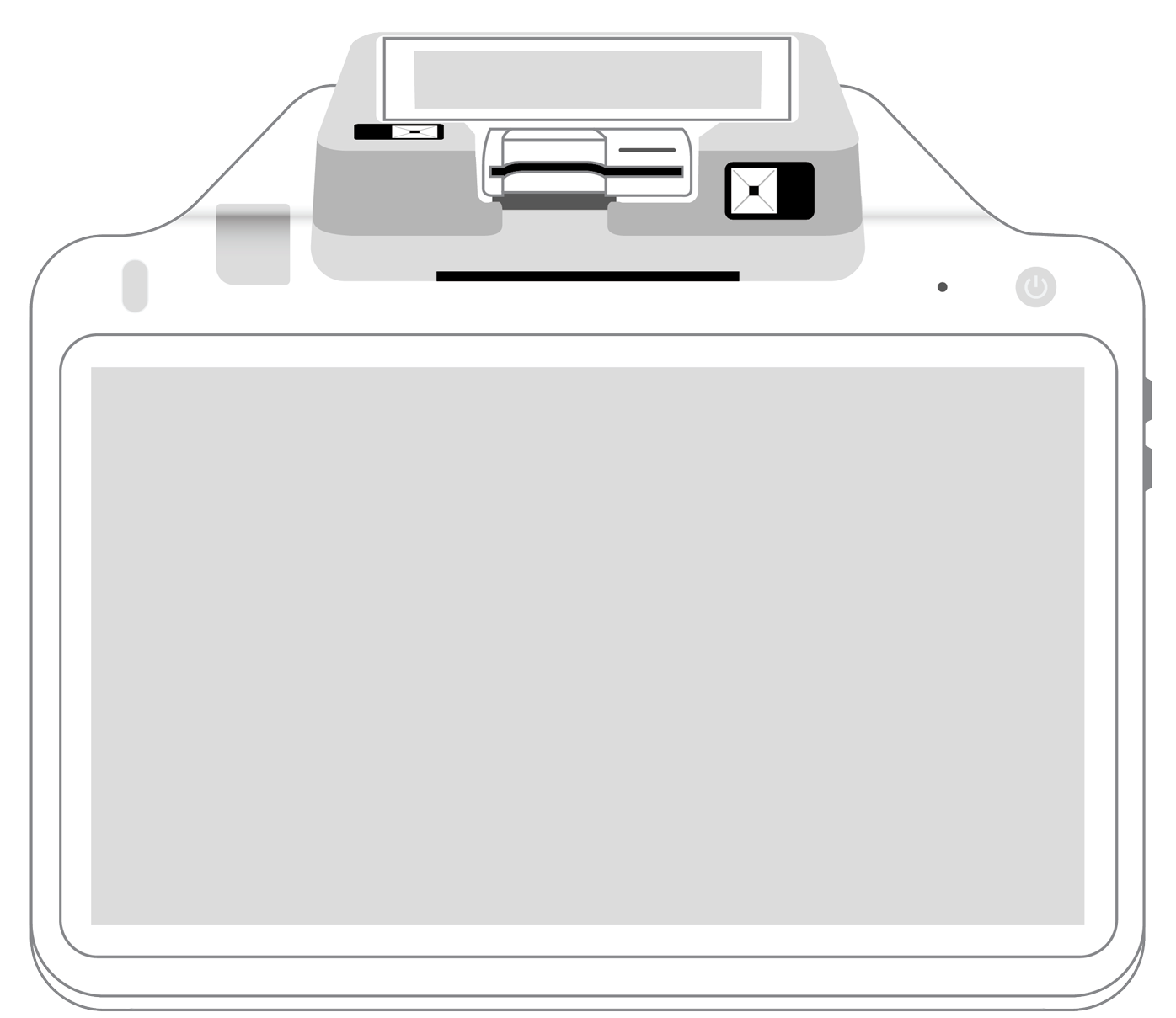

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||