How Credit Card Processing Fees Impact Shopping Habits

Whether you’re accepting customer payments with mobile credit card readers or traditional fixed terminals, one fact remains the same: A fee is charged every time a shopper makes a non-cash purchase.

From influencing product pricing to determining which payment methods are accepted, these fees often shape the overall customer experience.

As businesses look for ways to offset these costs, shoppers may face surcharges, limited payment options, or incentives to use alternative methods.

Understanding how these fees work sheds light on subtle factors that can influence where and how people choose to shop.

Credit card processing fees explained

Credit card processing fees are charges imposed on merchants every time a credit or debit card transaction is made.

These fees are usually a combination of interchange fees (paid to the card-issuing bank), assessment fees (paid to the card network), and processor fees (paid to the payment processor).

Typically, these charges average just over 2% of a credit card transaction amount. However, they can be over 4% in some cases.

There are a few variables that go into how card networks determine what the merchant will be charged. They include elements such as the type of card (credit or debit), the transaction method (swipe, chip, or online), the merchant’s industry, and the transaction amount.

Sellers frequently pass these expenses down to their customers, making swipe fees a potential game-changer for everyone involved in the commercial marketplace.

Why fees matter to shoppers

Though consumers don’t pay processing fees directly, the way businesses handle these costs can subtly shape shopping experiences.

Price increases

Many merchants build processing fees into their product pricing. This means shoppers may be paying slightly more for goods and services than they would if the business operated on a cash-only basis.

For budget-conscious consumers, these small increases can add up over time, especially with frequent purchases.

Cash discounts and credit surcharges

To combat rising fee costs, some businesses offer a cash discount or impose a credit card surcharge, charging extra for card payments.

These tactics are increasingly common, especially in service-based industries and small businesses.

As a result, savvy shoppers may be incentivized to switch to cash or debit to avoid added fees, which influences both how and where they choose to shop.

Minimum purchase requirements

In order to make credit card processing fees worth the cost, some merchants set a minimum purchase amount (e.g., $5 or $10) for credit card use.

This can impact impulse buying and frustrate customers who prefer using cards for smaller purchases. In many cases, shoppers may choose to add extra items to reach the minimum or abandon the transaction altogether.

Shaping payment preferences

The way a business handles processing fees can influence a customer’s preferred payment method over time. For example, stores offering discounts for cash payments or loyalty rewards for debit use may encourage consumers to rethink their automatic use of credit cards.

Additionally, if shoppers regularly encounter card surcharges, they may be more inclined to use digital wallets, bank transfers, or even emerging payment methods like “Buy Now, Pay Later” services.

The increasing popularity of mobile wallets and contactless payments also adds a new dimension to shopper preferences. While these tools are convenient, they still often come with processing costs on the merchant's end, meaning businesses must weigh convenience against profitability.

Impact on brand perception

Not surprisingly, the way a business manages its credit card processing strategy can affect how it’s perceived by its customers.

If shoppers feel they’re being penalized for using a card, it can create a negative impression. Transparency about fees, such as clearly stating surcharges or offering incentives for lower-cost payment methods, can help maintain trust and loyalty.

On the flip side, businesses that absorb fees without passing them on may be seen as offering better customer service, but they’ll often need to compensate with higher overall prices.

It’s a balancing act that plays out behind the scenes but affects every shopper at checkout.

The future of shopping

As payment technologies evolve, consumer habits are likely to continue shifting.

People may grow more selective about where they shop, opt for lower-cost payment methods, or gravitate toward businesses that are transparent about fees and offer more payment flexibility.

For merchants, this trend underscores the importance of understanding the true cost of credit card processing and being strategic about how to manage them, without alienating customers.

Offering multiple payment options, communicating clearly about surcharges, and even incentivizing fee-friendly choices can all help bridge the gap between business needs and customer expectations.

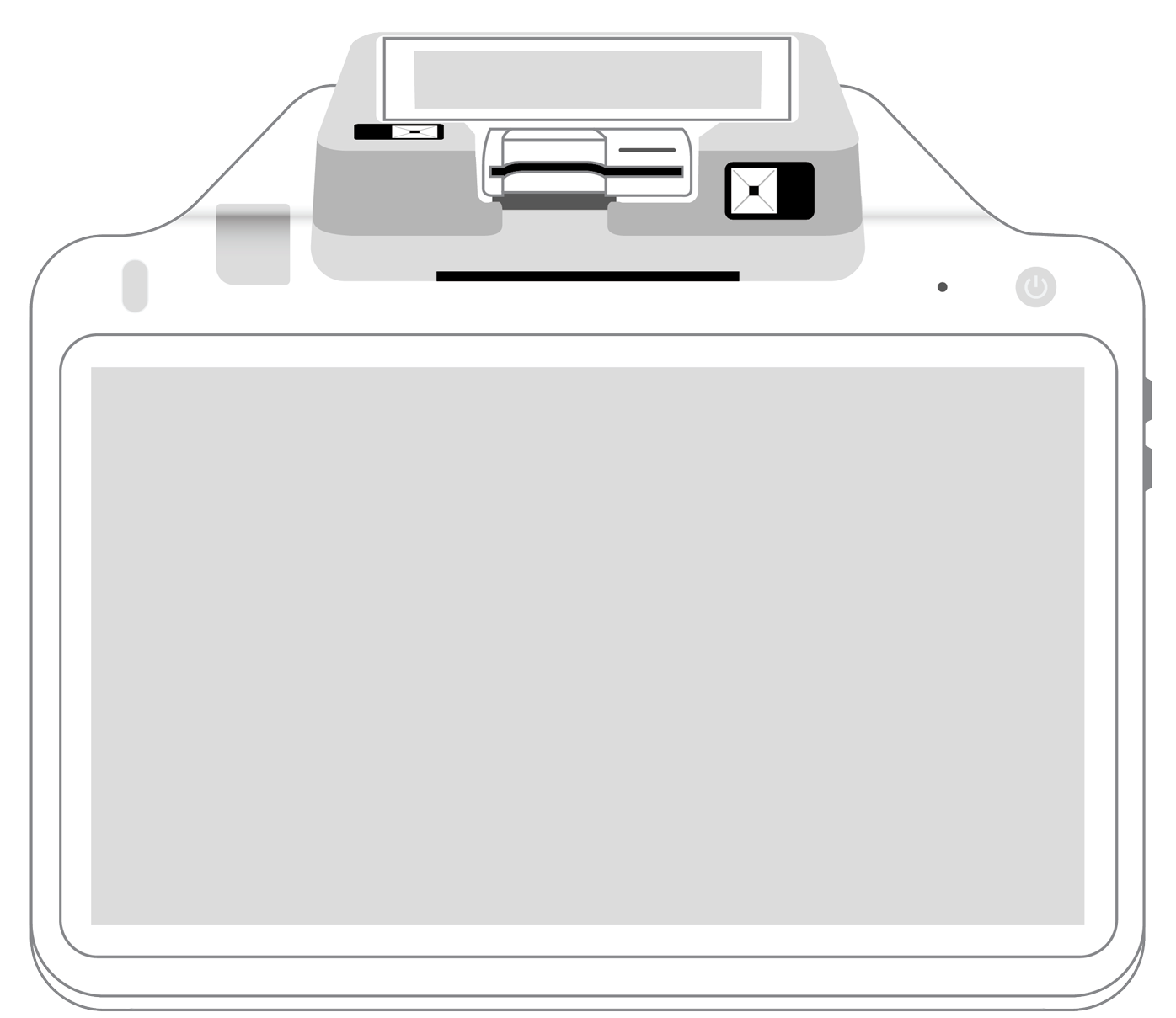

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||