How to accept credit card payments on your phone in 2020.

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.

Back in the dark ages, before the dawn of the mobile phone, merchants who wanted to accept credit cards from customers had no choice but to use stationary terminals. Although they took up a good deal of counter space, these mechanisms enabled sellers to jump on the plastic bandwagon as customers increasingly gave up cash in favor of Visa, Mastercard, Discover, and American Express.

As technology continues to advance at a breakneck pace, wireless card processors are becoming increasingly popular. Many of today’s retailers are moving their payment operations to the much more portable arena of their own mobile phones. Sellers who can particularly benefit, include the following:

- Independent consultants doing direct sales of kitchen items, candles, beauty products, etc.

- Merchants who sell at fairs or house parties.

- Food trucks and farmers market vendors.

- Restaurants.

- Contractors and repair business representatives who visit customers in their homes and offices and need to accept payments upon completion of delivery or specific jobs. Examples include landscapers, massage therapists, carpet cleaners, personal trainers, mobile dog groomers, exterminators, and web designers.

There is no time like the present to modernize your operations in the same way.

1. Getting started.

If you haven’t already done this, your first task is to compare pricing and equipment options between various credit card processors. Once you find a processor you like, you’ll need to apply for and set up your merchant account.

Your next step is to order the hardware you will need. The most important piece is the reader that will connect to your mobile phone. This reader could be a simple device that processes traditional magstripe cards. However, these are quickly being replaced by multi-functional, wireless Bluetooth readers that usually support EMV (Europay, Mastercard and Visa) chip cards and NFC (near field communication) contactless payments. In addition to your reader, you may also want or need a receipt printer or cash drawer. Your payment provider may offer these devices themselves or, at the very least, can direct you toward the best brands, models, and vendors.

2. Transaction fees.

If you already accept credit cards, you are accustomed to the fees your merchant account provider requires of you each month. All of these remain when you choose to change or augment your existing system with mobile payments. With many mobile processors, you will also be expected to pay a monthly account fee and will be charged for any equipment you are leasing.

3. Accepting payments on your phone.

Once your hardware and payment software is in place, you are ready to accept credit and debit card payments from your customers using your Android or iOS phone. However, make sure you have updated your phone to the most recent operating system version to maximize security before you take the next step. This is one of the easiest, yet most neglected, actions you can implement to avoid data breaches and other negative incidents that can cost you and your customers in many ways.

Next, open your credit card payment app. Input the amount you want your customer to pay, keeping in mind that you are also responsible for collecting any applicable state and local sales taxes. Most mobile processing apps have advanced tax settings that enable you to automate this aspect, thus preventing the risk of miscalculating or forgetting to charge these taxes altogether.

Finally, it’s time to conduct the actual payment using your Bluetooth-enabled card reader. There are several possible ways to pay:

• Swiping. Although most of today’s credit and debit cards contain EMV security chips, there are still some that do not. Moreover, some merchants still have not updated their systems in spite of the risk of liability they run. In either case, the customer’s card must be slid through the reader’s portal for processing. This is the least secure method of transacting debit or credit card payments.

• Dipping. If the merchant has an updated system and the customer’s card has an EMV chip, it can be placed or “dipped” in the reader for processing. After the information is scanned and verified, which only takes a few seconds, the customer can remove the card. Since the merchant never touches the card and therefore has no access to the numbers, expiration date, or security code it contains, this payment method is far less susceptible to a data breach than a traditional “swiped” transaction.

• Tapping. Today’s mobile phones do more than just help merchants process payments; they can also be used by customers to make payments. Simply by placing their phone near or tapping a contactless reader, all relevant card information can be communicated, encrypted, and verified, again with no direct merchant contact. Sellers love the enhanced security and customers enjoy the fact that they don’t even need to carry plastic cards anymore. Instead, they can simply use the mobile device that they always carry, taking advantage of the phone’s digital wallet feature to conveniently pay for goods and services.

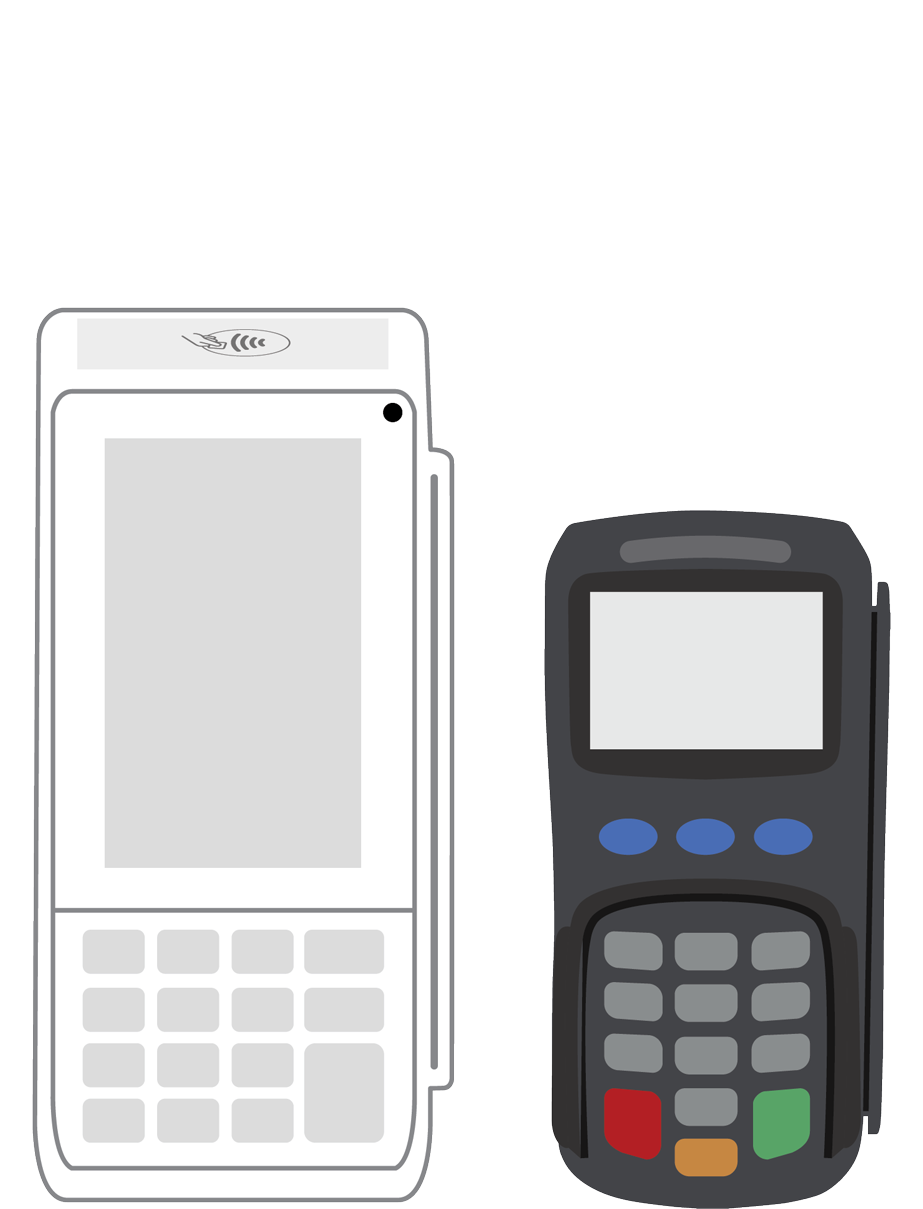

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||